0 saved

0 saved

19.9K views

19.9K views

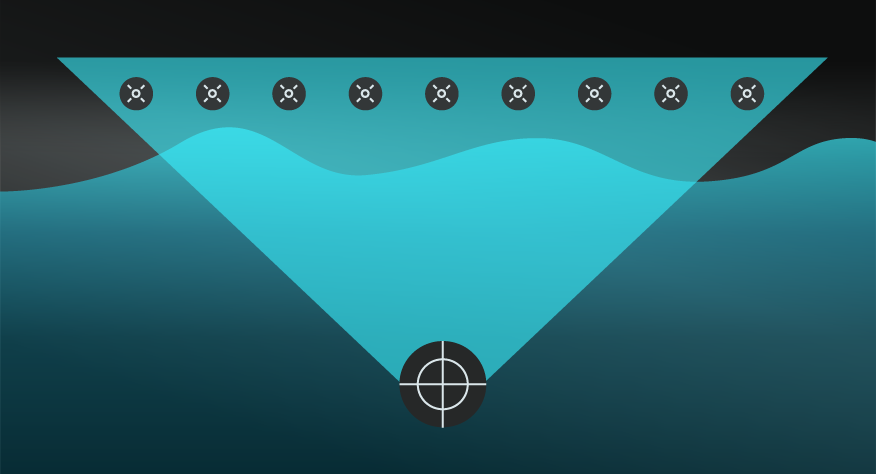

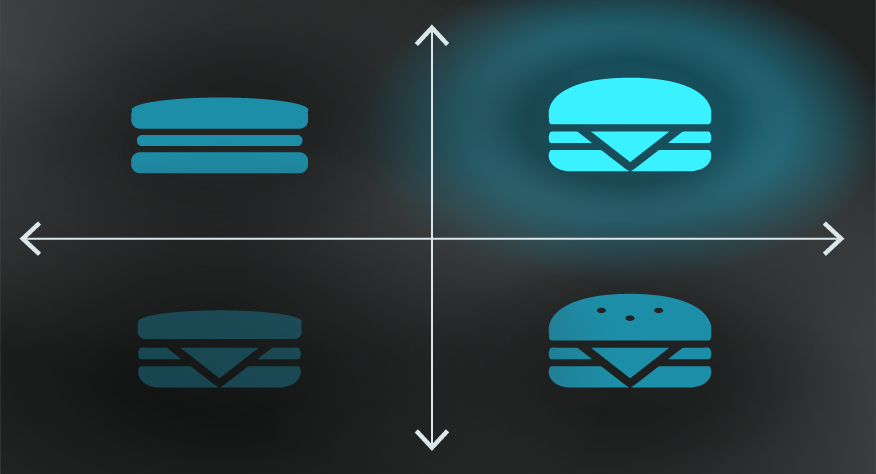

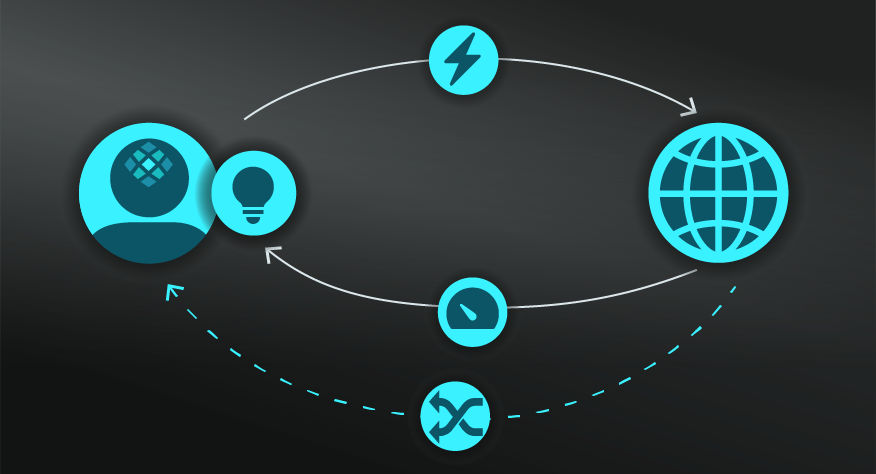

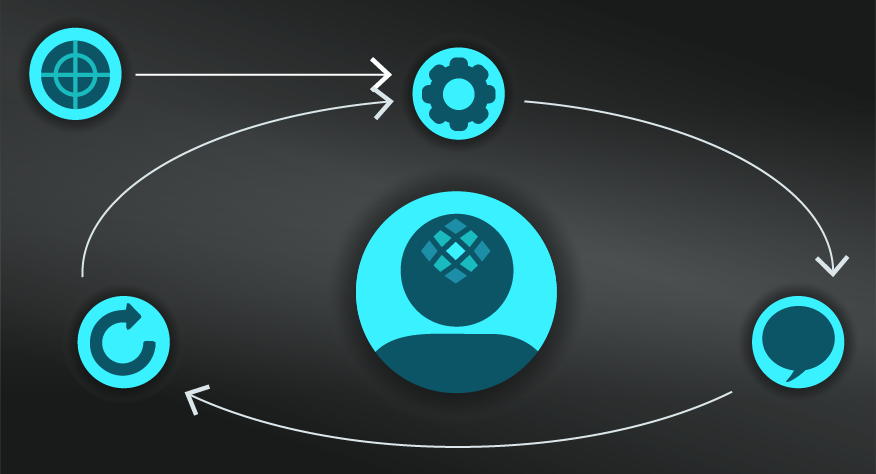

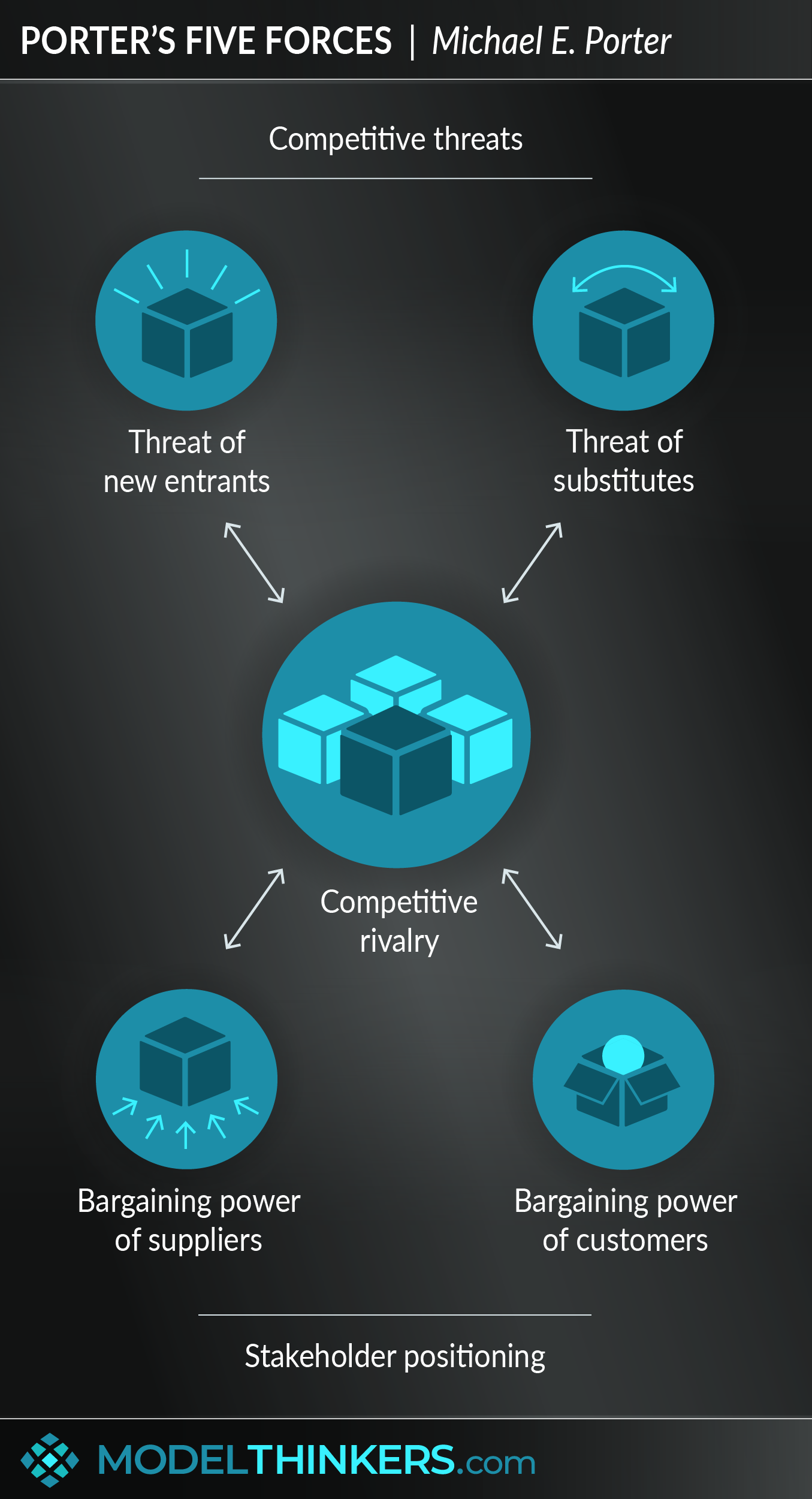

A standard tool in management accounting, Porter's five forces is a useful model for startups and businesses exploring new product ideas.

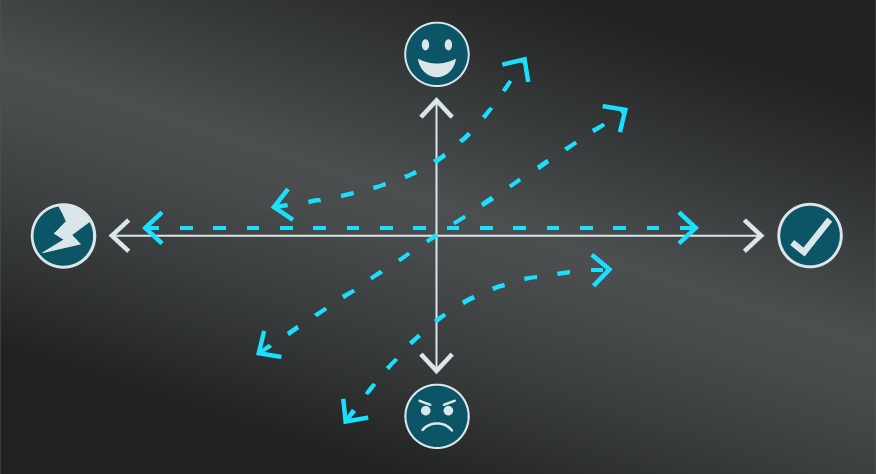

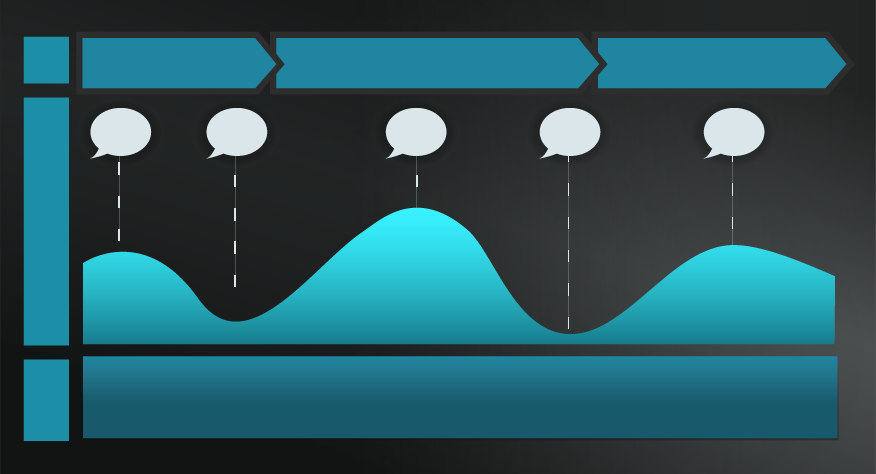

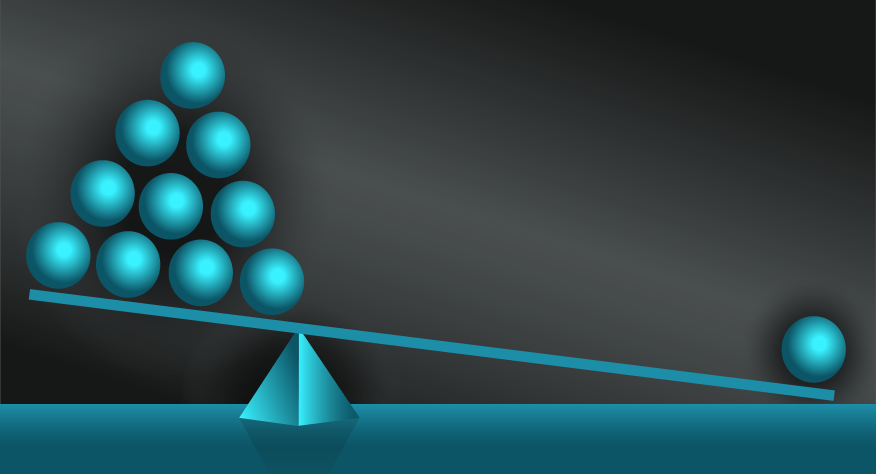

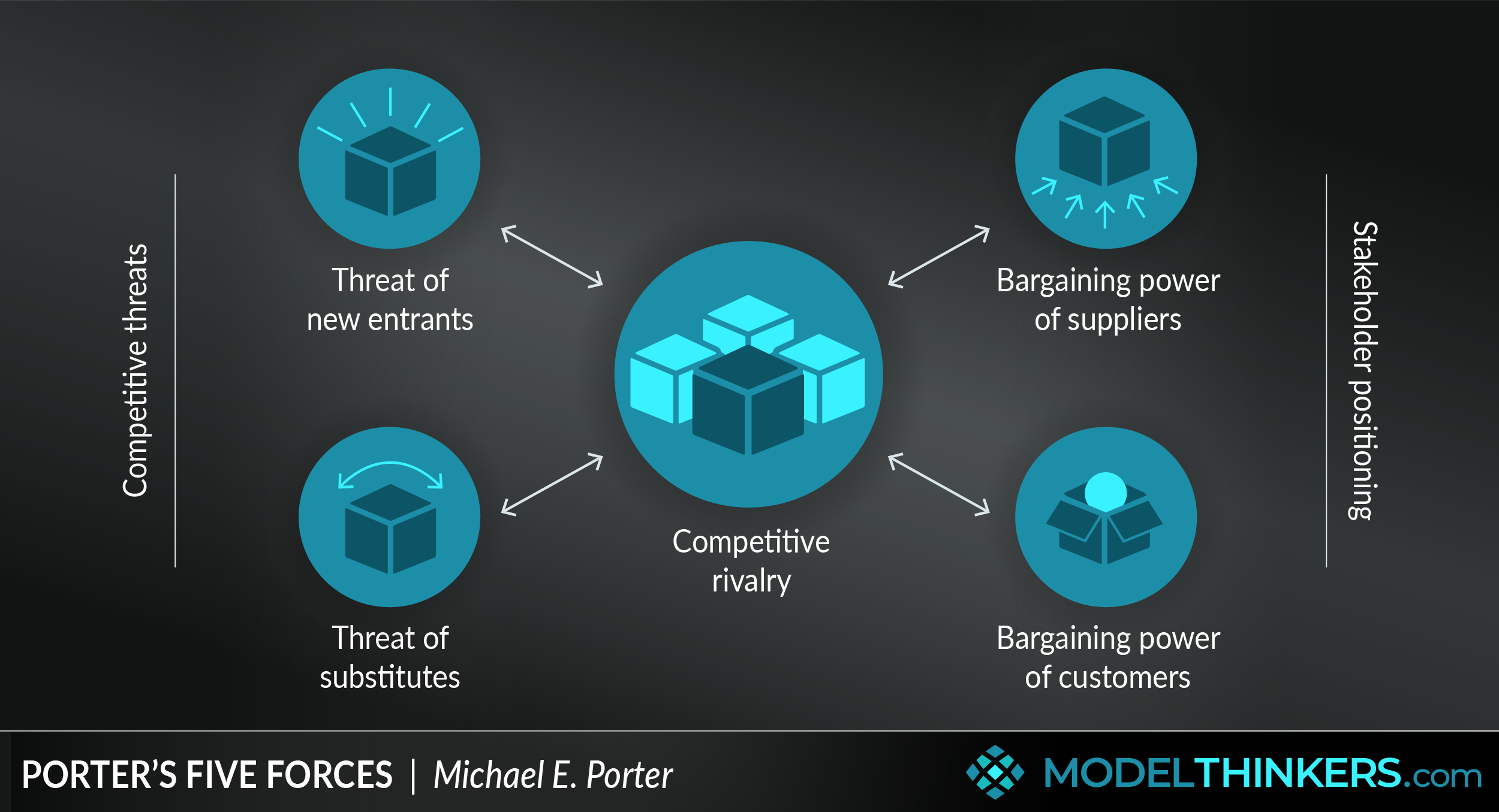

Porter’s Five Forces analyses the competitive intensity of an industry sector based on current rivalry, potential new entrants, and the bargaining power of suppliers and customers.

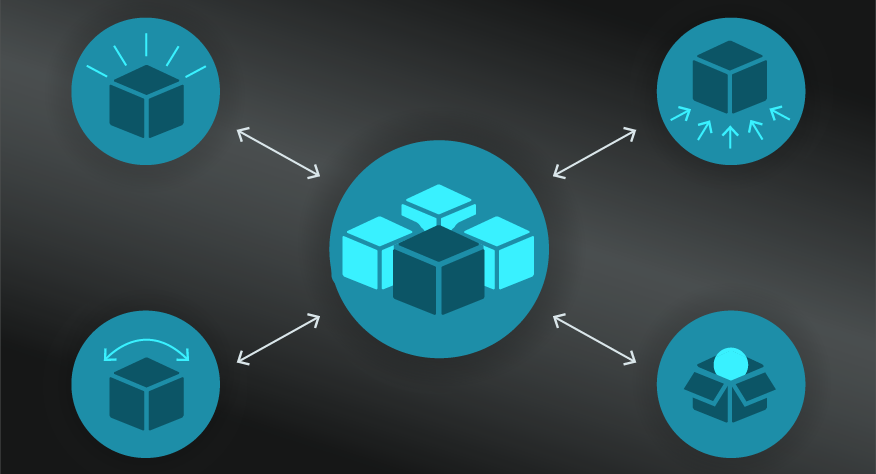

THE FIVE FORCES.

This analysis will help inform the profitability potential and attractiveness for the business or product initiatives. The five forces considered as part of the analysis are:

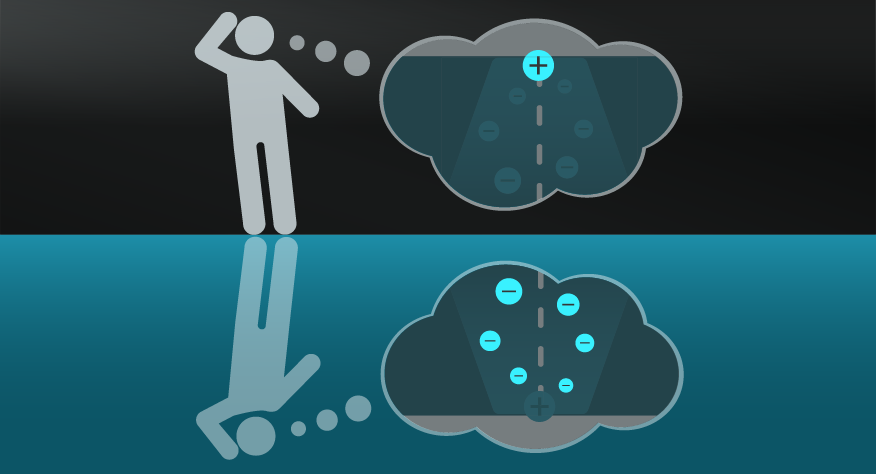

- Competitive rivalry: considered to be the most significant factor, this looks at the current behaviour of competitors including their number, concentration, marketing and branding as well as their lock-in effect versus propensity for customers to switch.

- Threat of new entrants: considering the barriers to entry for new entrants, such as government policy, specialist capabilities or capital requirements, and likelihood that an influx of new competitors will reduce market share.

- Threat of substitute: the options customers have of finding alternative products or services that solve the same problems.

- Bargaining power of suppliers: the power of suppliers over prices, the supply chain and reliability. The threat of substitute products or services: the price and equivalence of substitutes, as well as the customers' inclination to change.

- Bargaining power of customers: numbers, price sensitivity, orders and increased influence in a ‘buyers market’ with limited demand but high supply.

APPLICATION.

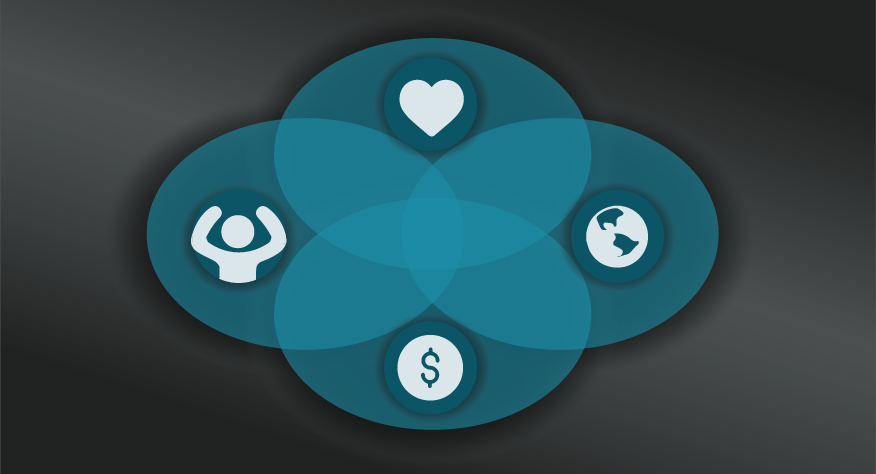

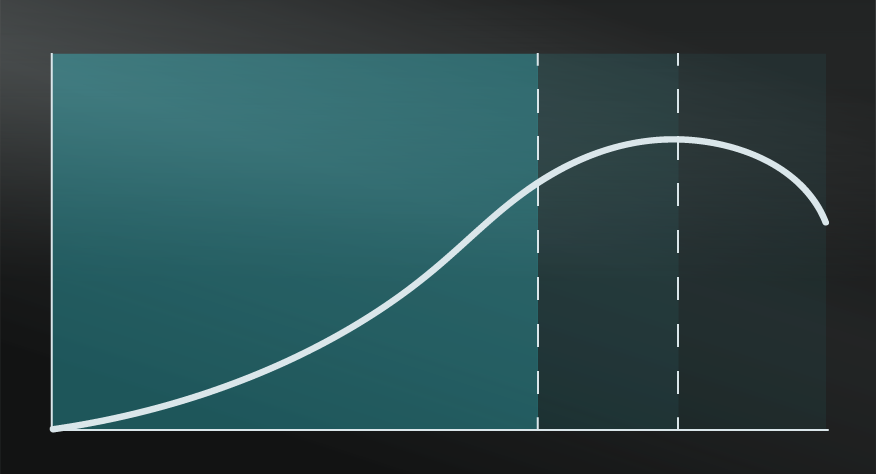

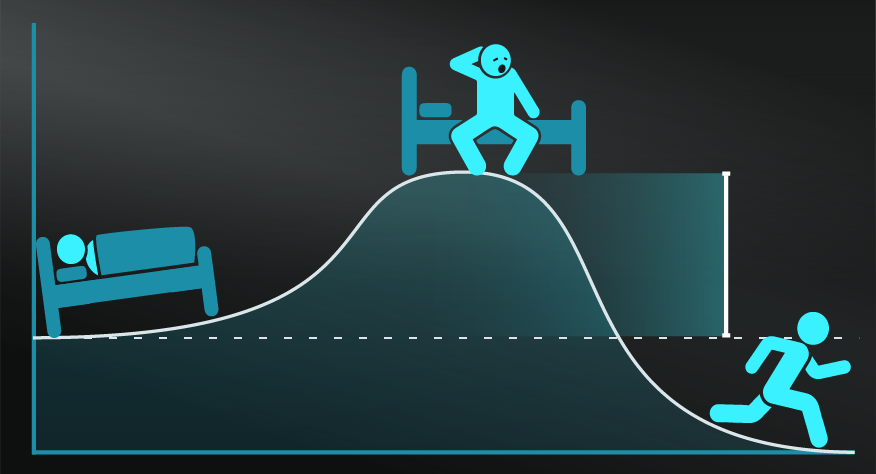

Porter's Five Forces analysis can be considered as part of a business or product strategy to expand your competitive advantage, consider cost adjustments, and potential market share.

- Research and brainstorm competitive rivalry

Creating a successful business depends on your ability to understand your competitors – being aware of their marketing strategies allows you to successfully promote your product.

- Research and brainstorm threat of new entrants

If you are in a profitable industry that yields a high return, emerging competitors will eventually decrease your profitability. Determine factors that could prevent new businesses from entering the industry, such as patents, regulatory and capital requirements, access to distribution channels, and industry profitability.

- Research and brainstorm threat of substitutes

Look at products that use different technology or business model but try to solve the same problem as your business. If you are selling wine, beer can be considered your substitute. Determine the availability of close substitutes, ease of substitution, and the number of substitute products available on the market.

- Research and brainstorm bargaining power of customers

Are your customers able to put your business under pressure and cause price changes? If buyers have many alternatives, their buyer power is high, but companies can reduce buyer power through measures such as loyalty programs or the lock-in effect.

- Research and brainstorm bargaining power of suppliers

Do the suppliers of your raw materials excerpt power over your business because of the lack of alternative suppliers? Consider supply chain sensitivity and alternatives.

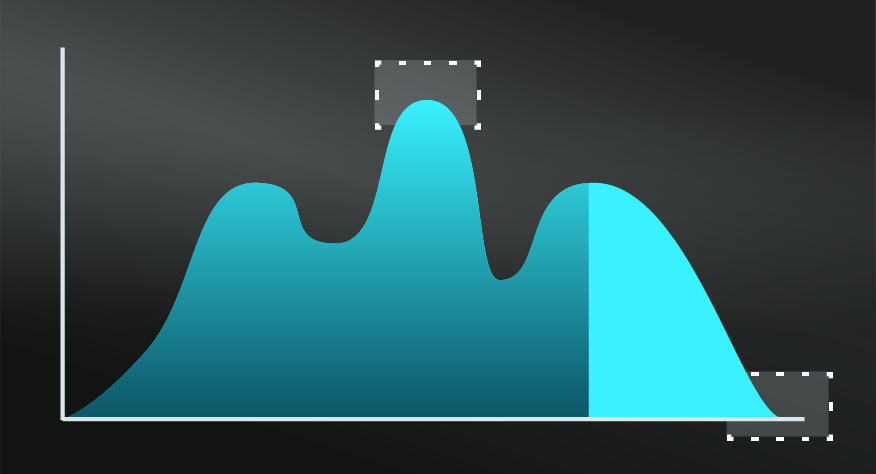

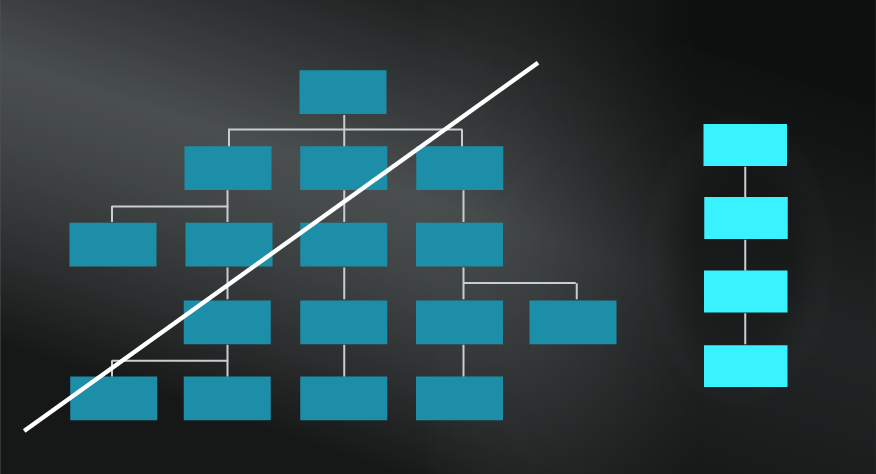

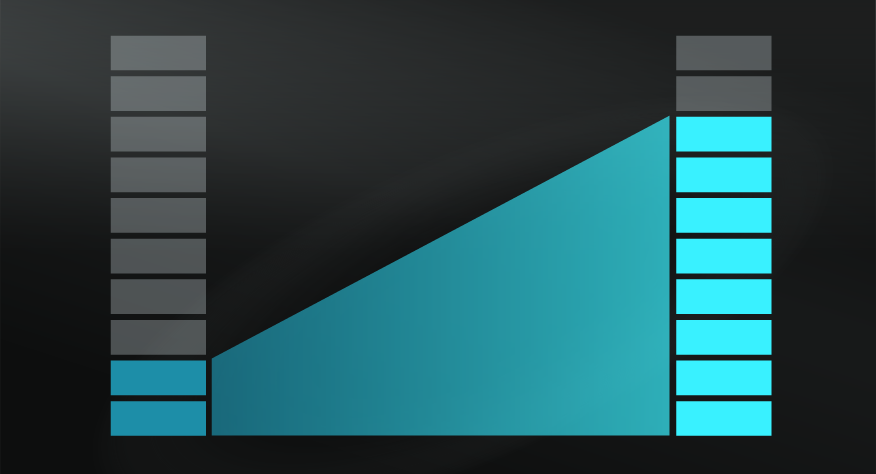

- The five forces are generally just one input

This framework is generally used as an important tool as part of a broader analysis that might consider value chain analysis, the BCG Matrix amongst others.

In the mid-1990s, theoreticians from the Yale School of Management proposed a 6th force, or 'complementors', to compensate for the lack of strategic alliances in the original framework. Porter rejected the idea and stated that complementors are in fact just factors that affect the five forces.

Porter’s framework has received criticism from academics and strategists for failing to take into account the following facts: competitors and other forces on the market are not unrelated and they often interact, the source of value is represented by structural advantage, and participants in a market can respond to competitive behaviour, thus lowering uncertainty levels. Another limitation of this model is not considering customer-centricity and the importance of creating customer value.

Porter’s five forces is a model that can be very useful to assess the attractiveness of your industry, but it may need to be combined with other frameworks if you want to include the resources that your business is bringing to the industry into your analysis.

Case studies of McDonalds, Apple, Nike and more

The Panmore Institute generously shares their Porter’s five forces analysis for a range of large corporates including Walt Disney, eBay, GE, Verizon, IBM, McDonalds, Apple, and Nike.

Turkish case study

The 7th International Strategic Management Conference outlined this surprisingly detailed academic case study of the global expansion of a Turkish food company. The use of Porter’s five forces was integral to the competitive analysis.

Use the following examples of connected and complementary models to weave Porter’s five forces into your broader latticework of mental models. Alternatively, discover your own connections by exploring the category list above.

Connected models:

- SWOT analysis: Porter’s developed his model in direct response to the widespread use of SWOT, positioning it as a more targeted option.

- BCG growth-share model:

- Lock-in effect: relevant when considering customer mobility.

Complementary models:

- Lean startup: to explore a potential market by taking iterative action.

- 4Ps of marketing: considering the marketing strategy of your business and that of competitors.

- Red queen effect: the risk of maintaining the ‘same game’ and running the same speed as competitors.

- The golden circle: to understand the ‘why’ behind entering a market.

- GE nine box matrix: a broader view of multi-divisional business analysis.

- Blue ocean strategy: posing a new approach to seek out less competitive markets.

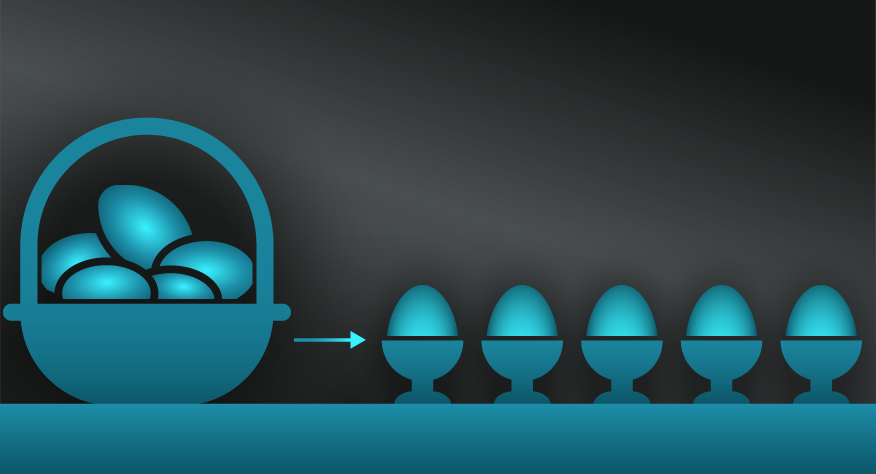

- Diversification: usually will result in more product initiatives in broader industries, requiring Porter’s five forces to help evaluate potential.

- Divide and conquer: potential strategy to deal with competition.

- Personas: used to help understand customer attitudes and behaviors, but also other stakeholders.

The originator of this mental model is Michael E. Porter of Harvard University, who first published the framework in Harvard Business Review in 1979.

Read in-depth about Porter’s five forces from his 1980 book Competitive Strategy: Techniques for Analyzing Industries and Competitors, which has been printed for more than 60 times in English.

My Notes

My Notes

Oops, That’s Members’ Only!

Fortunately, it only costs US$5/month to Join ModelThinkers and access everything so that you can rapidly discover, learn, and apply the world’s most powerful ideas.

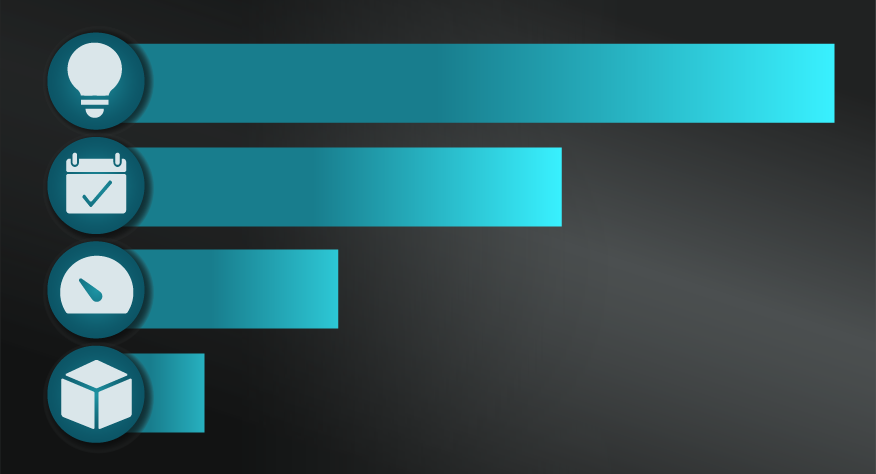

ModelThinkers membership at a glance:

“Yeah, we hate pop ups too. But we wanted to let you know that, with ModelThinkers, we’re making it easier for you to adapt, innovate and create value. We hope you’ll join us and the growing community of ModelThinkers today.”