0 saved

0 saved

21.2K views

21.2K views

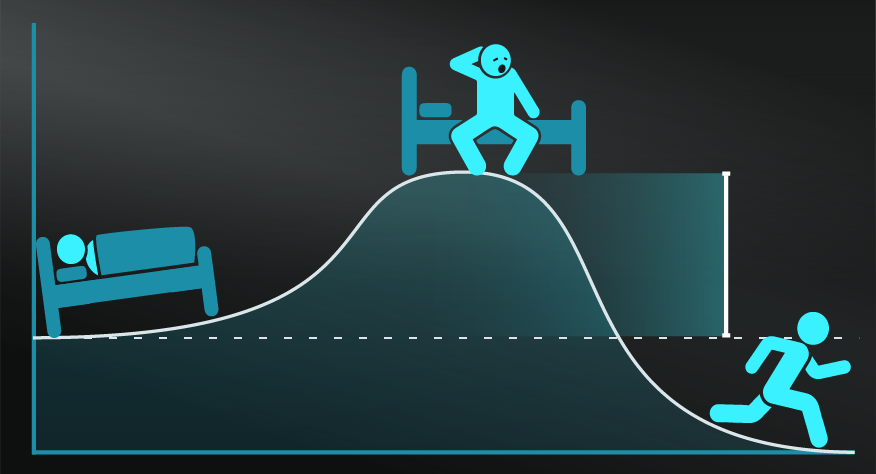

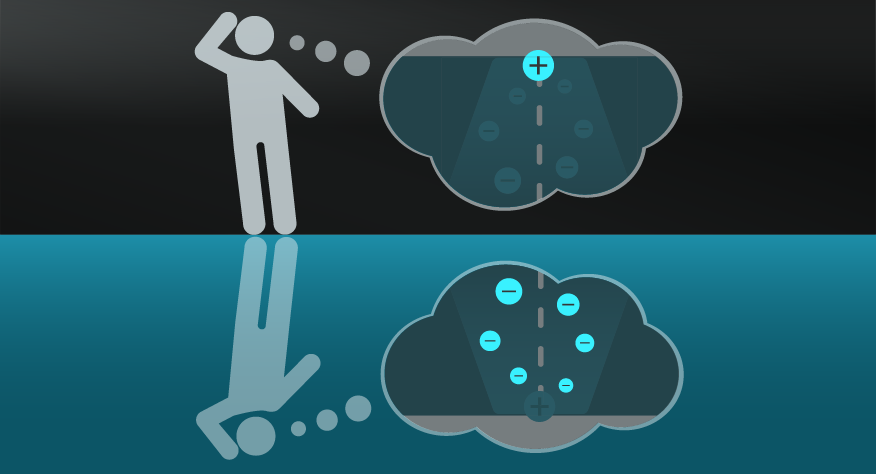

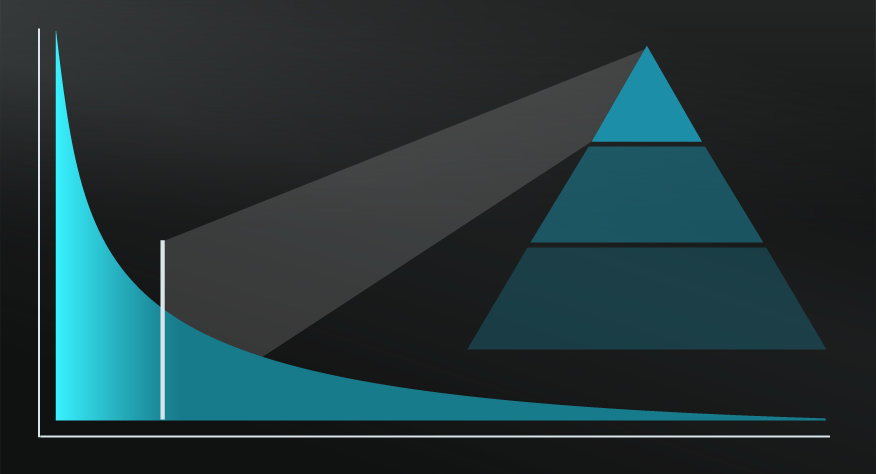

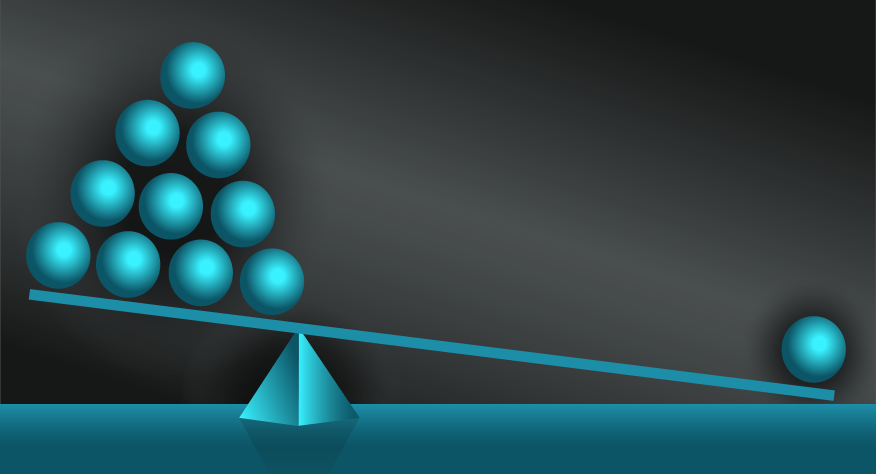

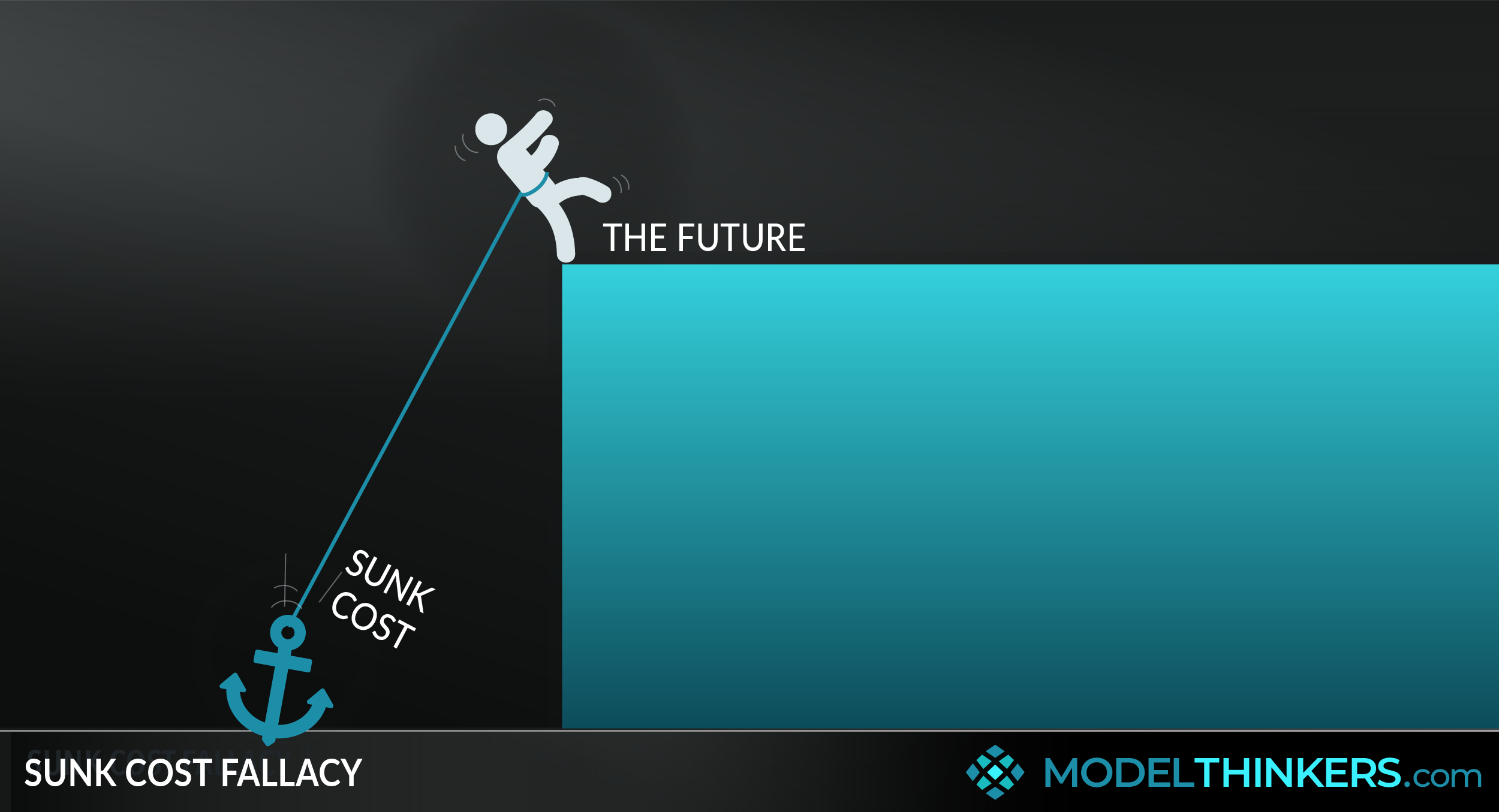

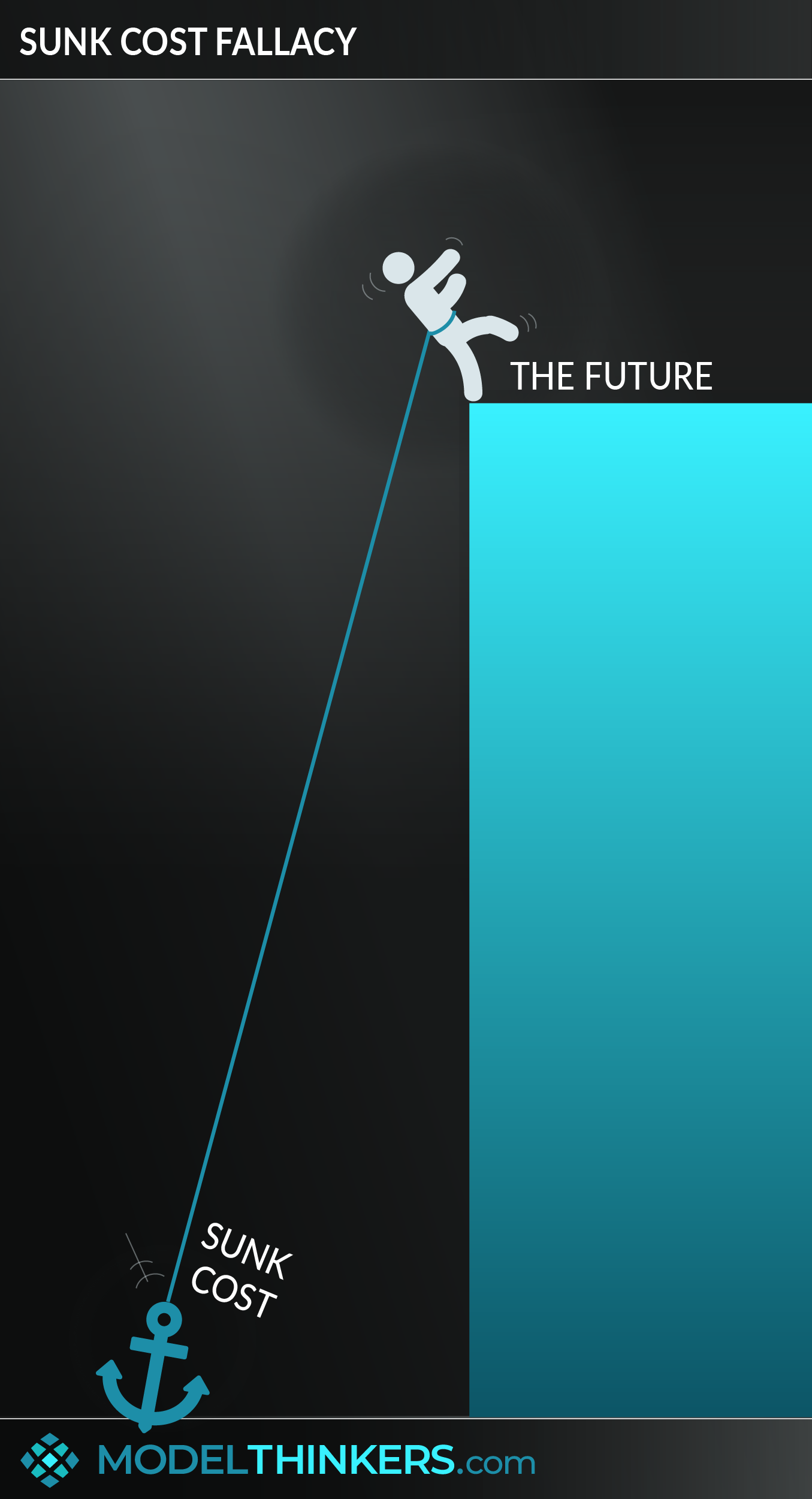

This model is a reminder to cut your losses and focus on future opportunities rather than getting pulled down by past decisions.

Curabitur pretium tincidunt lacus. Nulla gravida orci a odio, et viverra justo commodo id. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aenean euismod, nisi vel consectetur interdum, nisl nisi cursus nisi, vitae tincidunt nisi nisl eget nisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Vivamus lacinia odio vitae vestibulum. Nulla facilisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Nam sit amet erat euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt.

Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Curabitur pretium tincidunt lacus. Nulla gravida orci a odio, et viverra justo commodo id. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aenean euismod, nisi vel consectetur interdum, nisl nisi cursus nisi, vitae tincidunt nisi nisl eget nisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Vivamus lacinia odio vitae vestibulum. Nulla facilisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Nam sit amet erat euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt.

Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Curabitur pretium tincidunt lacus. Nulla gravida orci a odio, et viverra justo commodo id. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aenean euismod, nisi vel consectetur interdum, nisl nisi cursus nisi, vitae tincidunt nisi nisl eget nisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Vivamus lacinia odio vitae vestibulum. Nulla facilisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Nam sit amet erat euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt.

Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Curabitur pretium tincidunt lacus. Nulla gravida orci a odio, et viverra justo commodo id. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aenean euismod, nisi vel consectetur interdum, nisl nisi cursus nisi, vitae tincidunt nisi nisl eget nisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Vivamus lacinia odio vitae vestibulum. Nulla facilisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Nam sit amet erat euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt.

Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Curabitur pretium tincidunt lacus. Nulla gravida orci a odio, et viverra justo commodo id. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aenean euismod, nisi vel consectetur interdum, nisl nisi cursus nisi, vitae tincidunt nisi nisl eget nisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Vivamus lacinia odio vitae vestibulum. Nulla facilisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Nam sit amet erat euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt.

Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Curabitur pretium tincidunt lacus. Nulla gravida orci a odio, et viverra justo commodo id. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aenean euismod, nisi vel consectetur interdum, nisl nisi cursus nisi, vitae tincidunt nisi nisl eget nisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Vivamus lacinia odio vitae vestibulum. Nulla facilisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Nam sit amet erat euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt.

Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Curabitur pretium tincidunt lacus. Nulla gravida orci a odio, et viverra justo commodo id. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aenean euismod, nisi vel consectetur interdum, nisl nisi cursus nisi, vitae tincidunt nisi nisl eget nisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Vivamus lacinia odio vitae vestibulum. Nulla facilisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Nam sit amet erat euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt.

Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Curabitur pretium tincidunt lacus. Nulla gravida orci a odio, et viverra justo commodo id. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aenean euismod, nisi vel consectetur interdum, nisl nisi cursus nisi, vitae tincidunt nisi nisl eget nisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Vivamus lacinia odio vitae vestibulum. Nulla facilisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Nam sit amet erat euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt.

Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Curabitur pretium tincidunt lacus. Nulla gravida orci a odio, et viverra justo commodo id. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aenean euismod, nisi vel consectetur interdum, nisl nisi cursus nisi, vitae tincidunt nisi nisl eget nisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Vivamus lacinia odio vitae vestibulum. Nulla facilisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Nam sit amet erat euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt.

Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Curabitur pretium tincidunt lacus. Nulla gravida orci a odio, et viverra justo commodo id. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aenean euismod, nisi vel consectetur interdum, nisl nisi cursus nisi, vitae tincidunt nisi nisl eget nisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Vivamus lacinia odio vitae vestibulum. Nulla facilisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Nam sit amet erat euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt.

Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Curabitur pretium tincidunt lacus. Nulla gravida orci a odio, et viverra justo commodo id. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aenean euismod, nisi vel consectetur interdum, nisl nisi cursus nisi, vitae tincidunt nisi nisl eget nisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Vivamus lacinia odio vitae vestibulum. Nulla facilisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Nam sit amet erat euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt.

Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Curabitur pretium tincidunt lacus. Nulla gravida orci a odio, et viverra justo commodo id. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aenean euismod, nisi vel consectetur interdum, nisl nisi cursus nisi, vitae tincidunt nisi nisl eget nisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Vivamus lacinia odio vitae vestibulum. Nulla facilisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Nam sit amet erat euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt.

Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Curabitur pretium tincidunt lacus. Nulla gravida orci a odio, et viverra justo commodo id. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aenean euismod, nisi vel consectetur interdum, nisl nisi cursus nisi, vitae tincidunt nisi nisl eget nisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Vivamus lacinia odio vitae vestibulum. Nulla facilisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Nam sit amet erat euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt.

Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Curabitur pretium tincidunt lacus. Nulla gravida orci a odio, et viverra justo commodo id. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aenean euismod, nisi vel consectetur interdum, nisl nisi cursus nisi, vitae tincidunt nisi nisl eget nisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Vivamus lacinia odio vitae vestibulum. Nulla facilisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Nam sit amet erat euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt.

Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Curabitur pretium tincidunt lacus. Nulla gravida orci a odio, et viverra justo commodo id. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aenean euismod, nisi vel consectetur interdum, nisl nisi cursus nisi, vitae tincidunt nisi nisl eget nisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Vivamus lacinia odio vitae vestibulum. Nulla facilisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Nam sit amet erat euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt.

Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Curabitur pretium tincidunt lacus. Nulla gravida orci a odio, et viverra justo commodo id. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aenean euismod, nisi vel consectetur interdum, nisl nisi cursus nisi, vitae tincidunt nisi nisl eget nisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Vivamus lacinia odio vitae vestibulum. Nulla facilisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Nam sit amet erat euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt.

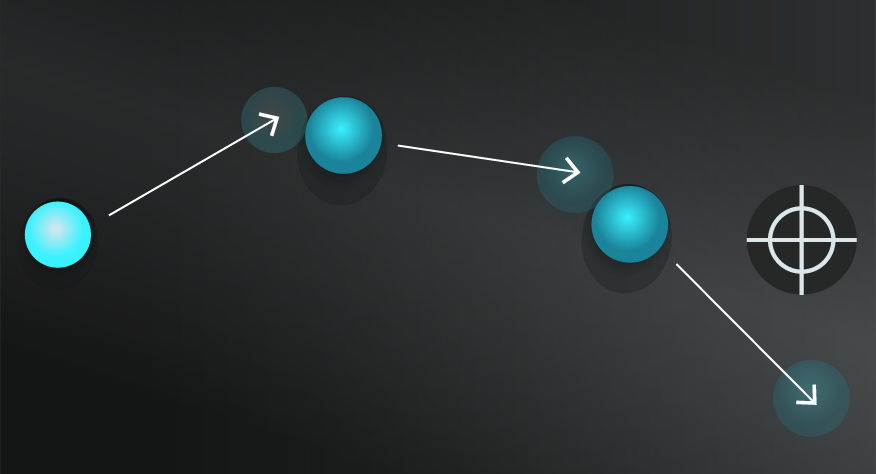

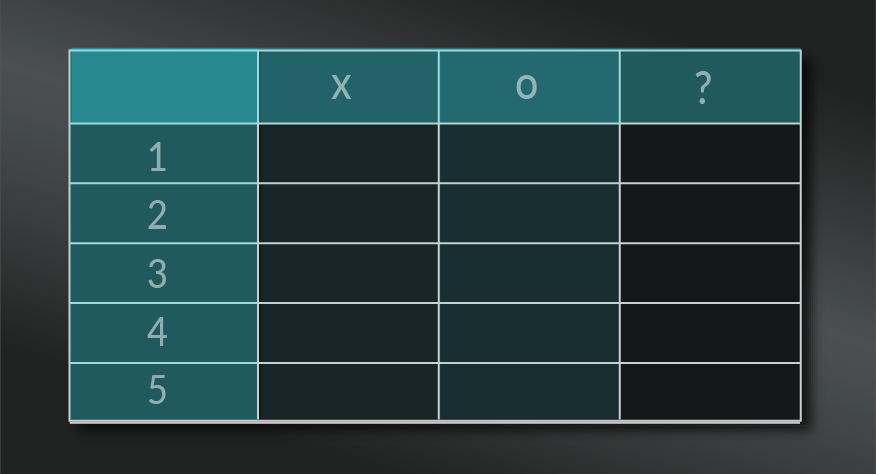

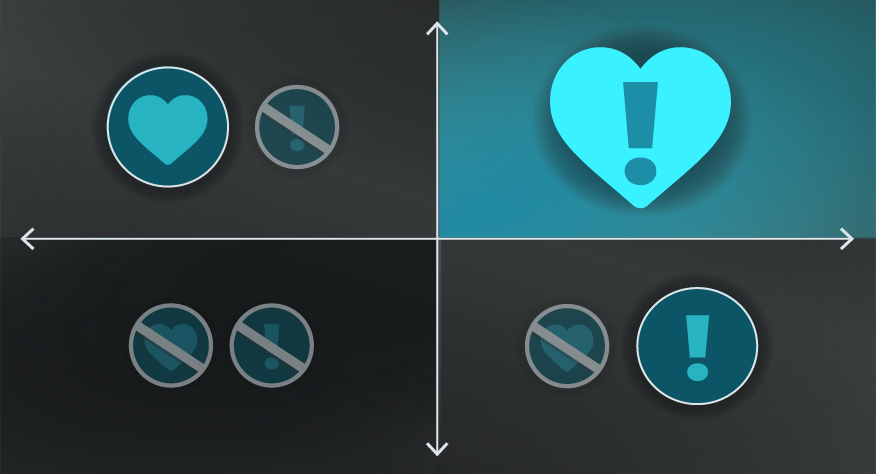

- Ask, ‘does this cost have an impact on what will happen in the future?’

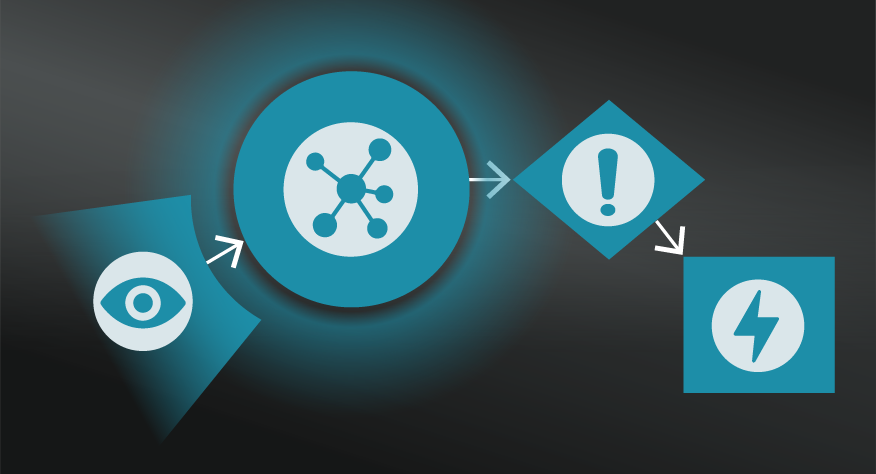

Identify Sunk Co ... Lorem ipsum dolor sit amet, consectetur adipiscing elit. Sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum. Curabitur pretium tincidunt lacus. Nulla gravida orci a odio, et viverra justo commodo id. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aenean euismod, nisi vel consectetur interdum, nisl nisi cursus nisi, vitae tincidunt nisi nisl eget nisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Vivamus lacinia odio vitae vestibulum. Nulla facilisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Nam sit amet erat euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Curabitur pretium tincidunt lacus. Nulla gravida orci a odio, et viverra justo commodo id. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aenean euismod, nisi vel consectetur interdum, nisl nisi cursus nisi, vitae tincidunt nisi nisl eget nisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Vivamus lacinia odio vitae vestibulum. Nulla facilisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Nam sit amet erat euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Curabitur pretium tincidunt lacus. Nulla gravida orci a odio, et viverra justo commodo id. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aenean euismod, nisi vel consectetur interdum, nisl nisi cursus nisi, vitae tincidunt nisi nisl eget nisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Vivamus lacinia odio vitae vestibulum. Nulla facilisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Nam sit amet erat euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Curabitur pretium tincidunt lacus. Nulla gravida orci a odio, et viverra justo commodo id. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aenean euismod, nisi vel consectetur interdum, nisl nisi cursus nisi, vitae tincidunt nisi nisl eget nisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Vivamus lacinia odio vitae vestibulum. Nulla facilisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Nam sit amet erat euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Curabitur pretium tincidunt lacus. Nulla gravida orci a odio, et viverra justo commodo id. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aenean euismod, nisi vel consectetur interdum, nisl nisi cursus nisi, vitae tincidunt nisi nisl eget nisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Vivamus lacinia odio vitae vestibulum. Nulla facilisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Nam sit amet erat euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Curabitur pretium tincidunt lacus. Nulla gravida orci a odio, et viverra justo commodo id. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aenean euismod, nisi vel consectetur interdum, nisl nisi cursus nisi, vitae tincidunt nisi nisl eget nisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Vivamus lacinia odio vitae vestibulum. Nulla facilisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Nam sit amet erat euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Curabitur pretium tincidunt lacus. Nulla gravida orci a odio, et viverra justo commodo id. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aenean euismod, nisi vel consectetur interdum, nisl nisi cursus nisi, vitae tincidunt nisi nisl eget nisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Vivamus lacinia odio vitae vestibulum. Nulla facilisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Nam sit amet erat euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Curabitur pretium tincidunt lacus. Nulla gravida orci a odio, et viverra justo commodo id. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aenean euismod, nisi vel consectetur interdum, nisl nisi cursus nisi, vitae tincidunt nisi nisl eget nisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Vivamus lacinia odio vitae vestibulum. Nulla facilisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Nam sit amet erat euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Curabitur pretium tincidunt lacus. Nulla gravida orci a odio, et viverra justo commodo id. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aenean euismod, nisi vel consectetur interdum, nisl nisi cursus nisi, vitae tincidunt nisi nisl eget nisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Vivamus lacinia odio vitae vestibulum. Nulla facilisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Nam sit amet erat euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Curabitur pretium tincidunt lacus. Nulla gravida orci a odio, et viverra justo commodo id. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aenean euismod, nisi vel consectetur interdum, nisl nisi cursus nisi, vitae tincidunt nisi nisl eget nisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Vivamus lacinia odio vitae vestibulum. Nulla facilisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Nam sit amet erat euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Curabitur pretium tincidunt lacus. Nulla gravida orci a odio, et viverra justo commodo id. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aenean euismod, nisi vel consectetur interdum, nisl nisi cursus nisi, vitae tincidunt nisi nisl eget nisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Vivamus lacinia odio vitae vestibulum. Nulla facilisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Nam sit amet erat euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Curabitur pretium tincidunt lacus. Nulla gravida orci a odio, et viverra justo commodo id. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aenean euismod, nisi vel consectetur interdum, nisl nisi cursus nisi, vitae tincidunt nisi nisl eget nisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Vivamus lacinia odio vitae vestibulum. Nulla facilisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Nam sit amet erat euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Curabitur pretium tincidunt lacus. Nulla gravida orci a odio, et viverra justo commodo id. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aenean euismod, nisi vel consectetur interdum, nisl nisi cursus nisi, vitae tincidunt nisi nisl eget nisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Vivamus lacinia odio vitae vestibulum. Nulla facilisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Nam sit amet erat euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Curabitur pretium tincidunt lacus. Nulla gravida orci a odio, et viverra justo commodo id. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aenean euismod, nisi vel consectetur interdum, nisl nisi cursus nisi, vitae tincidunt nisi nisl eget nisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Vivamus lacinia odio vitae vestibulum. Nulla facilisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Nam sit amet erat euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Curabitur pretium tincidunt lacus. Nulla gravida orci a odio, et viverra justo commodo id. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aenean euismod, nisi vel consectetur interdum, nisl nisi cursus nisi, vitae tincidunt nisi nisl eget nisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Vivamus lacinia odio vitae vestibulum. Nulla facilisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Nam sit amet erat euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Curabitur pretium tincidunt lacus. Nulla gravida orci a odio, et viverra justo commodo id. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aenean euismod, nisi vel consectetur interdum, nisl nisi cursus nisi, vitae tincidunt nisi nisl eget nisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Vivamus lacinia odio vitae vestibulum. Nulla facilisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Nam sit amet erat euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt.

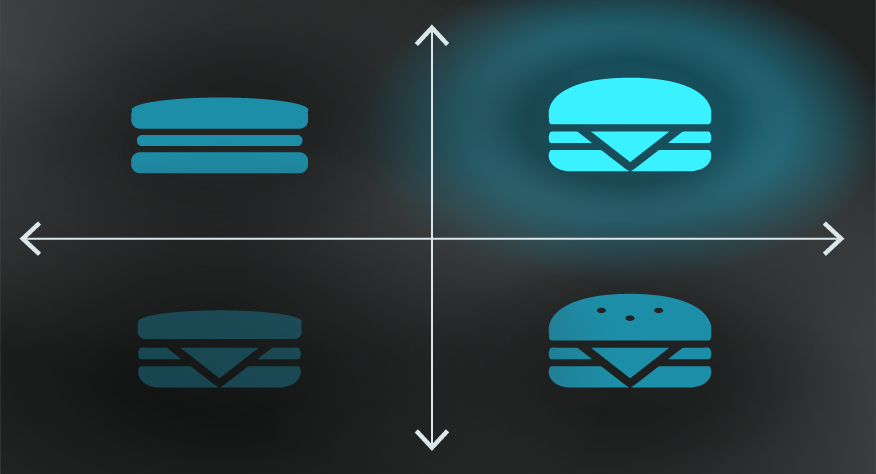

Identifying a Sunk Cost can be difficult when there is no precise way of comparing a loss to a gain. The desire to not appear wasteful also can limit your ability to base a decision on relevant costs exclusively, especially when you feel personally responsible for the investments representing sunk costs.

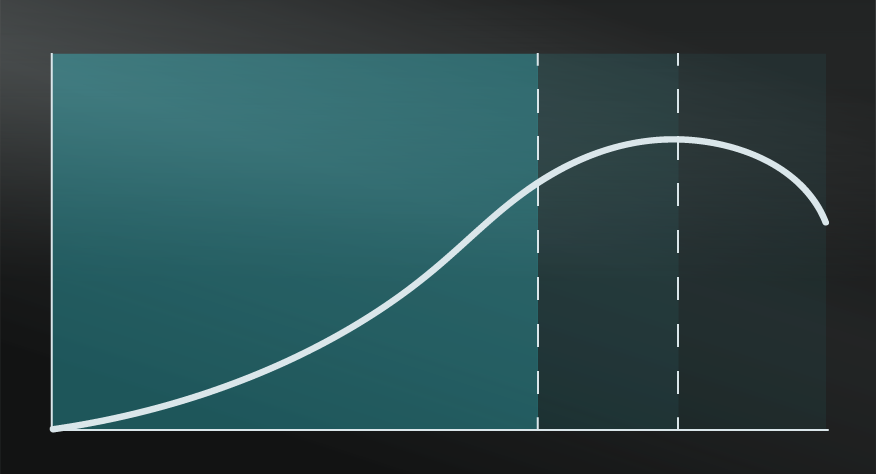

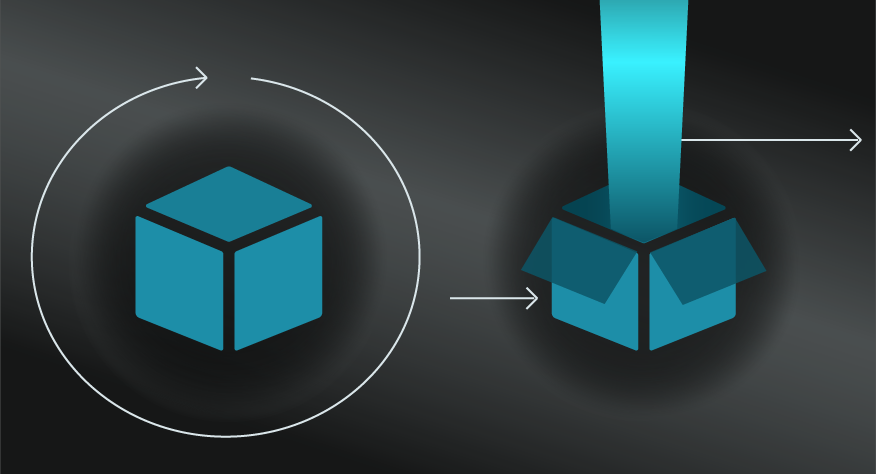

The Concorde Fallacy.

The Concorde Fallacy is an alternative name for the sunk cost fallacy, coming from the way the British and French governments continued to co-fund the development of the expensive Concorde supersonic aeroplane even after it became financially untenable. Their previous investment, financially and politically, was thought to determine the ongoing funding.

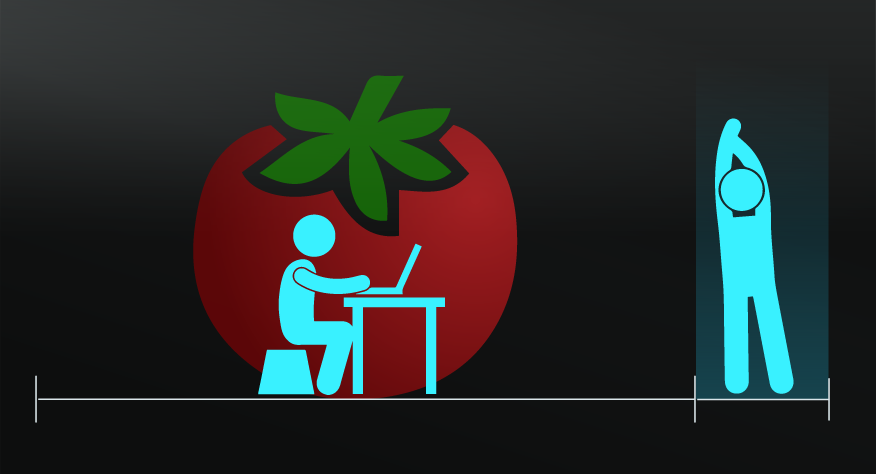

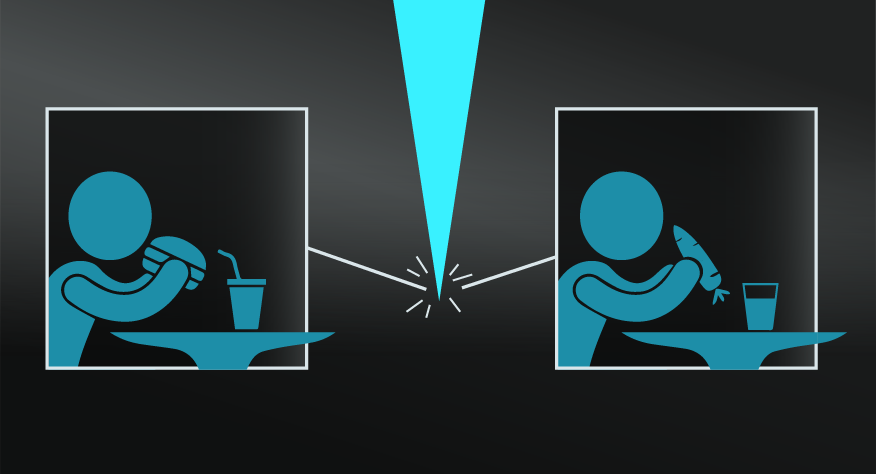

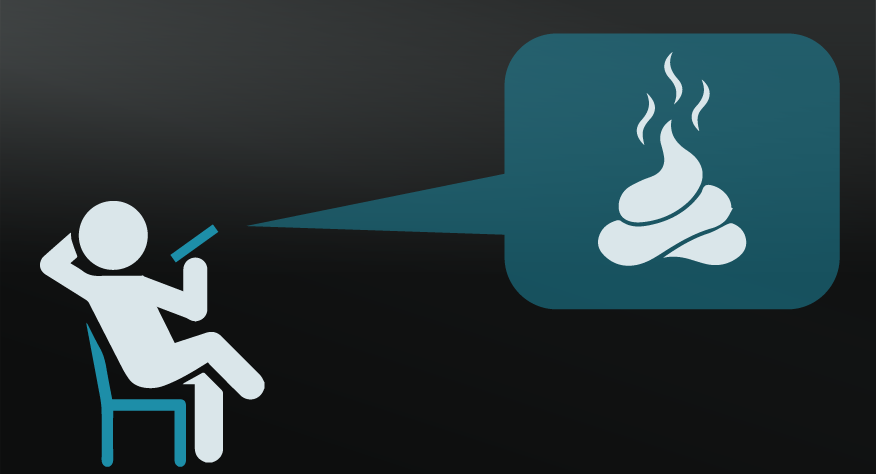

Eat too much?

A common example of the sunk cost fallacy is when someone buys a large meal, then overeats to ensure ‘they get their money worth’.

The sunk cost fallacy is an unconscious bias that arises from accounting and financial domains. It is an important consideration in decision making.

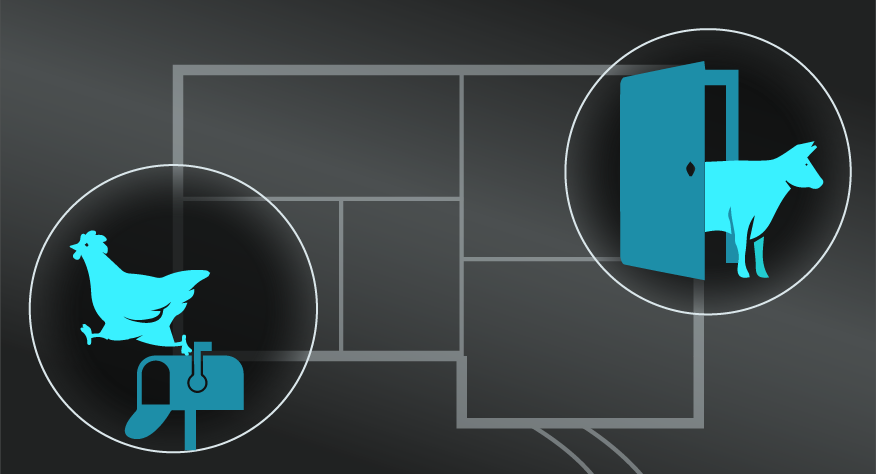

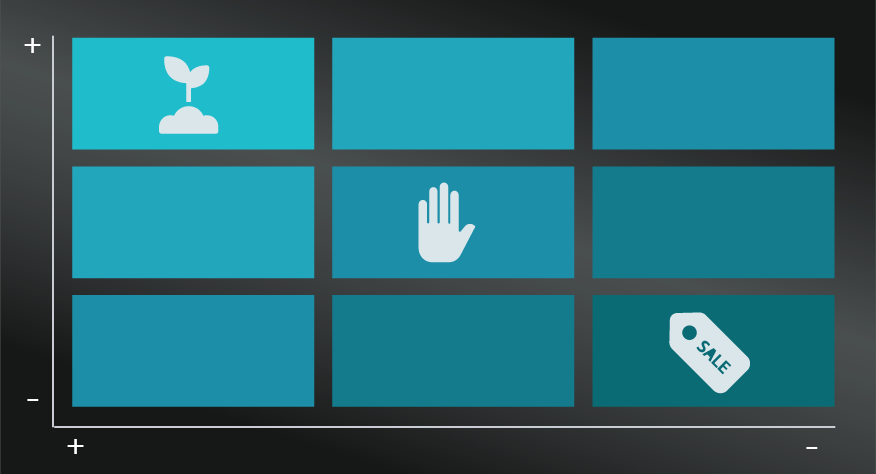

Use the following examples of connected and complementary models to weave the sunk cost fallacy into your broader latticework of mental models. Alternatively, discover your own connections by exploring the category list above.

Connected models:

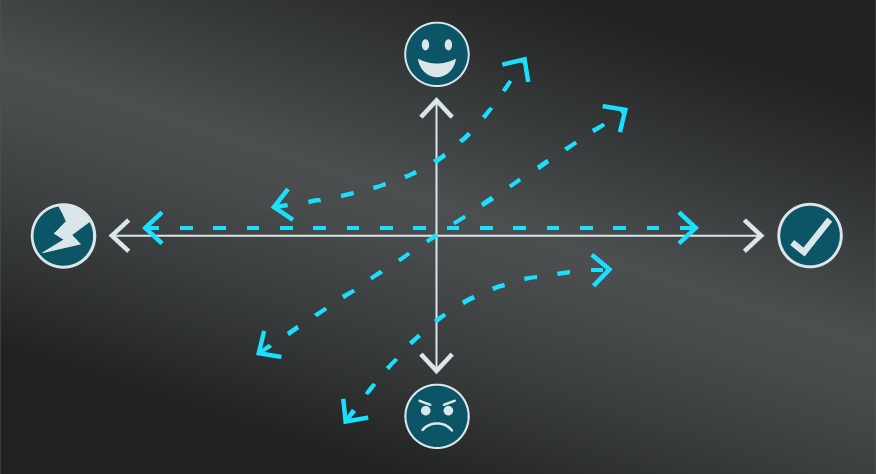

- Cost-benefit analysis: to consider actual pros and cons of a choice

- Opportunity cost: to consider the potential loss of a future facing decision.

Complementary models:

- First principle thinking: in breaking down a situation to its basics.

- Inversion: considering the opposite, e.g. ‘how can we continue to make that loss again?’

- The Lindy effect: to challenge sunk costs and seeing past longevity as a potential positive.

- Availability heuristic: being overly impacted by immediate situations and losses.

- Lock-in effect: is there greater friction to breaking from the status quo.

Read N. Gregory Mankiw’s Principles of economics for information on various economic theories that involve the concept of sunk costs.

This brief article references some of the relevant studies arising from Behaviorual Economics and the Sunk Cost fallacy. Check this video resource for a quick overview of the sunk cost concept and how it applies to the Concorde supersonic plane case.

My Notes

My Notes

Oops, That’s Members’ Only!

Fortunately, it only costs US$5/month to Join ModelThinkers and access everything so that you can rapidly discover, learn, and apply the world’s most powerful ideas.

ModelThinkers membership at a glance:

“Yeah, we hate pop ups too. But we wanted to let you know that, with ModelThinkers, we’re making it easier for you to adapt, innovate and create value. We hope you’ll join us and the growing community of ModelThinkers today.”