0 saved

0 saved

19.3K views

19.3K views

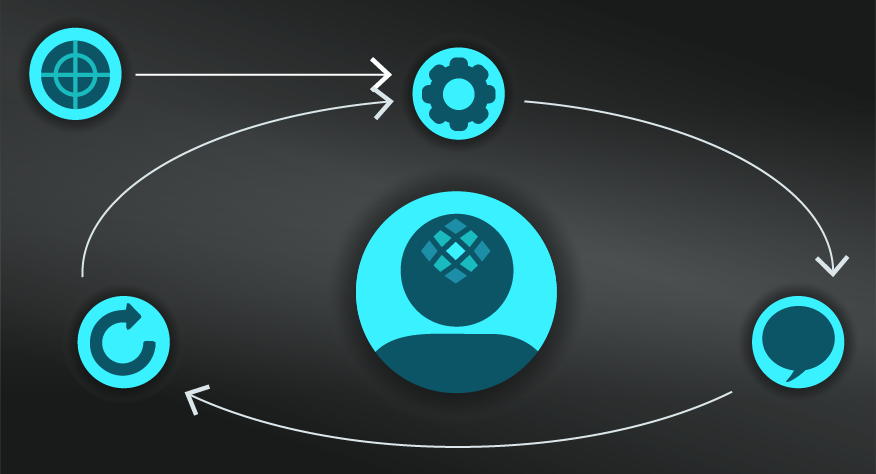

This is a fundamental for any budget, especially for scaling or growing ventures.

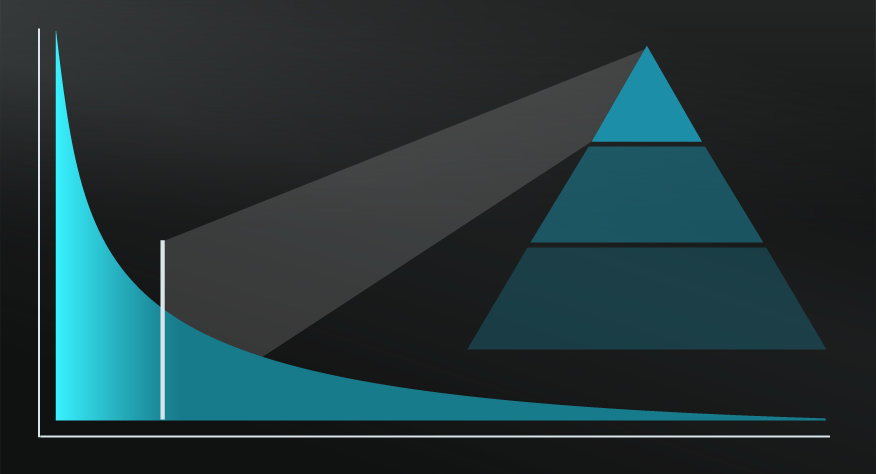

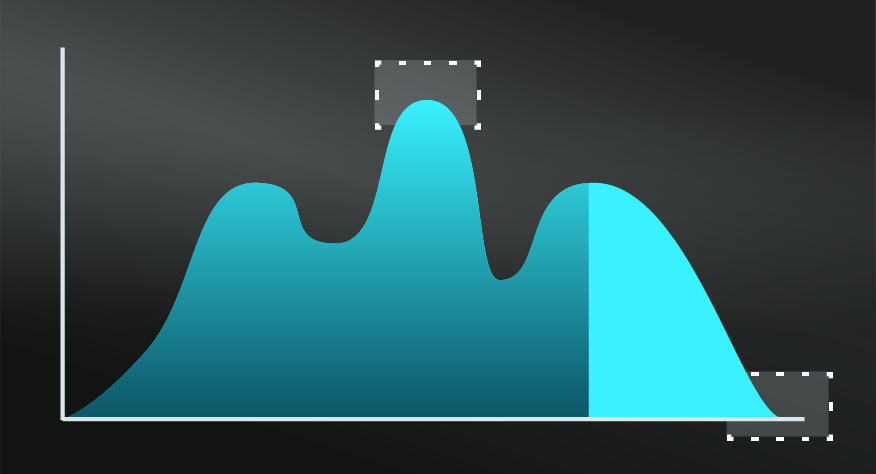

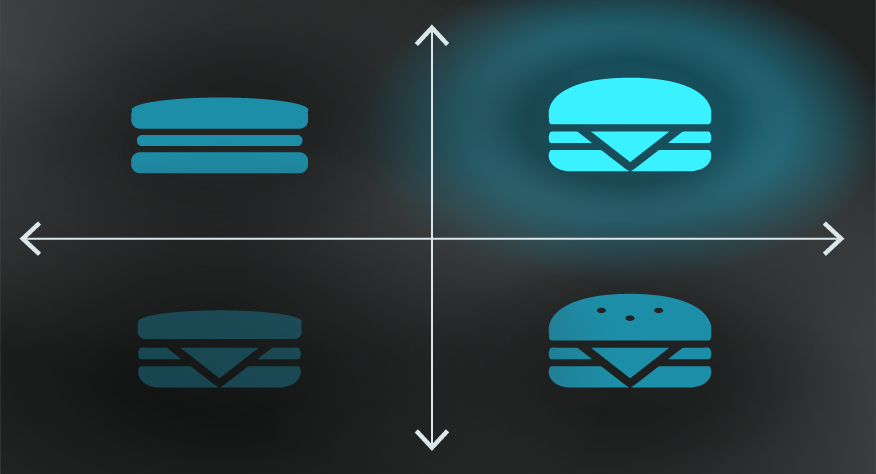

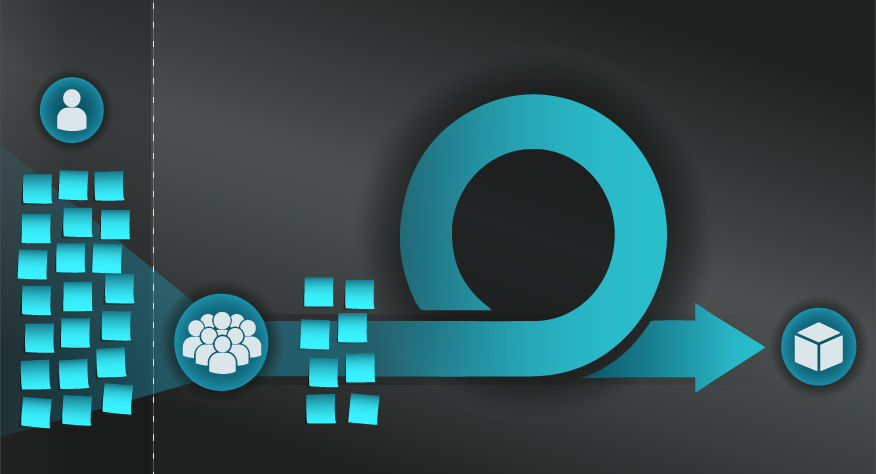

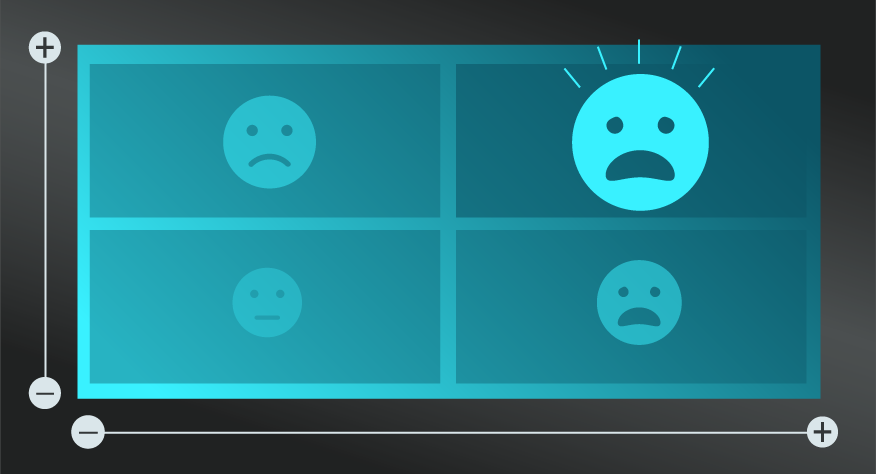

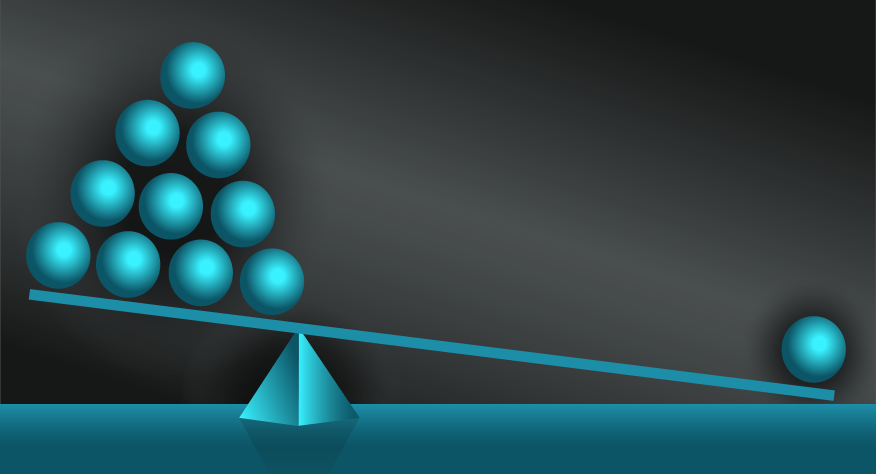

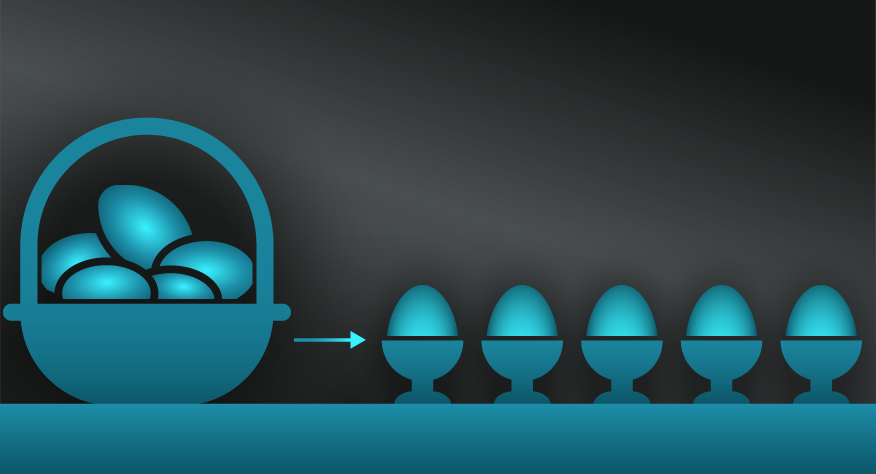

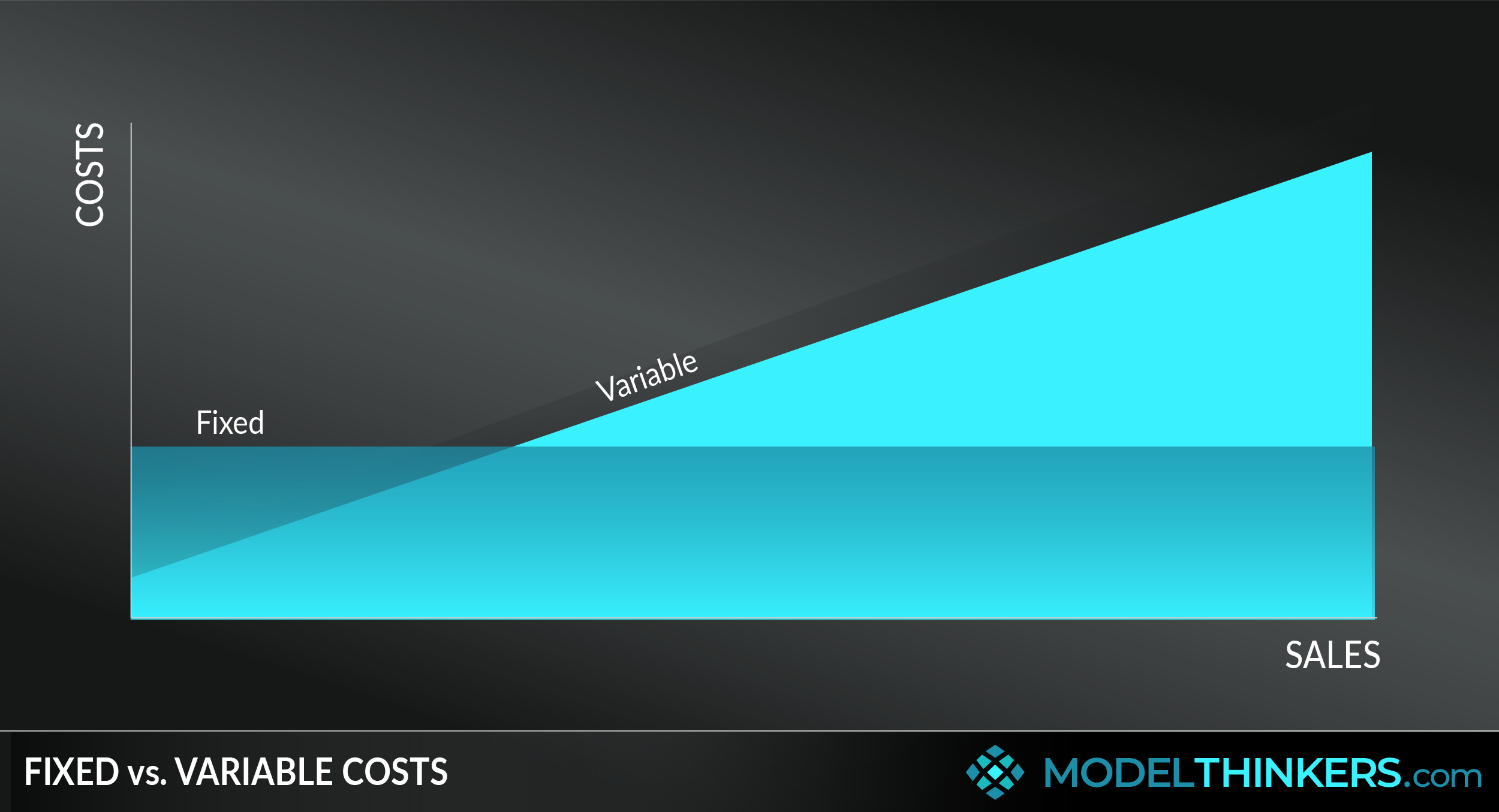

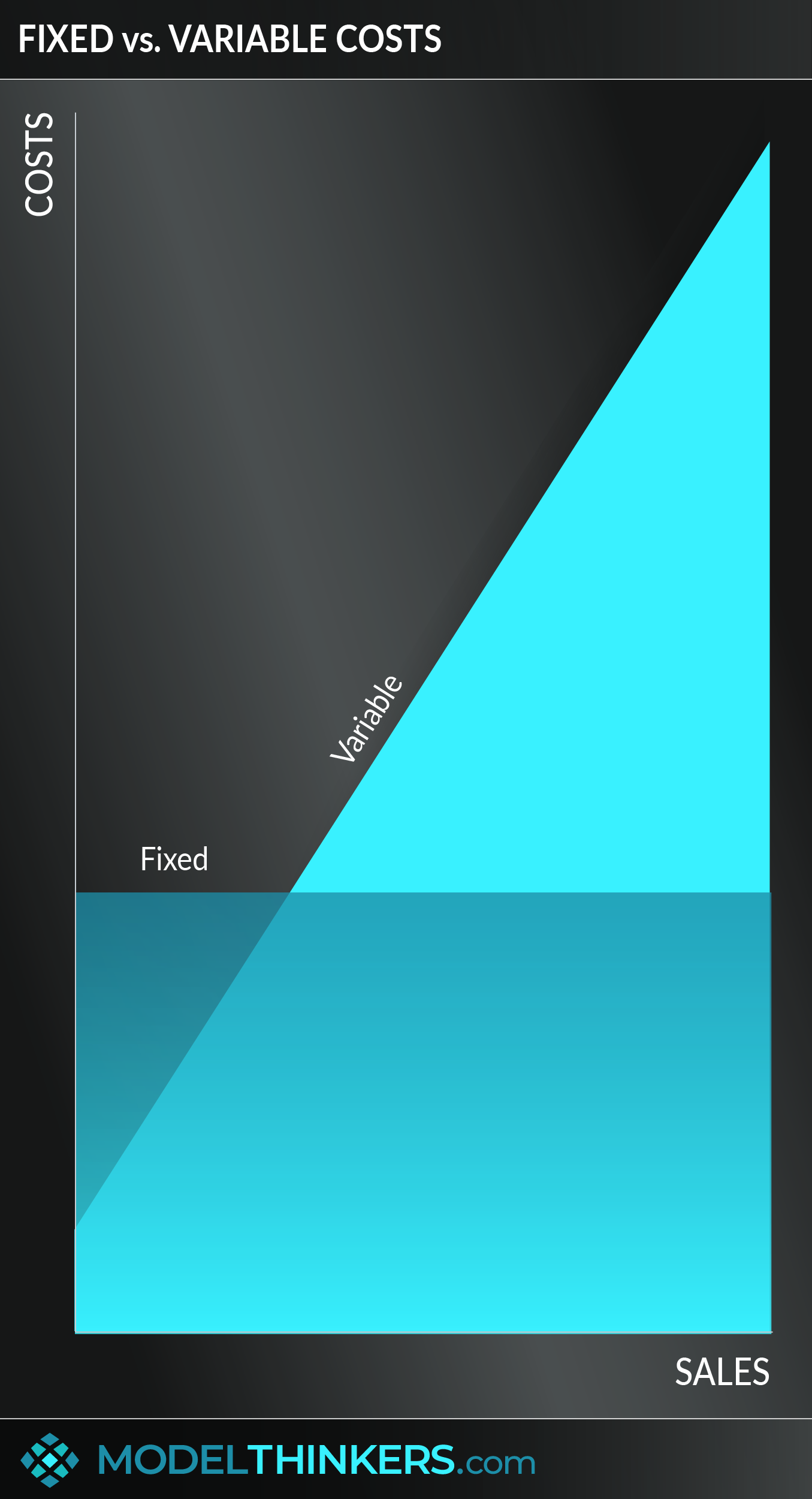

Fixed and Variable Costs refer to the two types of company costs, with fixed costs remaining constant and variable costs growing in line with sales growth.

FIXED COSTS.

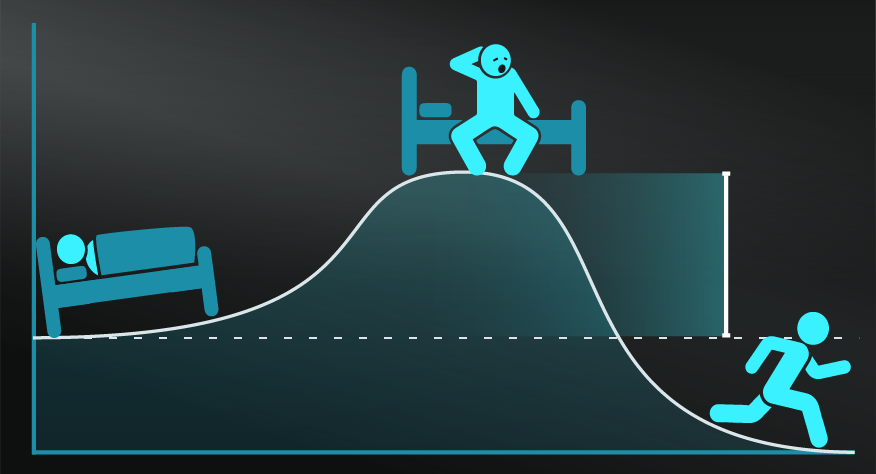

Fixed costs are independent of output and stay the same no matter how much you produce and sell, they often include office rent, employee payroll, equipment depreciation, etc. Even if you sell nothing for a month, those fixed costs will still exist.

VARIABLE COSTS.

In contrast, variable costs are related to change in activity and sales volume, they include taxes, operating and delivery costs, sales commissions etc..

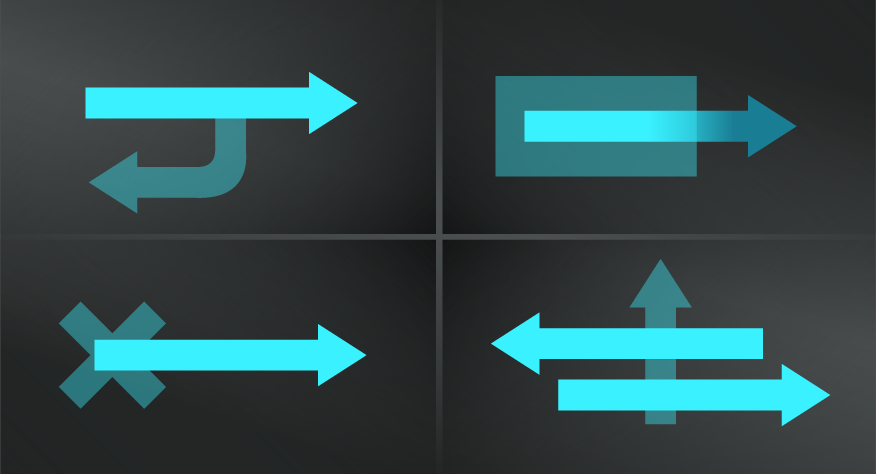

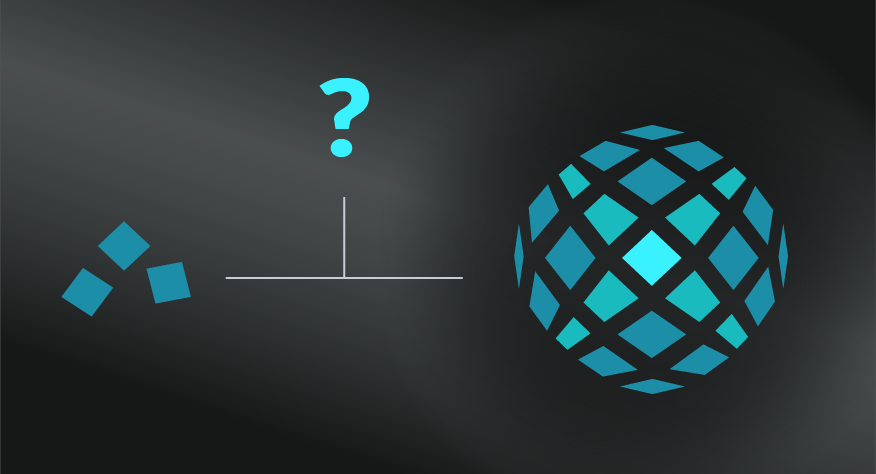

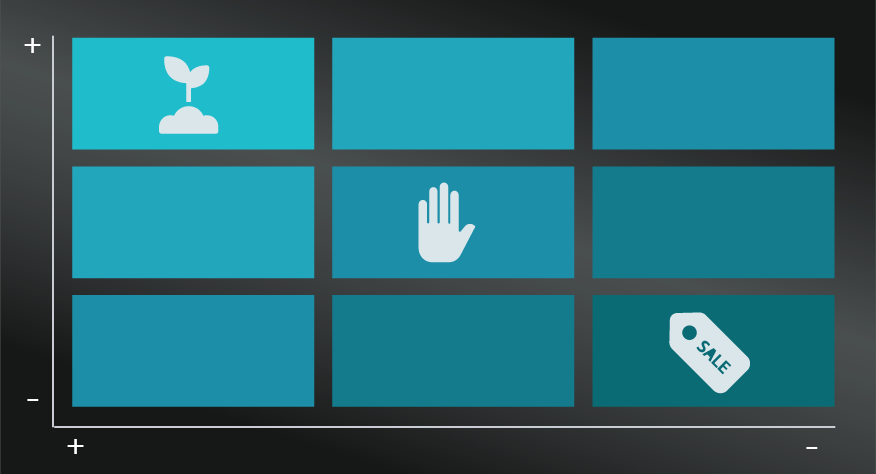

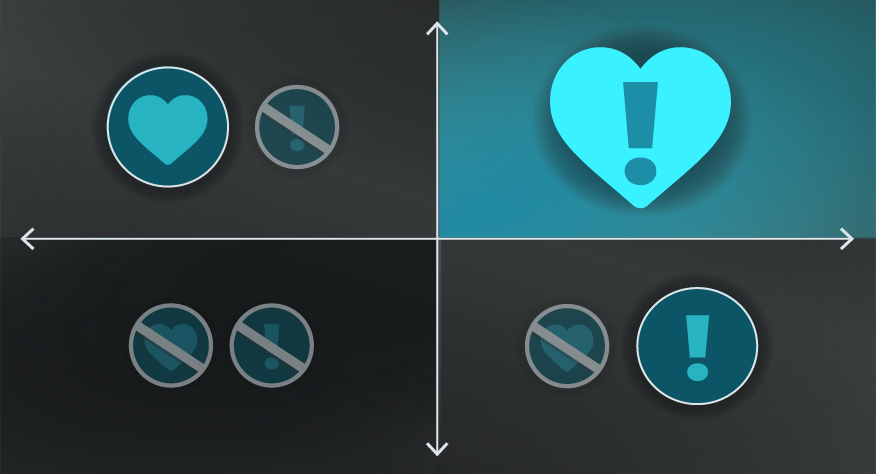

COST STRATEGIES.

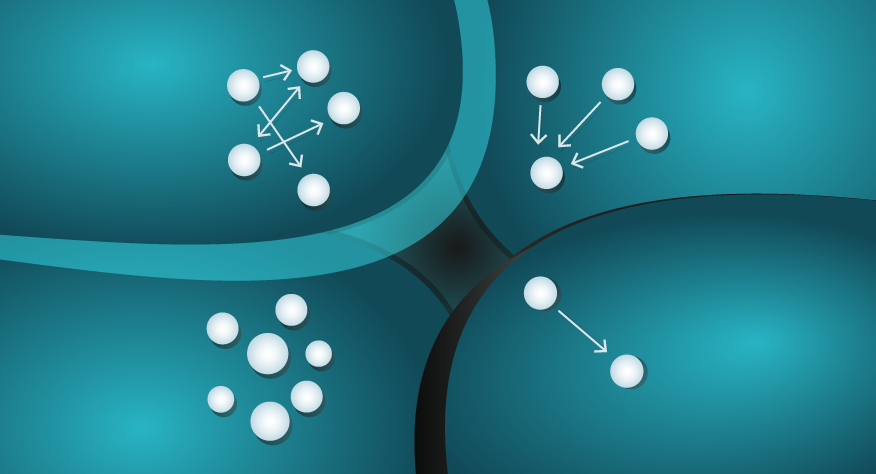

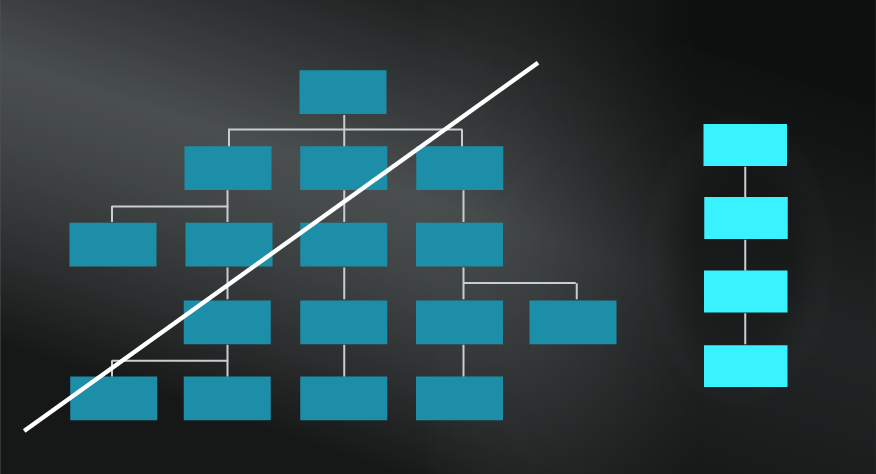

Some established businesses rely on large fixed costs as a deterrent to competitors' market entry, however, there has been a trend towards more variable cost business models that are built lean and designed to scale. Industries with lower fixed costs also support greater amounts of niche markets, with greater competition and specialisation.

DIGITAL PRODUCTS.

This model is also useful to consider traditional versus digital products. Traditional, physical products tend to carry considerable variable costs to ramp up production and delivery. By contrast, digital products can generally scale more easily with lower variable costs.

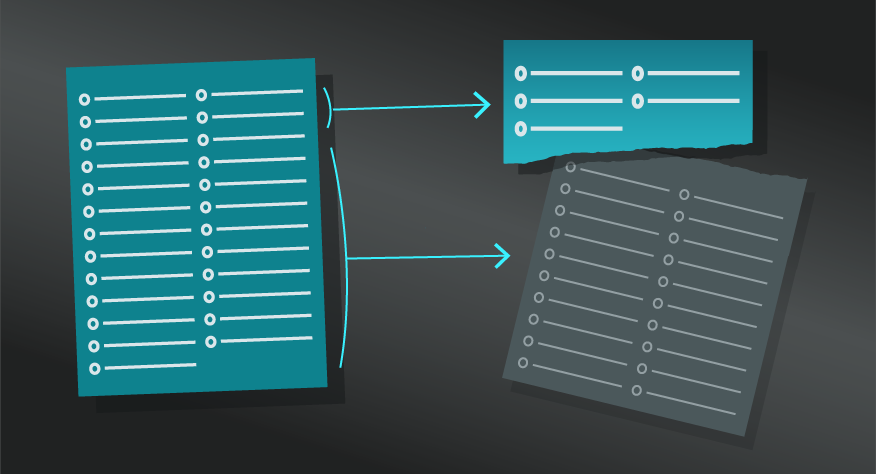

- Identify fixed costs

While the categories around rent, utilities, staff and so on are general, there will be specific fixed costs in your business. It is important to review your income statements and identify costs that do not change based on your business output or results.

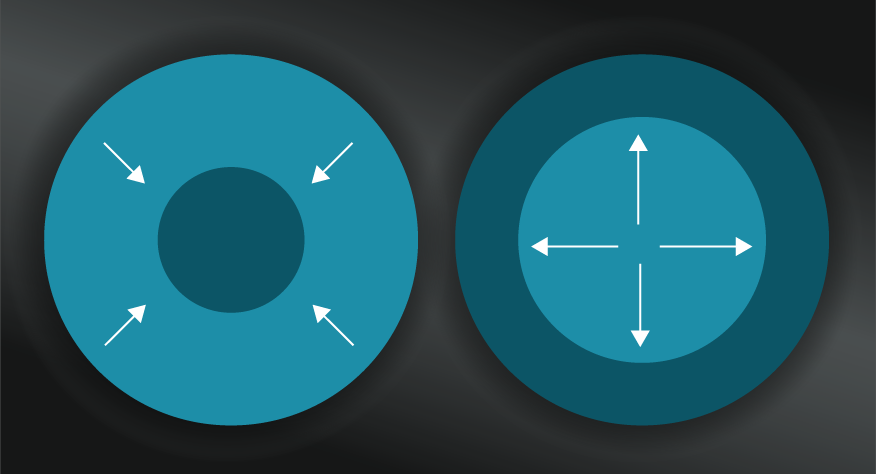

- Keep fixed costs to a minimum level

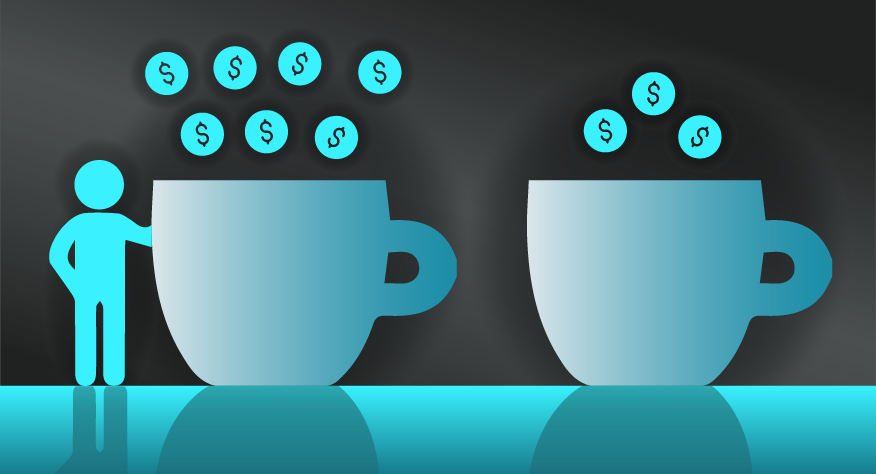

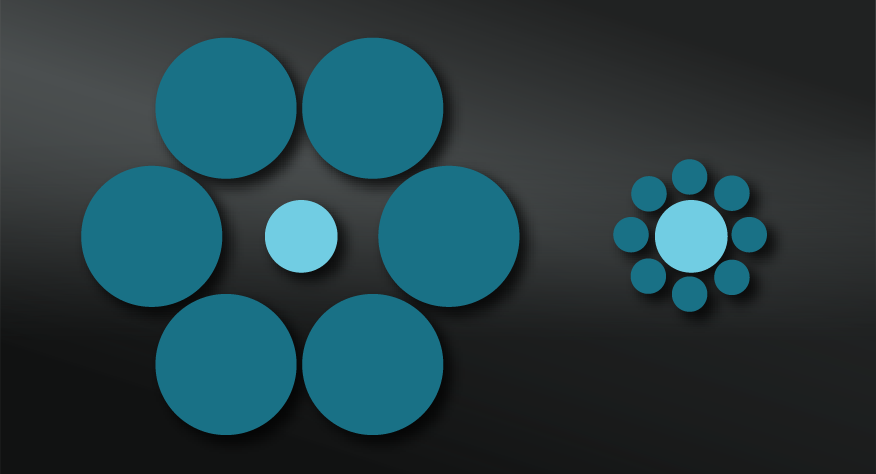

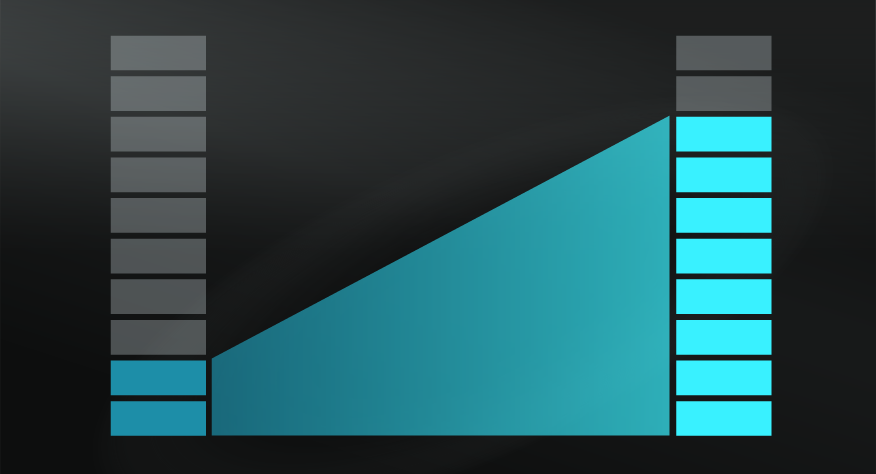

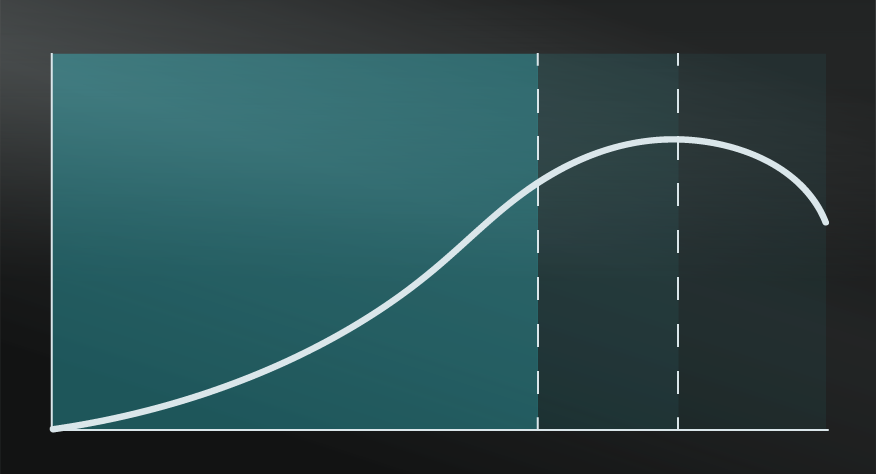

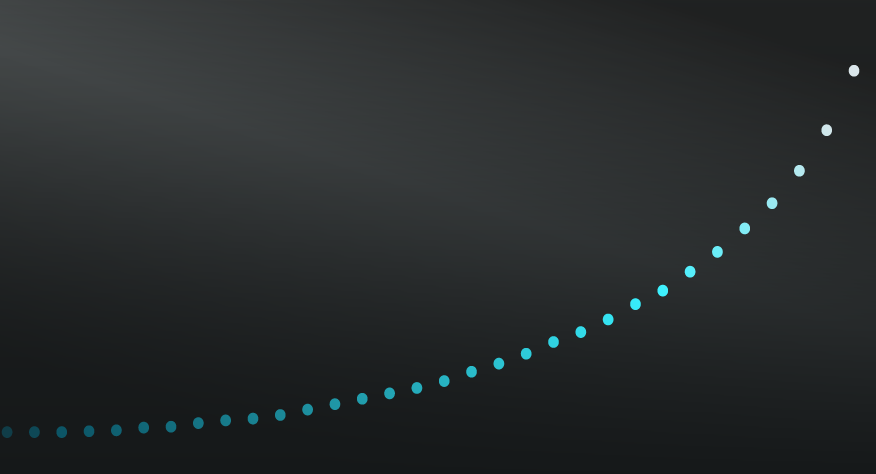

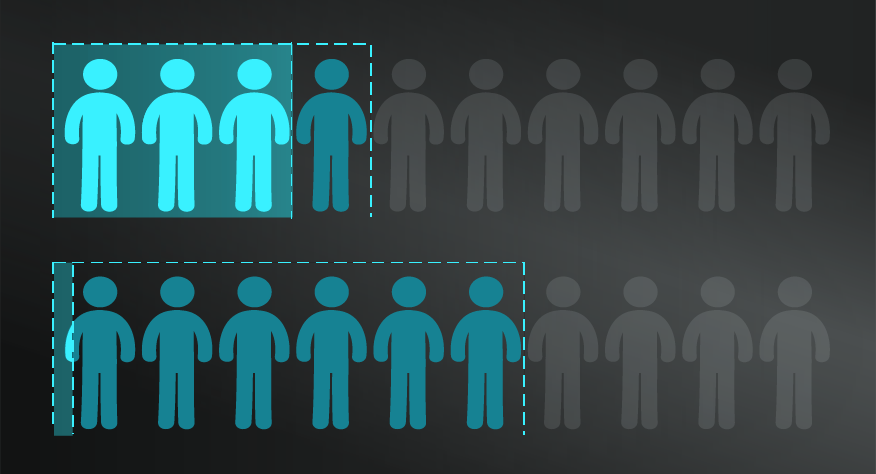

The more fixed costs your company has, the more revenue you need in order to break even and be profitable, unrelated to income. The impact of fixed costs drops when production increases because the fixed cost per unit lowers – if your lease is $10,000 per month, producing 1,000 units yields a fixed cost of 10$ per unit, while producing 10,000 units lowers the fixed cost to $1 per unit.

- Remember that fixed costs can change too

In the long run, you may also deal with changes in fixed costs, caused by new contractual agreements or schedules. Your rent can be increased after the end of the lease agreement or utility costs can rise, all of these having an impact on your business. A useful metric to watch is your average fixed cost which equates to the total fixed cost/number of units made.

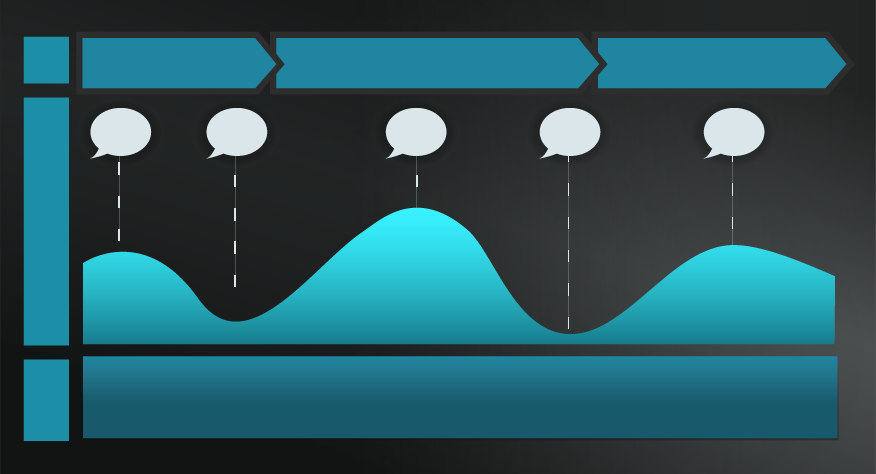

- Monitor and challenge variable costs

Variable costs change continuously from month to month and they can easily get out of control. The volatility of variable costs can cut your profit margins and even cause an abrupt loss for your business. At the same time, they can help you reduce costs in your ‘lean times’ and are the first place you go to cut costs. So monitoring them and challenging them regularly is crucial.

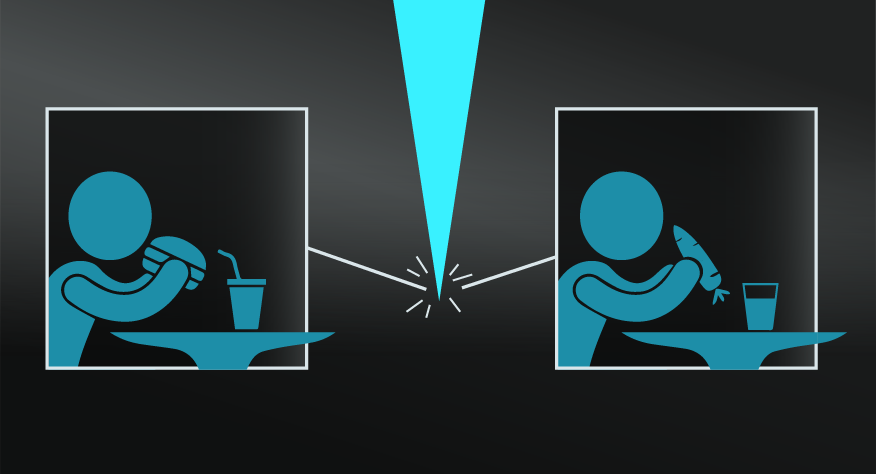

- Consider alternative business models to lower risk

Organising an event which involves paid speakers? Rather than offering them a set speaking fee (fixed cost) consider a profit share approach (variable cost) that scales with the success of the outcome. This lowers risk but can also lower the profit if the event is a success.

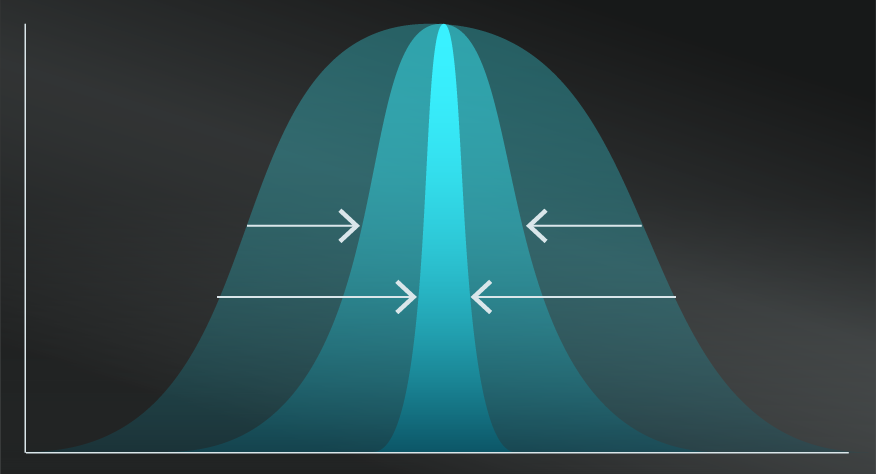

Using the two categories of fixed and variable costs may not be sufficient for an effective breakeven analysis, as companies may also have so-called semi-variable costs. These refer to expenses that contain both a fixed-cost component and a variable-cost component and they vary with production but not in direct proportion to volume. Examples include the minimum fee for being able to provide a service, such as telephone charges.

High turnover industries and variable costs.

Typically businesses with high turnover of physical products are associated with high variable costs. These might include grocery stores, departments stores and some clothes retailers. Often these businesses have lower barriers to entry, so newcomers can enter more easily, but require skilled approaches to customer analysis and stock management to ensure they don’t carry high amounts of stock at any time.

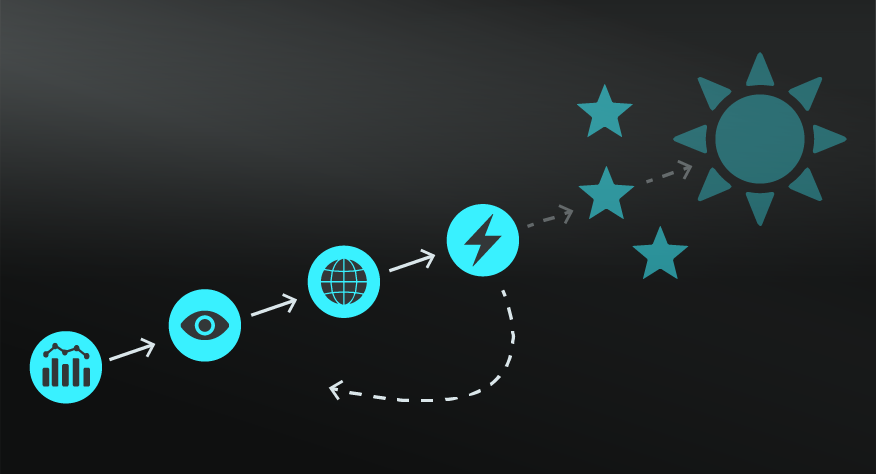

Fixed and variable costs are a basic element of a financial and economic toolkit.

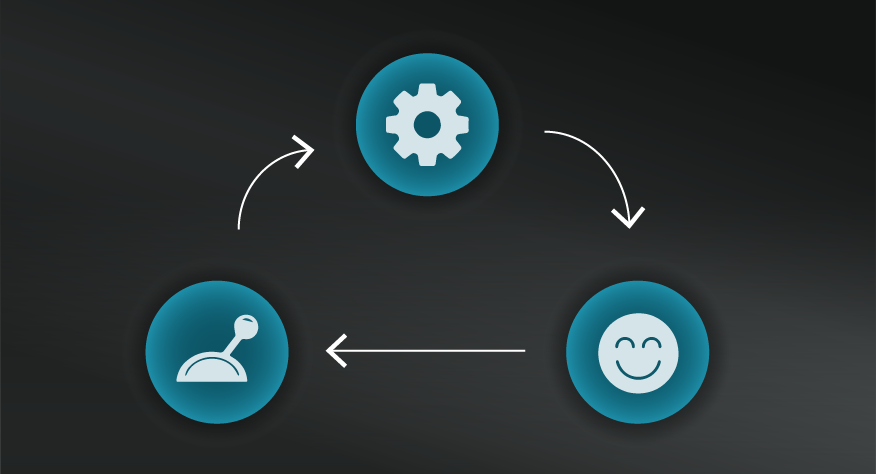

Use the following examples of connected and complementary models to weave fixed and variable costs into your broader latticework of mental models. Alternatively, discover your own connections by exploring the category list above.

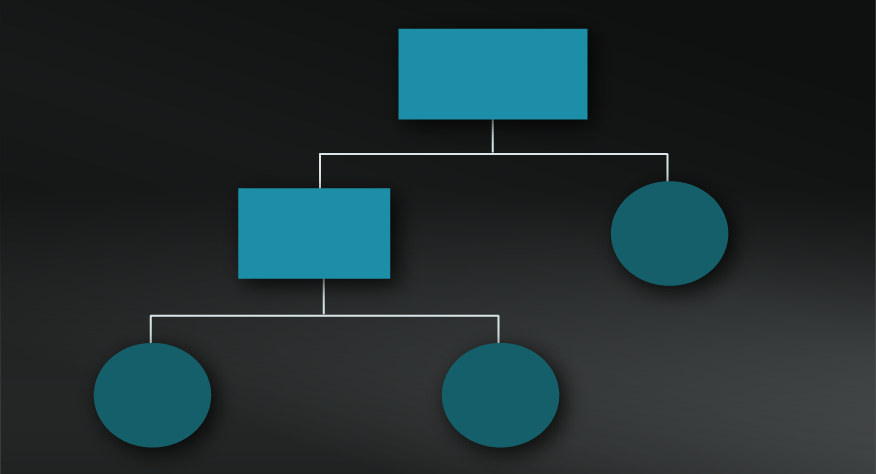

Connected models:

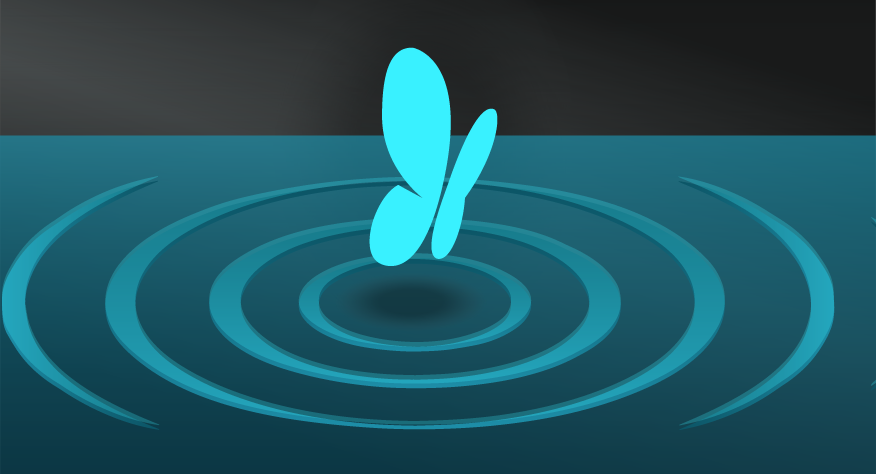

- Economies of scale: the ability to scale essentially relates to the balance of these costs.

- Balance scorecard: in considering the financial element of the scorecard.

- Activation energy: fixed costs might be considered a metaphor for activation energy, or the ‘cost to play’ in an industry.

Complementary models:

- Blue ocean strategy: when considering barriers to entry and new opportunities.

Usage of the terms fixed costs and variable costs can depend on the context; the two terms are used in economics, business planning, and accounting, and in each field they can have different meanings and refer to different expenditures.

Monitoring and adjusting your company’s fixed and variable costs allows you to obtain economies of scale – where the cost per unit decreases when production expands.

My Notes

My Notes

Oops, That’s Members’ Only!

Fortunately, it only costs US$5/month to Join ModelThinkers and access everything so that you can rapidly discover, learn, and apply the world’s most powerful ideas.

ModelThinkers membership at a glance:

“Yeah, we hate pop ups too. But we wanted to let you know that, with ModelThinkers, we’re making it easier for you to adapt, innovate and create value. We hope you’ll join us and the growing community of ModelThinkers today.”