0 saved

0 saved

34.6K views

34.6K views

Can't be bothered changing banks? Already committed to Apple over Android? Or the other way around? Well, you've already experienced this mental model.

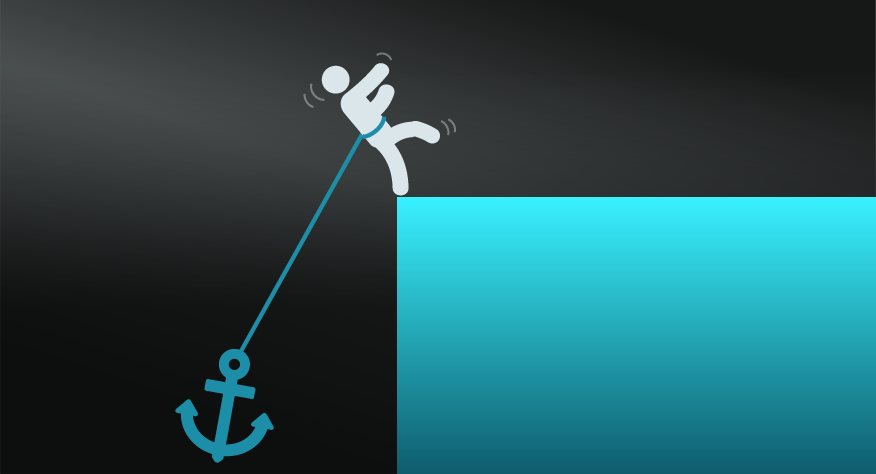

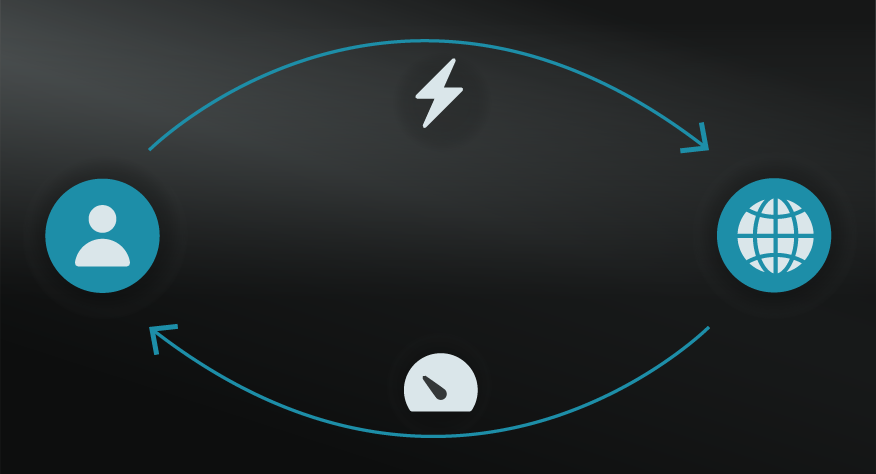

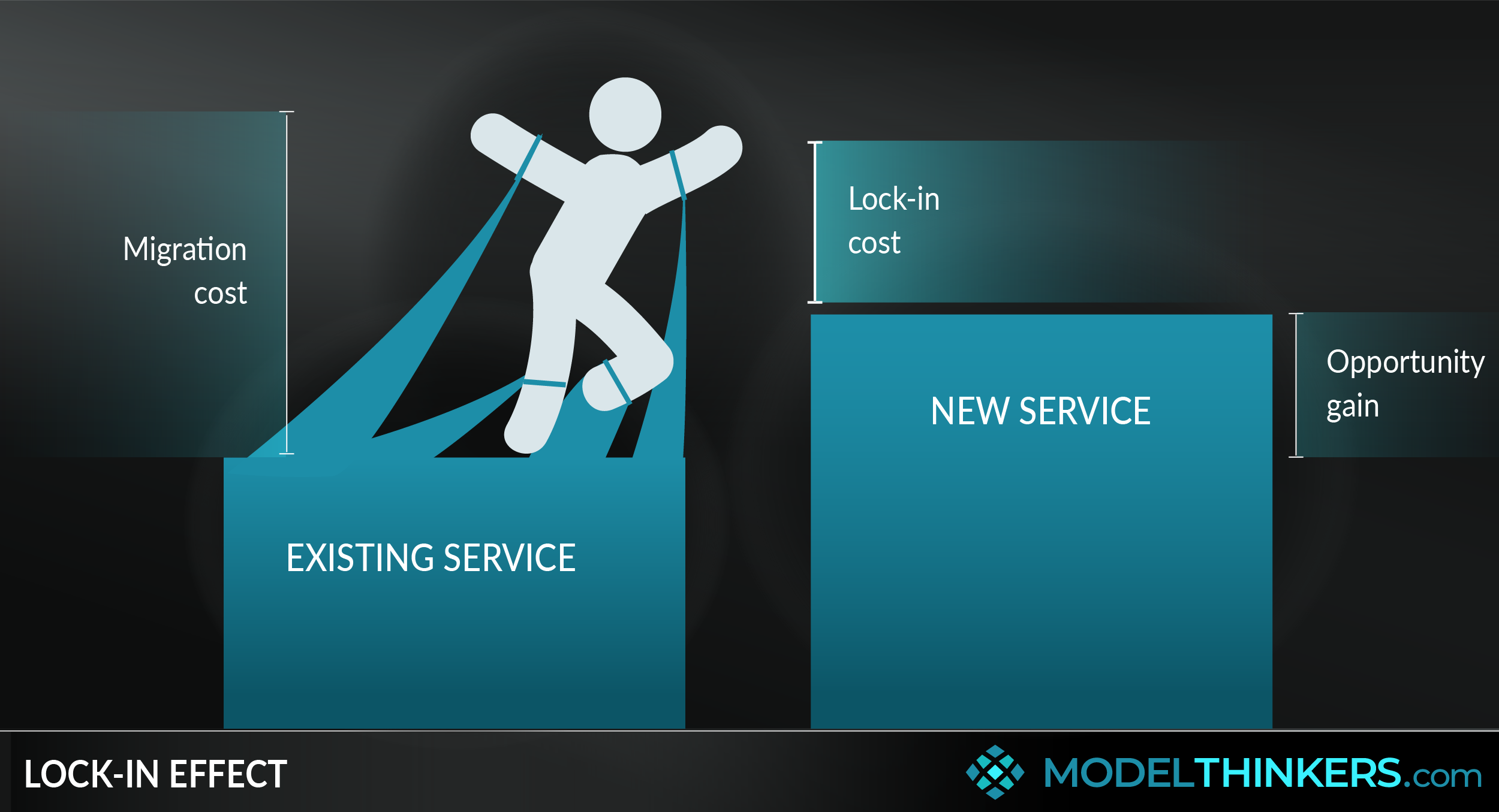

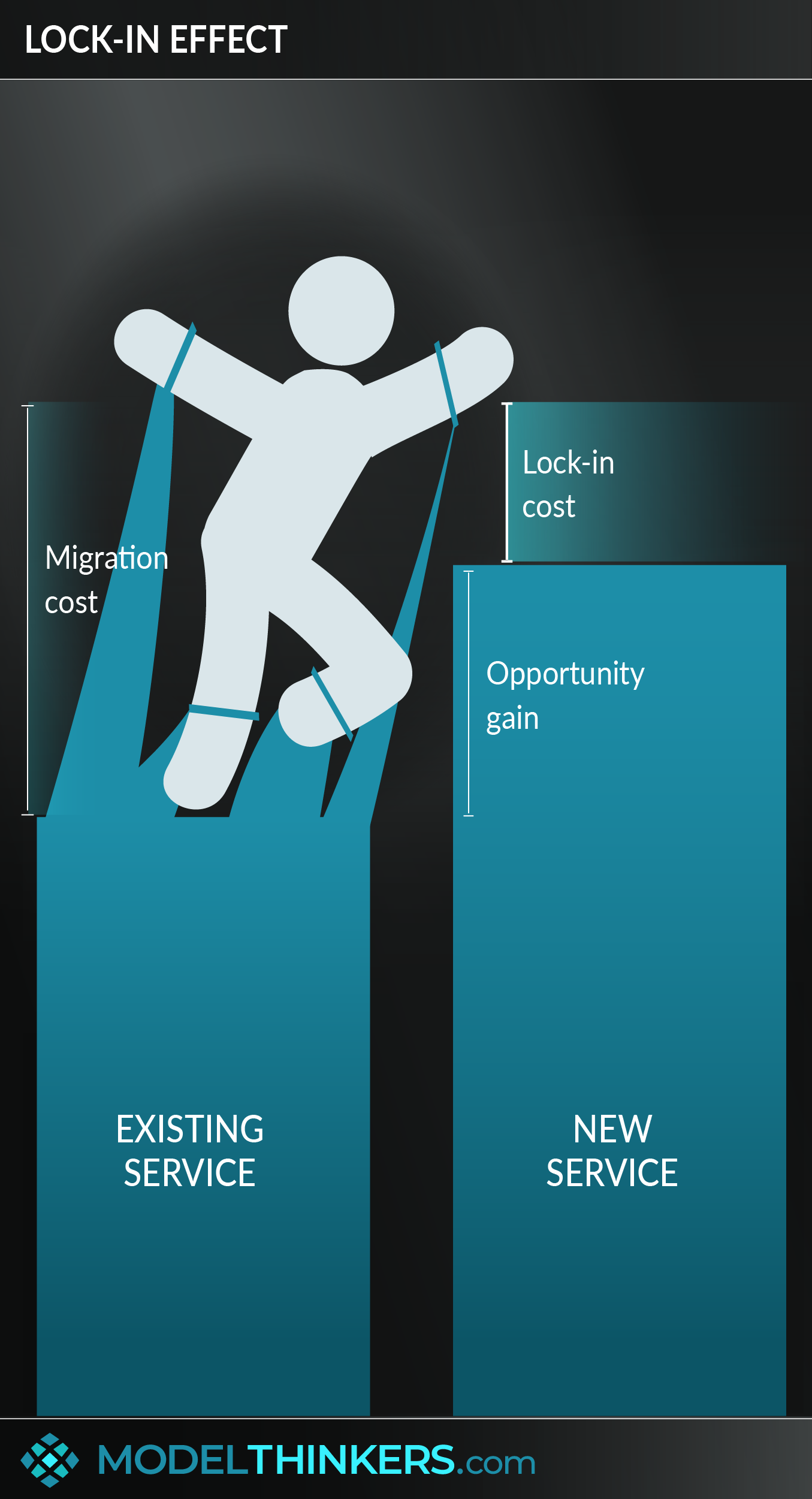

The Lock-In Effect is a strategy for keeping customers by making it hard for them to leave.

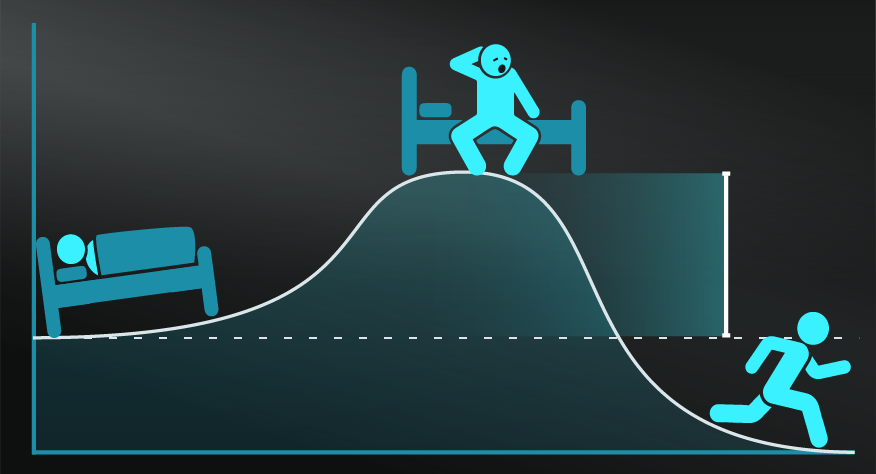

CUSTOMER INERTIA.

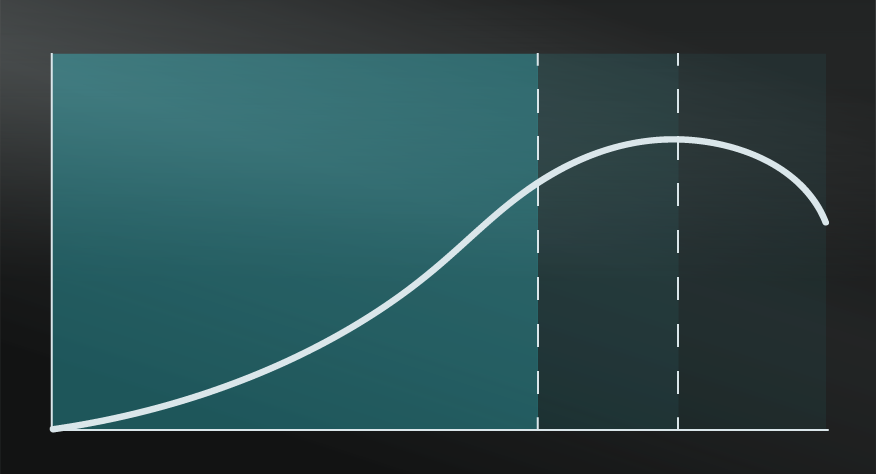

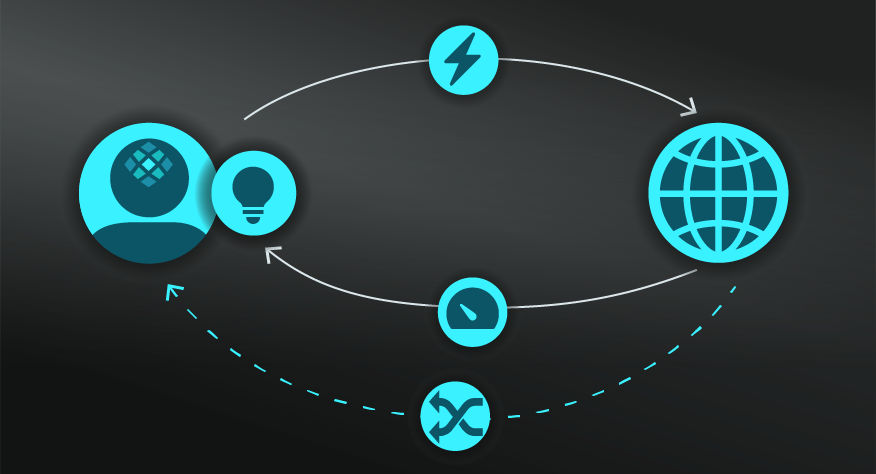

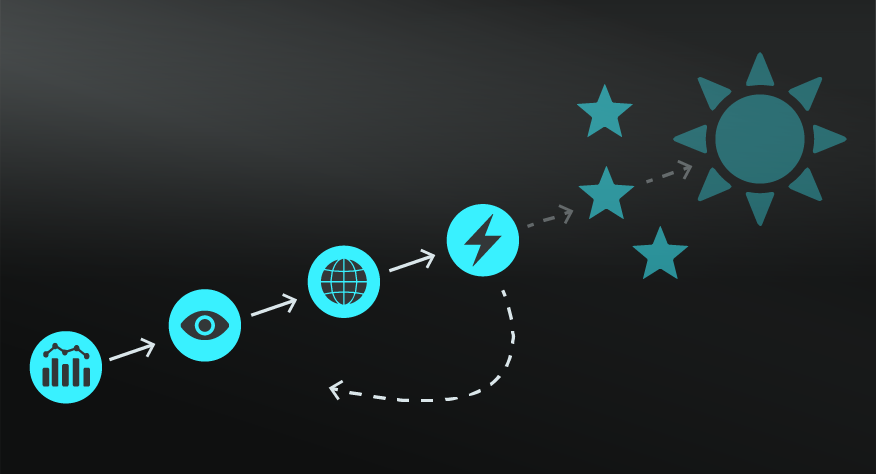

The Lock-In Effect can be achieved through creating more value in comparison to competitors and even developing a customer dependency on a good or service, as well as increasing the blocks facing a customer who wishes to make a change. The lock-in cost can be represented as the cost of moving services less the opportunity cost gained by moving to a competitor.

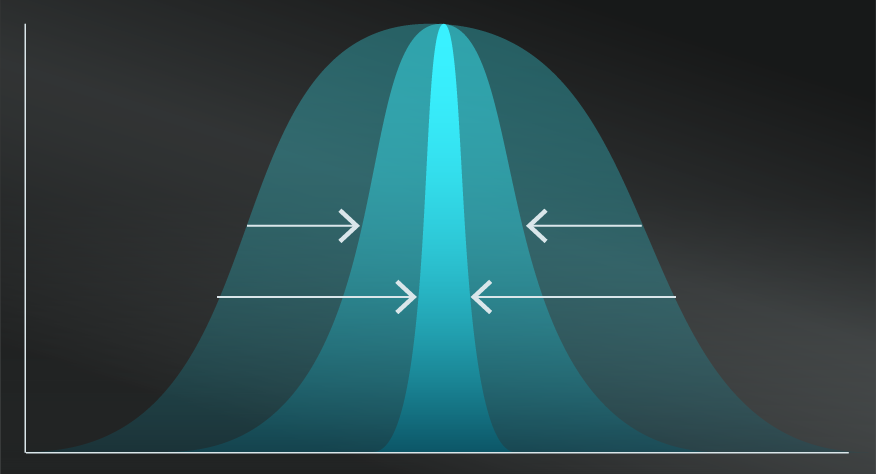

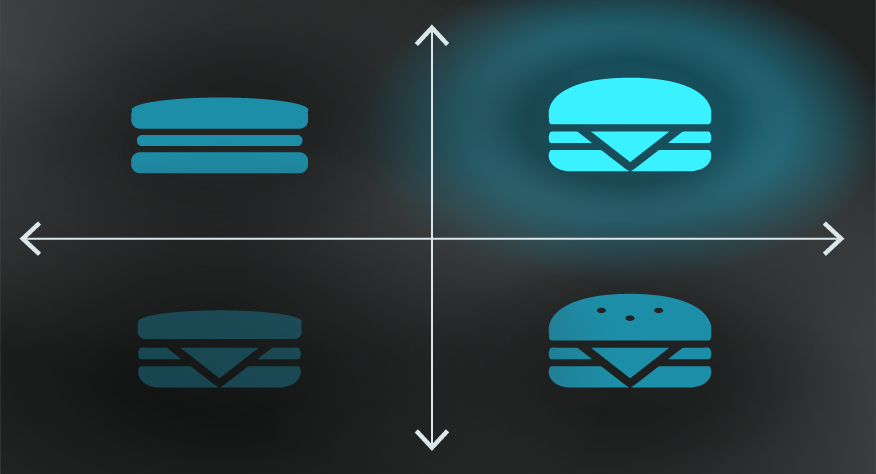

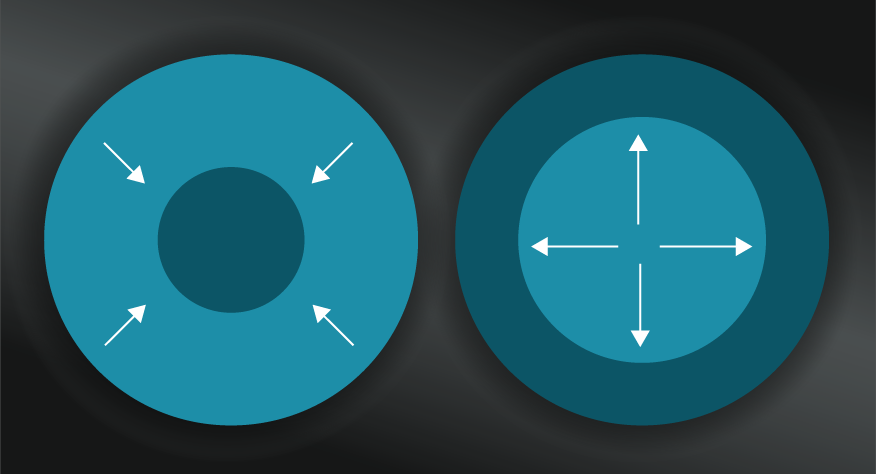

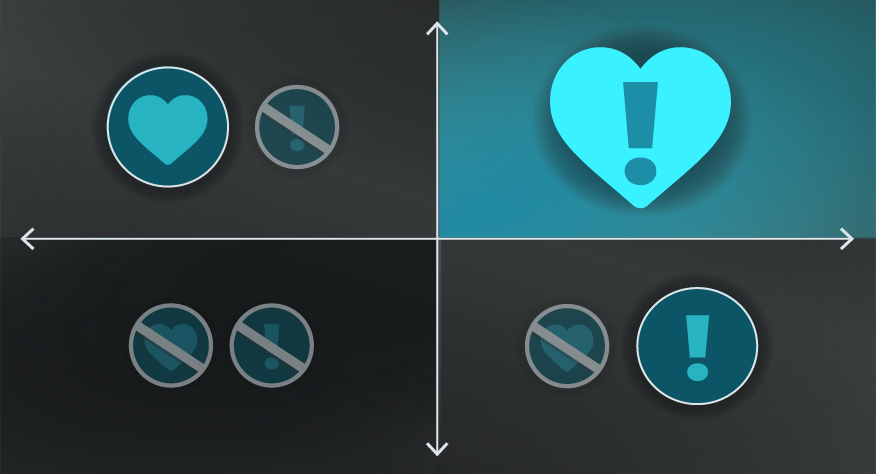

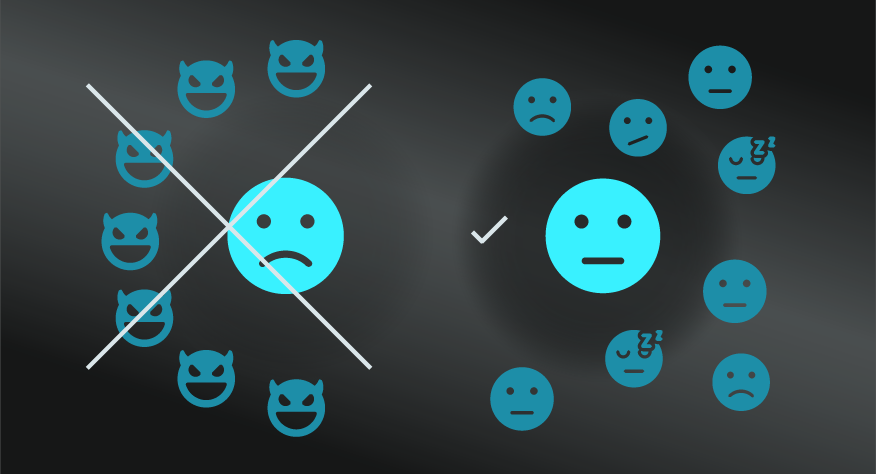

MORE FRICTION vs MANIPULATION.

Using the Lock-In Effect by increasing friction on customer movement is generally perceived to be manipulative by customers. The ethical option is to focus on delivering greater value, making any move become less appealing.

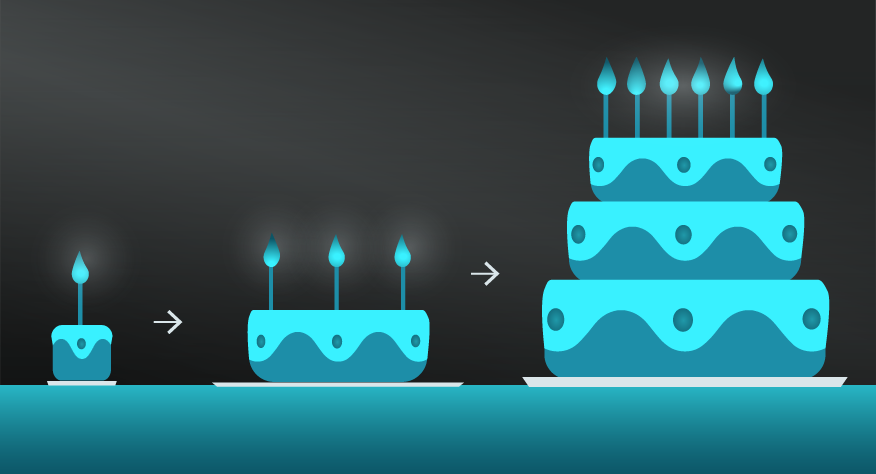

THE CHALLENGE FOR STARTUPS.

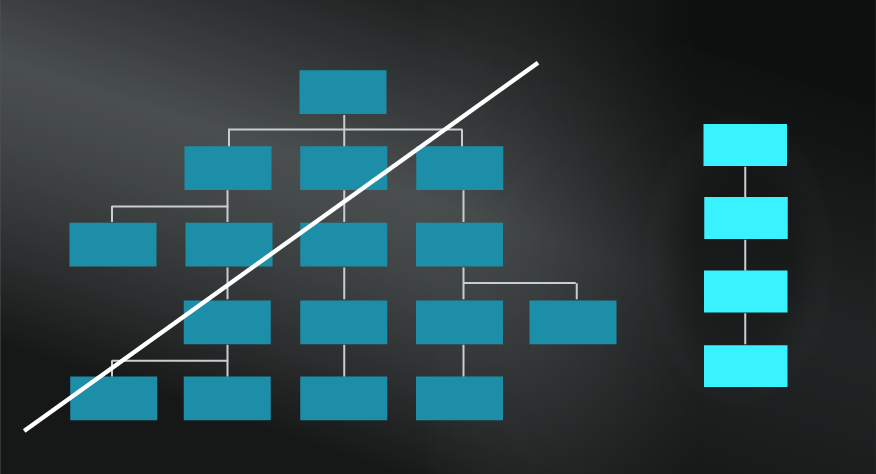

As a newcomer to a contested market, the key question will often involve how will you break the Lock-In Effect of your competitors by offering greater value and reducing friction/ cost to change. It might be difficult to battle on price, which means creating a unique or different Value Proposition might be required.

IN YOUR LATTICEWORK.

Understand the Lock-In Effect by digging into Loss Aversion, the Endowment Heuristic, Activation Energy and, to a lesser extent, Hyperbolic Discounting.

It also relates to Opportunity Cost, though inertia adds a greater weight than a simple Cost-Benefit Analysis.

Finally, for entrepreneurs, rather than competing in the same domain with existing competitors, you might want to consider the Blue Ocean Strategy to seek out new markets where the Lock-in Effect has less impact.

- Lower your barrier of adoption

Entering a dominant market with a higher value product might not be enough to fight the lock-in effect. Your strategy will have to include lowering barriers to change and adoption, perhaps including a ‘break out bonus’ or offering to transfer data for free from a competitor.

- Consider emotional lock-in

Sometimes customers find it hard to give up on a service because they feel emotionally attached to it. This is generally amplified by your ability to tell a powerful brand story and personalise your service. This links to the fact that switching costs may not necessarily be real, they must be perceived as high by your customers.

- Associate the lock-in with advantages

If you are offering a new technology, your lock-in strategy might focus on communicating benefits like economies of scale, single point of contact, and better integration.

- Be upfront about your lock-in strategy

If you choose to apply this mental model, it’s recommended that you are transparent about it and inform customers on practices such as high termination fees beforehand. Otherwise, even as you lock-in initial customers, negative reviews and feedback will deter future customers.

Using the unethical version of the Lock-In Effect, where you offer an average service and lock in customers using barriers to exiting, creates customer resentment. In some countries governments have legislated to ensure lower lock-in effect of key services such as utilities and banks, to encourage a more competitive market.

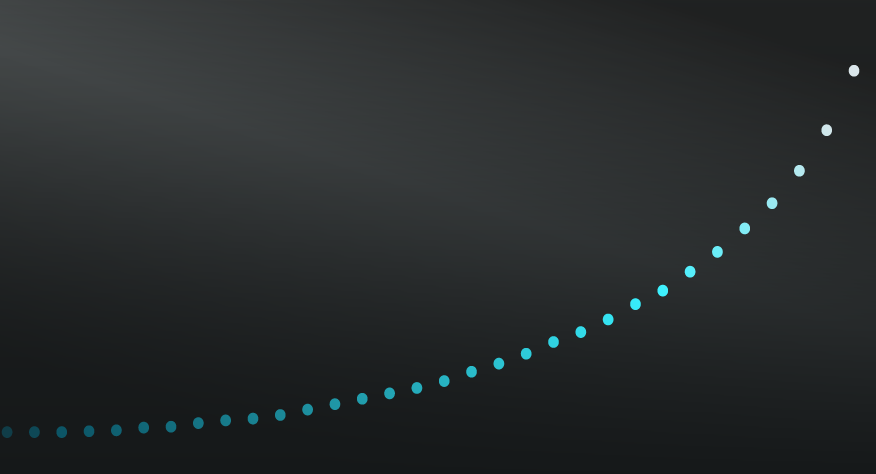

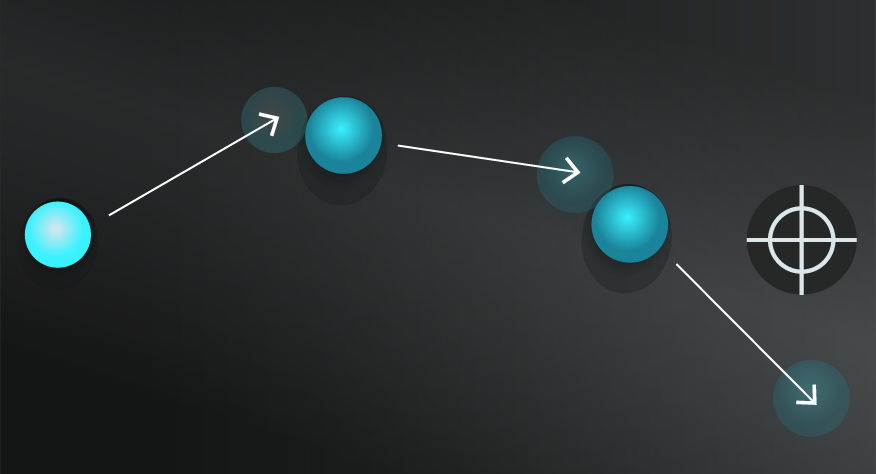

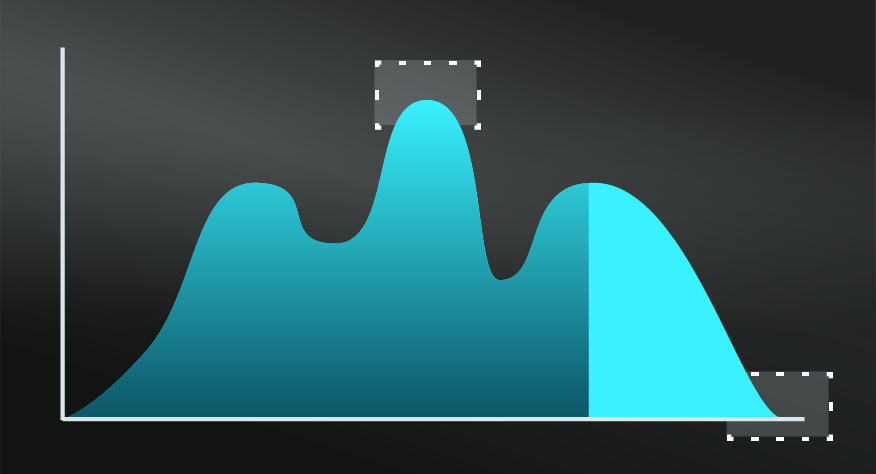

The lock-in effect may also develop without the initiator’s intention, like the QWERTY keyboard being the most used keyboard model in the world until alternatives were totally eliminated. This was later called the Qwerty Phenomenon, which shows us the winning system is not the best one, but the first product available with a new technology takes a larger share of the market and tends to dominate. A similar phenomenon was seen with the rise of VHS video over Beta.

Any big tech company, ever.

Most big tech companies use lock-in strategies, promoting a linked ecosystem of products rather than modular elements.

From Apple providing lock-in through the AppStore, to the Microsoft suite of office products. Similar examples relate to operating systems, platforms and even software file formats. Other companies, such as Spotify and Netflix use your choice history to provide intuitive recommendations as an additional value consideration to lock you into their subscription-based services.

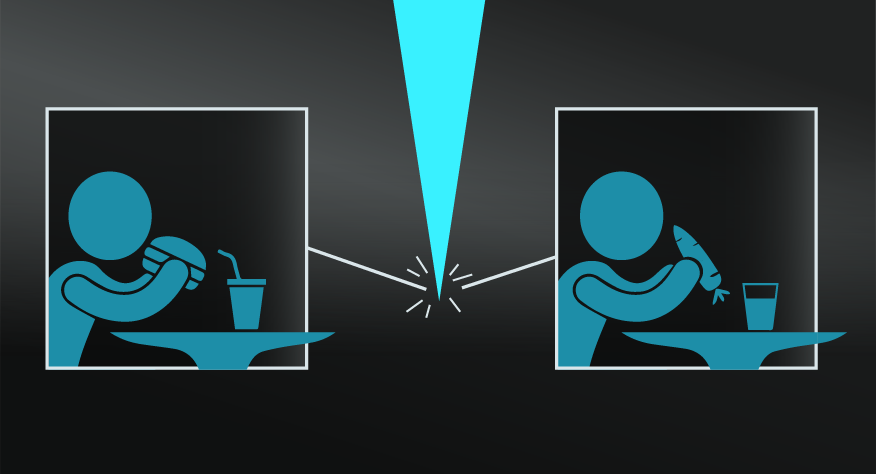

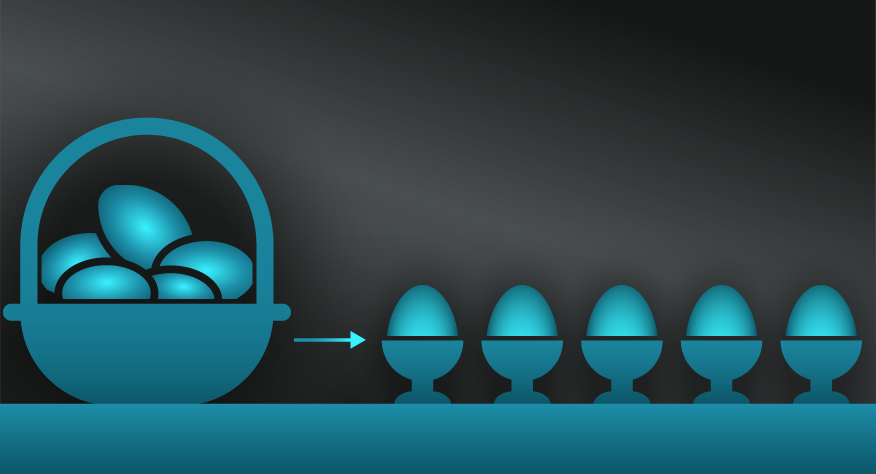

Razors.

A variant of the lock-in strategy is the razor and blades business model, where an item (razor) is sold at a low price while consumable supplies (blades) come at a significant cos

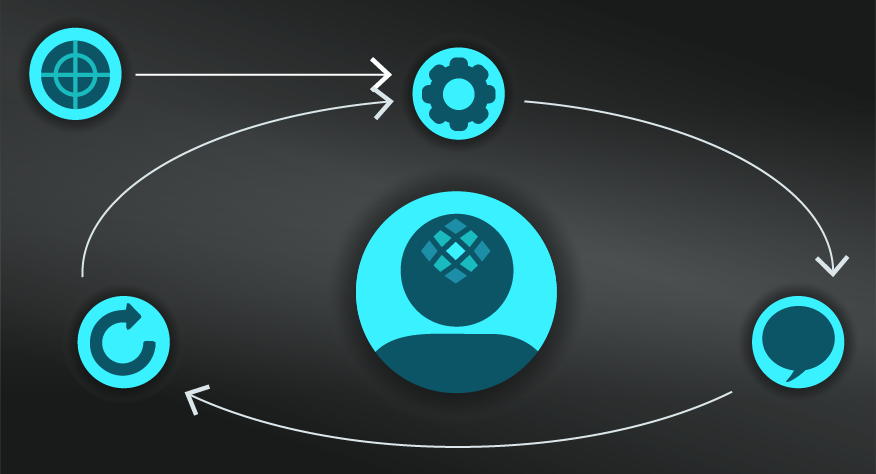

The lock-in effect is used as part of a marketing and business strategy.

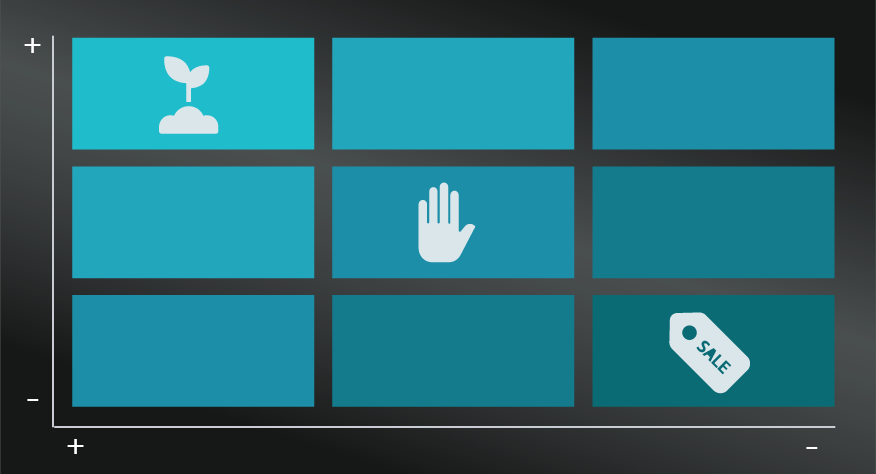

Use the following examples of connected and complementary models to weave the lock-in effect into your broader latticework of mental models. Alternatively, discover your own connections by exploring the category list above.

Connected models:

- Loss aversion, the status quo heuristic and the endowment heuristic: all behavioural economist inspired models that go to explain lock-in and over valuing what you have.

- Porter’s five forces: as part of a broader competitive strategy.

- Blue ocean strategy: when considering challenging existing markets.

- 4Ps of marketing: considering basic marketing decisions.

- Activation energy: the resistance to moving.

Complementary models:

- Red Queen effect: whether your new offer will be matched and negated by the competition with greater market share.

- Features vs benefits: considering actual solutions that your customers care about to lower attrition.

The originator of the Lock-In Effect is unknown.

See this academic paper which looks at ecommerce case study and concludes that emotional lock-in strategies were more effective than other barriers such as monetary, temporal, habitual, emotional and legal barriers.

My Notes

My Notes

Oops, That’s Members’ Only!

Fortunately, it only costs US$5/month to Join ModelThinkers and access everything so that you can rapidly discover, learn, and apply the world’s most powerful ideas.

ModelThinkers membership at a glance:

“Yeah, we hate pop ups too. But we wanted to let you know that, with ModelThinkers, we’re making it easier for you to adapt, innovate and create value. We hope you’ll join us and the growing community of ModelThinkers today.”