0 saved

0 saved

16.9K views

16.9K views

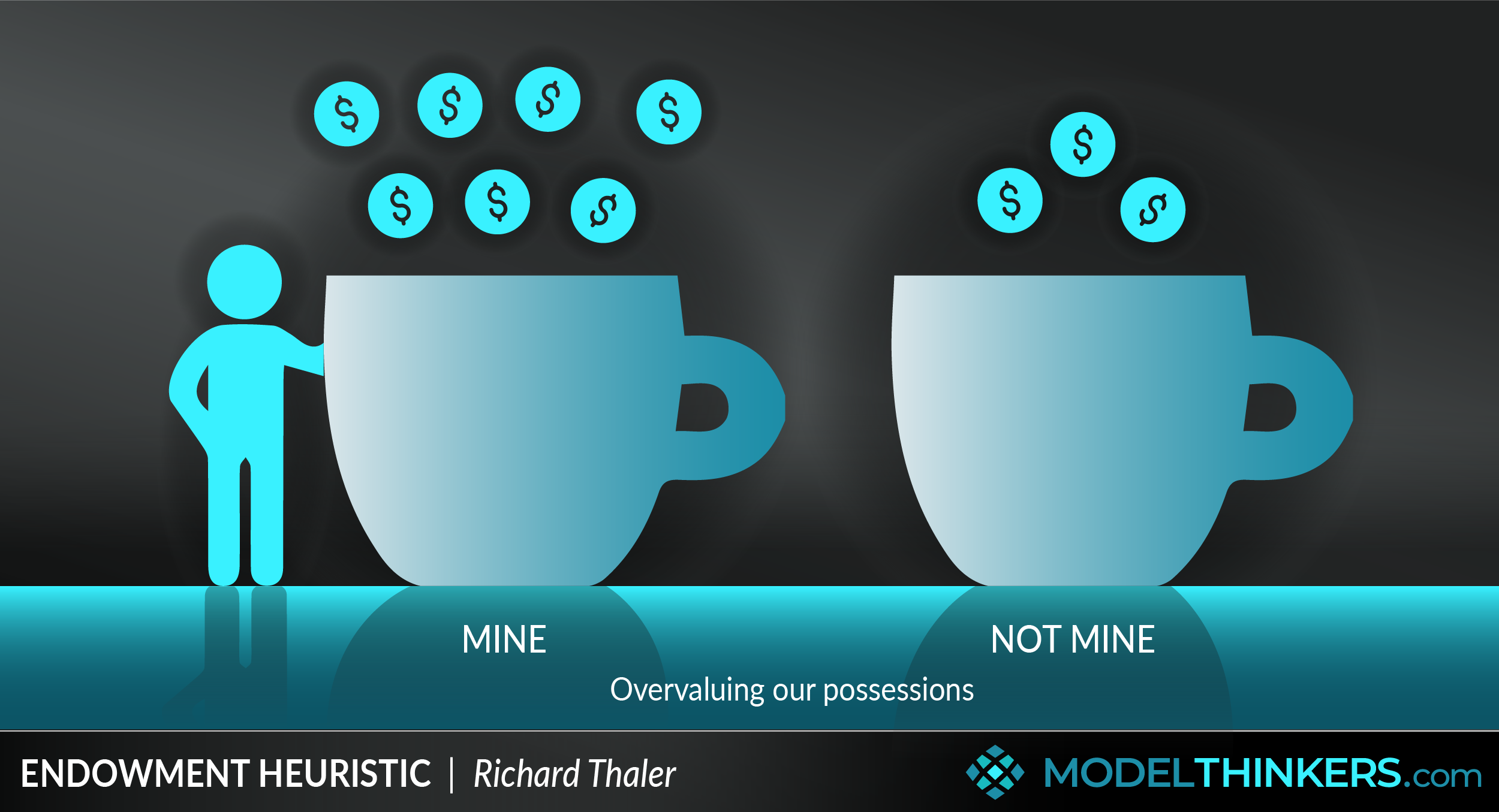

No, it's not just you — we all tend to overestimate the value of our possessions, and there's a name for it.

Curabitur pretium tincidunt lacus. Nulla gravida orci a odio, et viverra justo commodo id. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aenean euismod, nisi vel consectetur interdum, nisl nisi cursus nisi, vitae tincidunt nisi nisl eget nisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Vivamus lacinia odio vitae vestibulum. Nulla facilisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Nam sit amet erat euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt.

Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Curabitur pretium tincidunt lacus. Nulla gravida orci a odio, et viverra justo commodo id. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aenean euismod, nisi vel consectetur interdum, nisl nisi cursus nisi, vitae tincidunt nisi nisl eget nisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Vivamus lacinia odio vitae vestibulum. Nulla facilisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Nam sit amet erat euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt.

Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Curabitur pretium tincidunt lacus. Nulla gravida orci a odio, et viverra justo commodo id. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aenean euismod, nisi vel consectetur interdum, nisl nisi cursus nisi, vitae tincidunt nisi nisl eget nisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Vivamus lacinia odio vitae vestibulum. Nulla facilisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Nam sit amet erat euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt.

Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Curabitur pretium tincidunt lacus. Nulla gravida orci a odio, et viverra justo commodo id. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aenean euismod, nisi vel consectetur interdum, nisl nisi cursus nisi, vitae tincidunt nisi nisl eget nisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Vivamus lacinia odio vitae vestibulum. Nulla facilisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Nam sit amet erat euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt.

Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Curabitur pretium tincidunt lacus. Nulla gravida orci a odio, et viverra justo commodo id. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aenean euismod, nisi vel consectetur interdum, nisl nisi cursus nisi, vitae tincidunt nisi nisl eget nisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Vivamus lacinia odio vitae vestibulum. Nulla facilisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Nam sit amet erat euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt.

Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Curabitur pretium tincidunt lacus. Nulla gravida orci a odio, et viverra justo commodo id. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aenean euismod, nisi vel consectetur interdum, nisl nisi cursus nisi, vitae tincidunt nisi nisl eget nisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Vivamus lacinia odio vitae vestibulum. Nulla facilisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Nam sit amet erat euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt.

Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Curabitur pretium tincidunt lacus. Nulla gravida orci a odio, et viverra justo commodo id. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aenean euismod, nisi vel consectetur interdum, nisl nisi cursus nisi, vitae tincidunt nisi nisl eget nisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Vivamus lacinia odio vitae vestibulum. Nulla facilisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Nam sit amet erat euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt.

Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Curabitur pretium tincidunt lacus. Nulla gravida orci a odio, et viverra justo commodo id. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aenean euismod, nisi vel consectetur interdum, nisl nisi cursus nisi, vitae tincidunt nisi nisl eget nisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Vivamus lacinia odio vitae vestibulum. Nulla facilisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Nam sit amet erat euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt.

Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Curabitur pretium tincidunt lacus. Nulla gravida orci a odio, et viverra justo commodo id. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aenean euismod, nisi vel consectetur interdum, nisl nisi cursus nisi, vitae tincidunt nisi nisl eget nisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Vivamus lacinia odio vitae vestibulum. Nulla facilisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Nam sit amet erat euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt.

Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Curabitur pretium tincidunt lacus. Nulla gravida orci a odio, et viverra justo commodo id. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aenean euismod, nisi vel consectetur interdum, nisl nisi cursus nisi, vitae tincidunt nisi nisl eget nisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Vivamus lacinia odio vitae vestibulum. Nulla facilisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Nam sit amet erat euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt.

Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Curabitur pretium tincidunt lacus. Nulla gravida orci a odio, et viverra justo commodo id. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aenean euismod, nisi vel consectetur interdum, nisl nisi cursus nisi, vitae tincidunt nisi nisl eget nisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Vivamus lacinia odio vitae vestibulum. Nulla facilisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Nam sit amet erat euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt.

Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Curabitur pretium tincidunt lacus. Nulla gravida orci a odio, et viverra justo commodo id. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aenean euismod, nisi vel consectetur interdum, nisl nisi cursus nisi, vitae tincidunt nisi nisl eget nisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Vivamus lacinia odio vitae vestibulum. Nulla facilisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Nam sit amet erat euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt.

Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Curabitur pretium tincidunt lacus. Nulla gravida orci a odio, et viverra justo commodo id. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aenean euismod, nisi vel consectetur interdum, nisl nisi cursus nisi, vitae tincidunt nisi nisl eget nisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Vivamus lacinia odio vitae vestibulum. Nulla facilisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Nam sit amet erat euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt.

Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Curabitur pretium tincidunt lacus. Nulla gravida orci a odio, et viverra justo commodo id. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aenean euismod, nisi vel consectetur interdum, nisl nisi cursus nisi, vitae tincidunt nisi nisl eget nisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Vivamus lacinia odio vitae vestibulum. Nulla facilisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Nam sit amet erat euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt.

Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Curabitur pretium tincidunt lacus. Nulla gravida orci a odio, et viverra justo commodo id. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aenean euismod, nisi vel consectetur interdum, nisl nisi cursus nisi, vitae tincidunt nisi nisl eget nisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Vivamus lacinia odio vitae vestibulum. Nulla facilisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Nam sit amet erat euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt.

Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Curabitur pretium tincidunt lacus. Nulla gravida orci a odio, et viverra justo commodo id. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aenean euismod, nisi vel consectetur interdum, nisl nisi cursus nisi, vitae tincidunt nisi nisl eget nisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Vivamus lacinia odio vitae vestibulum. Nulla facilisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Nam sit amet erat euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt.

- Be mindful of the endowment heuristic in sales conversations.

When purchasing something, be aware ...

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Ut enim ad minim veniam, quis nostrud exercitation ullamco laboris nisi ut aliquip ex ea commodo consequat. Duis aute irure dolor in reprehenderit in voluptate velit esse cillum dolore eu fugiat nulla pariatur. Excepteur sint occaecat cupidatat non proident, sunt in culpa qui officia deserunt mollit anim id est laborum.

Curabitur pretium tincidunt lacus. Nulla gravida orci a odio, et viverra justo commodo id. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aenean euismod, nisi vel consectetur interdum, nisl nisi cursus nisi, vitae tincidunt nisi nisl eget nisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Vivamus lacinia odio vitae vestibulum. Nulla facilisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Nam sit amet erat euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt.

Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Curabitur pretium tincidunt lacus. Nulla gravida orci a odio, et viverra justo commodo id. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aenean euismod, nisi vel consectetur interdum, nisl nisi cursus nisi, vitae tincidunt nisi nisl eget nisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Vivamus lacinia odio vitae vestibulum. Nulla facilisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Nam sit amet erat euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt.

Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Curabitur pretium tincidunt lacus. Nulla gravida orci a odio, et viverra justo commodo id. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aenean euismod, nisi vel consectetur interdum, nisl nisi cursus nisi, vitae tincidunt nisi nisl eget nisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Vivamus lacinia odio vitae vestibulum. Nulla facilisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Nam sit amet erat euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt.

Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Curabitur pretium tincidunt lacus. Nulla gravida orci a odio, et viverra justo commodo id. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aenean euismod, nisi vel consectetur interdum, nisl nisi cursus nisi, vitae tincidunt nisi nisl eget nisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Vivamus lacinia odio vitae vestibulum. Nulla facilisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Nam sit amet erat euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt.

Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Curabitur pretium tincidunt lacus. Nulla gravida orci a odio, et viverra justo commodo id. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aenean euismod, nisi vel consectetur interdum, nisl nisi cursus nisi, vitae tincidunt nisi nisl eget nisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Vivamus lacinia odio vitae vestibulum. Nulla facilisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Nam sit amet erat euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt.

Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Curabitur pretium tincidunt lacus. Nulla gravida orci a odio, et viverra justo commodo id. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aenean euismod, nisi vel consectetur interdum, nisl nisi cursus nisi, vitae tincidunt nisi nisl eget nisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Vivamus lacinia odio vitae vestibulum. Nulla facilisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Nam sit amet erat euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt.

Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Curabitur pretium tincidunt lacus. Nulla gravida orci a odio, et viverra justo commodo id. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aenean euismod, nisi vel consectetur interdum, nisl nisi cursus nisi, vitae tincidunt nisi nisl eget nisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Vivamus lacinia odio vitae vestibulum. Nulla facilisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Nam sit amet erat euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt.

Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Curabitur pretium tincidunt lacus. Nulla gravida orci a odio, et viverra justo commodo id. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aenean euismod, nisi vel consectetur interdum, nisl nisi cursus nisi, vitae tincidunt nisi nisl eget nisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Vivamus lacinia odio vitae vestibulum. Nulla facilisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Nam sit amet erat euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt.

Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Curabitur pretium tincidunt lacus. Nulla gravida orci a odio, et viverra justo commodo id. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aenean euismod, nisi vel consectetur interdum, nisl nisi cursus nisi, vitae tincidunt nisi nisl eget nisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Vivamus lacinia odio vitae vestibulum. Nulla facilisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Nam sit amet erat euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt.

Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Curabitur pretium tincidunt lacus. Nulla gravida orci a odio, et viverra justo commodo id. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aenean euismod, nisi vel consectetur interdum, nisl nisi cursus nisi, vitae tincidunt nisi nisl eget nisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Vivamus lacinia odio vitae vestibulum. Nulla facilisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Nam sit amet erat euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt.

Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Curabitur pretium tincidunt lacus. Nulla gravida orci a odio, et viverra justo commodo id. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aenean euismod, nisi vel consectetur interdum, nisl nisi cursus nisi, vitae tincidunt nisi nisl eget nisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Vivamus lacinia odio vitae vestibulum. Nulla facilisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Nam sit amet erat euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt.

Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Curabitur pretium tincidunt lacus. Nulla gravida orci a odio, et viverra justo commodo id. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aenean euismod, nisi vel consectetur interdum, nisl nisi cursus nisi, vitae tincidunt nisi nisl eget nisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Vivamus lacinia odio vitae vestibulum. Nulla facilisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Nam sit amet erat euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt.

Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Curabitur pretium tincidunt lacus. Nulla gravida orci a odio, et viverra justo commodo id. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aenean euismod, nisi vel consectetur interdum, nisl nisi cursus nisi, vitae tincidunt nisi nisl eget nisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Vivamus lacinia odio vitae vestibulum. Nulla facilisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Nam sit amet erat euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt.

Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Curabitur pretium tincidunt lacus. Nulla gravida orci a odio, et viverra justo commodo id. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aenean euismod, nisi vel consectetur interdum, nisl nisi cursus nisi, vitae tincidunt nisi nisl eget nisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Vivamus lacinia odio vitae vestibulum. Nulla facilisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Nam sit amet erat euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt.

Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Curabitur pretium tincidunt lacus. Nulla gravida orci a odio, et viverra justo commodo id. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aenean euismod, nisi vel consectetur interdum, nisl nisi cursus nisi, vitae tincidunt nisi nisl eget nisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Vivamus lacinia odio vitae vestibulum. Nulla facilisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Nam sit amet erat euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt.

Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Curabitur pretium tincidunt lacus. Nulla gravida orci a odio, et viverra justo commodo id. Aliquam in felis sit amet augue laoreet fringilla. Suspendisse potenti. Sed in libero ut nibh placerat accumsan. Proin ac libero euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt. Aenean euismod, nisi vel consectetur interdum, nisl nisi cursus nisi, vitae tincidunt nisi nisl eget nisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Vivamus lacinia odio vitae vestibulum. Nulla facilisi. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo.

Nam sit amet erat euismod, tincidunt nisi a, tincidunt nunc. Sed sit amet ipsum non quam tincidunt tincidunt. Nulla facilisi. Donec vel libero nec justo tincidunt tincidunt. Sed ut perspiciatis unde omnis iste natus error sit voluptatem accusantium doloremque laudantium, totam rem aperiam, eaque ipsa quae ab illo inventore veritatis et quasi architecto beatae vitae dicta sunt explicabo. Integer in libero ut justo cursus tincidunt. Sed vitae libero sit amet dolor tincidunt tincidunt.

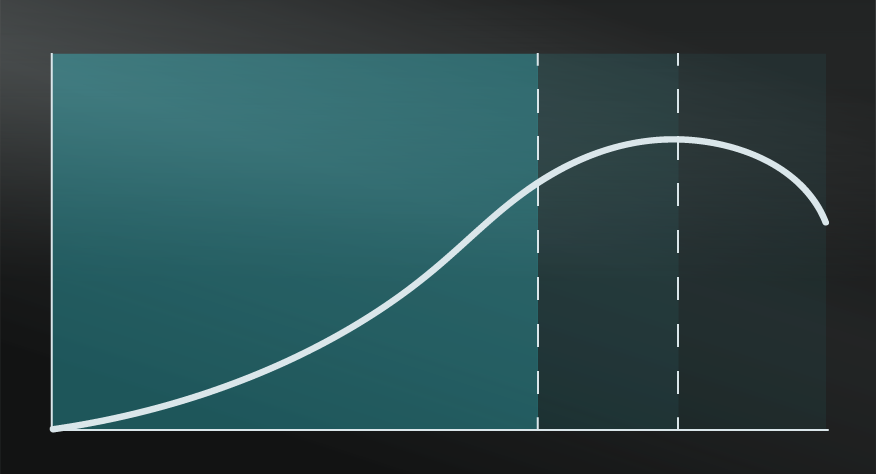

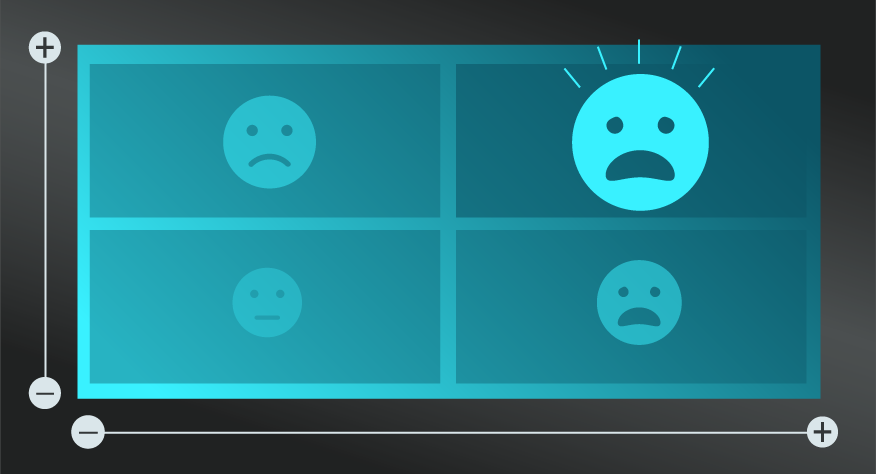

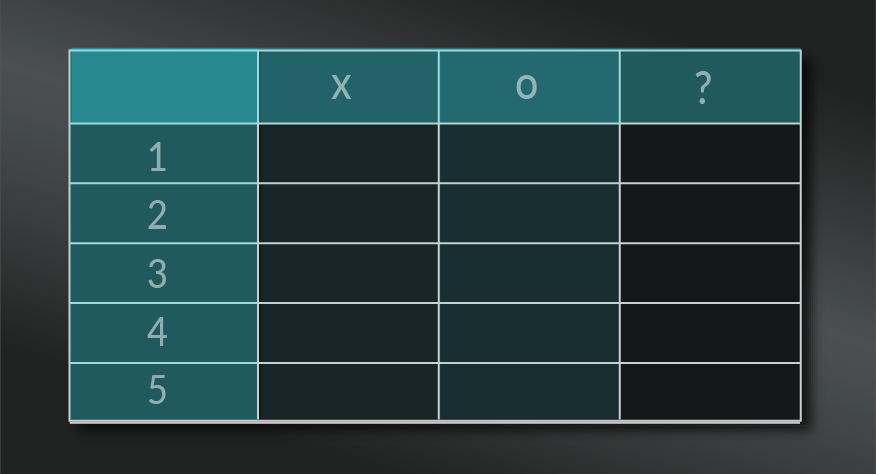

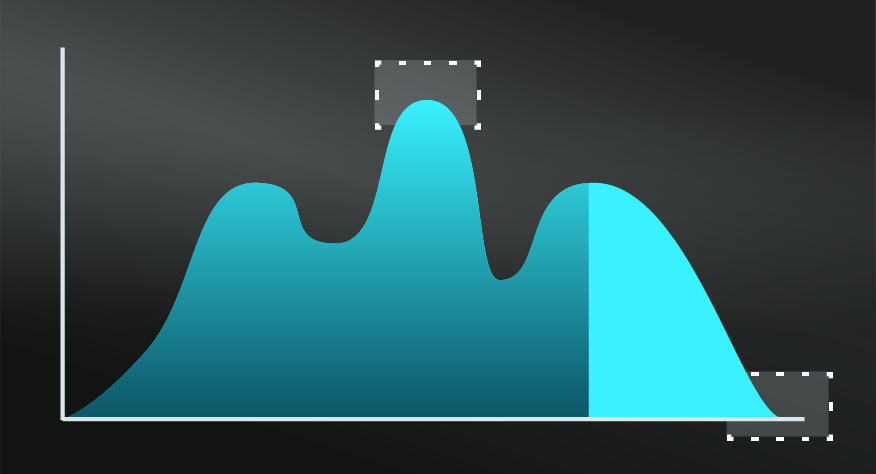

There have been critics of the Endowment Heuristic, with some claiming it does not exist or at least is not as apparent in real life as in fixed experiments. For example, some argue that the results from the mug experiment (see the ‘In Practice’ section) was more due to artificial scarcity.

Mugs.

This 1991 paper by Daniel Kahneman, Jack Knetcsch and Richard Thaler describes the classic example of the endowment heuristic involving mugs. In it, participants were given a mug and then given the chance to trade it. They found that the value attributed to owned mugs was twice as high as they were actually willing to pay for such a mug that they did not own.

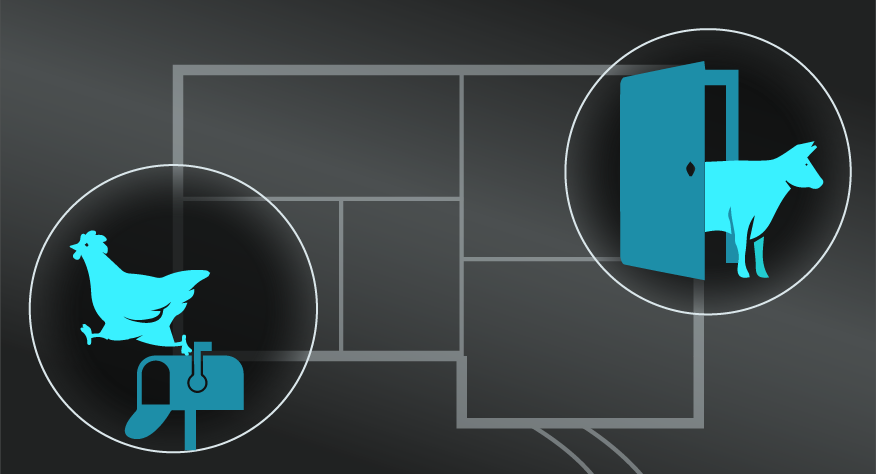

The endowment heuristic is part of behavioural economics, stemming from the fast and slow thinking mental model and relating closely to loss aversion.

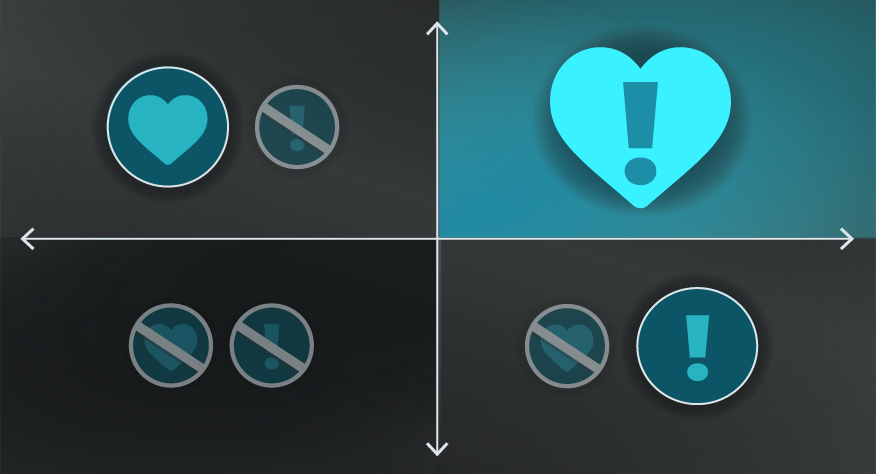

Use the following examples of connected and complementary models to weave availability heuristic into your broader latticework of mental models. Alternatively, discover your own connections by exploring the category list above.

Connected models:

- Fast and slow thinking: providing broader context to the endowment effect.

- Loss aversion and opportunity cost: a closely linked heuristic and bias.

- Lock in effect: and challenge of customer loyalty.

Complementary models:

- Design thinking: consider strategies to co-design and increase ownership of initiatives.

- Lean startup: iterating with minimum viable products, allowing audience groups to access and own quickly and cheaply.

Aristotle noted the tendency towards the Endowment Effect in Ancient Greece, when he explained: “For most things are differently valued by those who have them and by those who wish to get them: what belongs to us, and what we give away, always seems very precious to us.”

However, the term itself was first coined by the behavioural economist Richard Thaler in his 1980 paper entitled ‘Toward a Positive Theory of Consumer Choice.’

My Notes

My Notes

Oops, That’s Members’ Only!

Fortunately, it only costs US$5/month to Join ModelThinkers and access everything so that you can rapidly discover, learn, and apply the world’s most powerful ideas.

ModelThinkers membership at a glance:

“Yeah, we hate pop ups too. But we wanted to let you know that, with ModelThinkers, we’re making it easier for you to adapt, innovate and create value. We hope you’ll join us and the growing community of ModelThinkers today.”