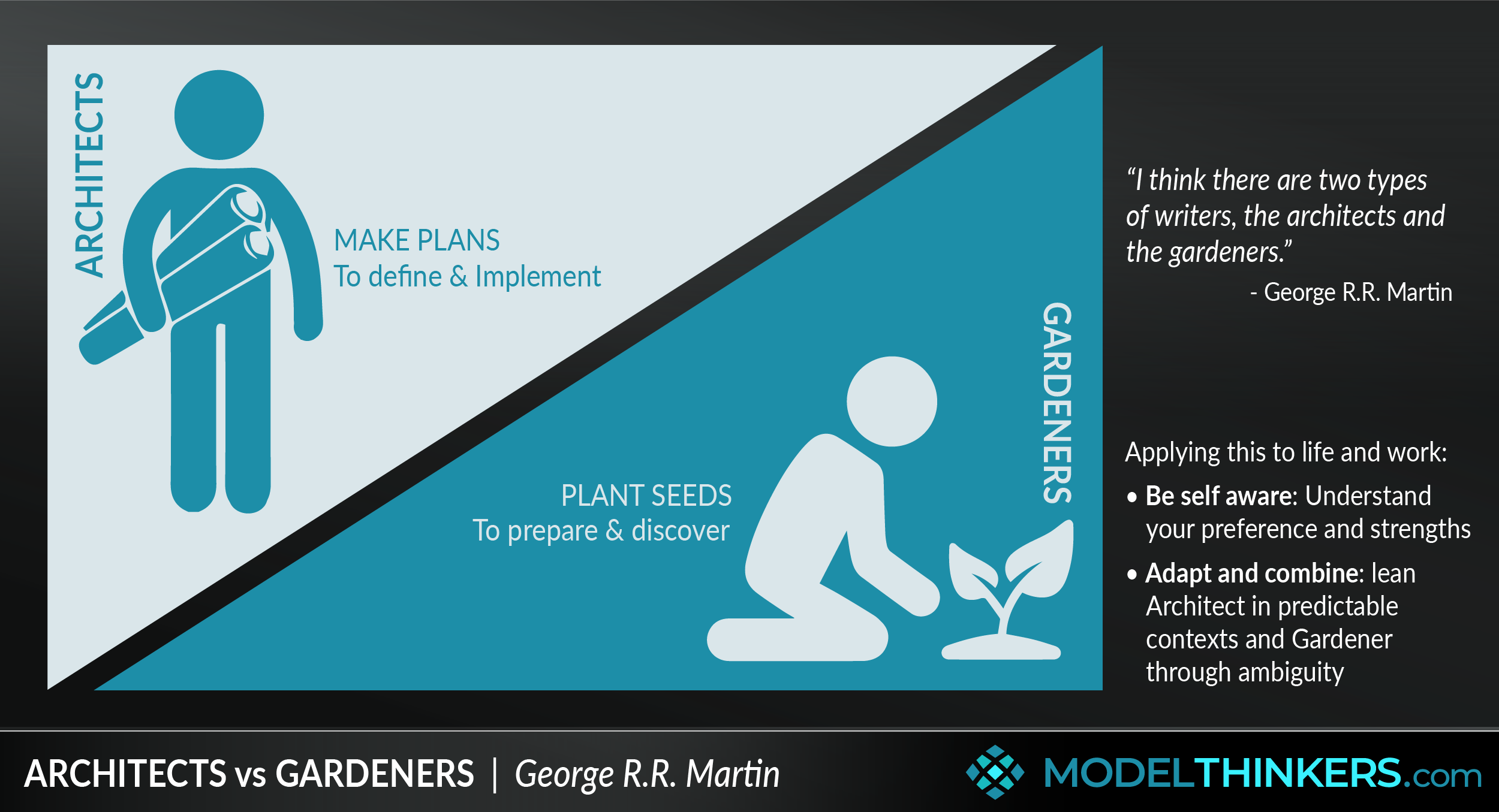

Architects vs Gardeners

No matter what you thought about the end of the HBO version of Game of Thrones, it’s worth considering George R.R. Martin’s framing of writers as ‘Architects or Gardeners’, and extending that metaphor to your life and work.

George R.R. Martin’s Architects vs Gardners describes two possible approaches to writing that can be extended to apply more broadly. Architects design everything upfront before implementing their plan, while Gardeners plant seeds and are open to how their garden might grow and develop through ongoing cycles of discovery.

LESSONS FROM WRITERS

In the context of writing the Architects versus Gardeners frame is also known as 'Plotters versus Pantsers', the latter referring to ‘writing by the seat of your pants’. Here are some examples of where well-known writers land on this spectrum:

LEAN TOWARDS ARCHITECTS

LEAN TOWARDS GARDENERS

"I always have a basic plot outline, but I like to leave some things to be decided while I write."

J.K. Rowling

"Outlines are the last resource of bad fiction writers who wish to God they were writing masters' theses."

Stephen King

“I do a lot of upfront work on my outline and worldbuilding. I do less upfront work on my characters. Once I know the setting and the general story, then I basically cast people in roles and write scenes from their perspective.”

Brandon Sanderson

“What comes first is an image, scene, or voice. Something fairly small. Sometimes that seed is contained in a poem I've already written. The structure or design gets worked out in the course of the writing. I couldn't write the other way round, with structure first. It would be too much like paint-by-numbers."

Margaret Atwood

"If you do enough planning before you start to write, there's no way you can have writer's block. I do a complete chapter by chapter outline."

R.L Stein

“I’m much more a gardener than architect.”

George R.R. Martin

As Rowling and Sanderson point out, Architects still discover ideas within their outlines. Similarly, Martin notes that when you plant seeds you have an idea of what you’re planting, however, you're not exactly sure how it’s going to turn out. The consistent theme here is that rather than a binary view of these options, it’s more useful to think of them as shifting choices on a spectrum.

APPLIED TO LIFE, WORK & LEADERSHIP.

Like all mental models and concepts that we share at ModelThinkers, it's worth exploring how this idea can be best applied to a variety of contexts. In many ways, this metaphor is simple and personal way of representing the tension between Waterfall vs Agile approaches. With that in mind, here are some prompts to help you consider leaning more one way or the other on the Architect vs Gardener spectrum.

When to lean towards Architect.

Identify more predictable areas of your life or work that you have greater control over and where being an Architect with stronger planning might return greater results.

Establish areas where you want to take the thinking and creative effort out of execution, this relates to R.L. Stein’s advice on outlining to avoid writer's block and might involve planning out your work week and scheduling each block with clear intention when your work is relatively predictable.

When to lean towards Gardener.

Identify where your life or work is more ambiguous or out of your direct control. In such situations, it's likely advantageous to 'plant seeds', still with intention, but with greater flexibility and openness about how things might turn out. For example, if you can't predict your team's roadmap then you might hire generalists and multi-skilled people who can better adapt to future needs.

Determine where you want to provide greater engagement and creativity in the journey. Martin compares this to the difference between catching a plane where the journey is defined and controlled, to taking a road trip where the trip is still an adventure. This might involve providing team members with more freedom to define and innovate their approach within some guidelines rather than making them stick to your detailed plan.

How to better combine the two approaches.

Be more conscious about what plans you are creating versus which seeds you are planting, and how they might better combine. This is similar to Sanderson who defines plot and setting but gives more freedom to see where how the characters develop. For you, it might involve mapping out a clear business strategy but allowing specific products to have 'free reign' in how they develop.

Martin's metaphor is ultimately a simplistic frame to help bring awareness to your options. For a deeper understanding of where and when to apply various techniques, be sure to dive into the Cynefin Framework, which identifies appropriate courses of action based on various domains.

IN YOUR LATTICEWORK.

In addition to using Dave Snowden’s Cynefin Framework to choose appropriate techniques depending on your domain, it's worth exploring Covey's Circle of Concern & Control to identify and work with your level of agency in any particular context.

Beyond that, one might argue that leaning Gardener provides greater opportunities to incorporate Feedback Loops through ambiguous situations. While Architects might argue that they can more consistently apply tested approaches and solutions, in writing terms this might include executing a version of the Hero’s Journey.