0 saved

0 saved

18.8K views

18.8K views

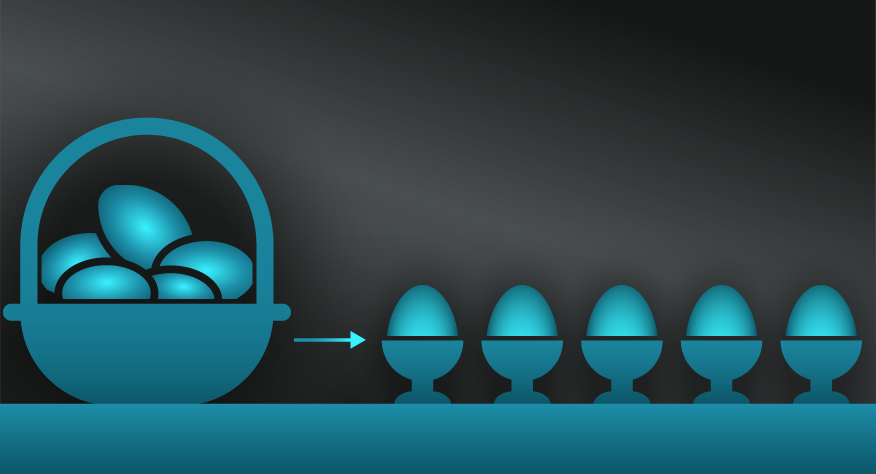

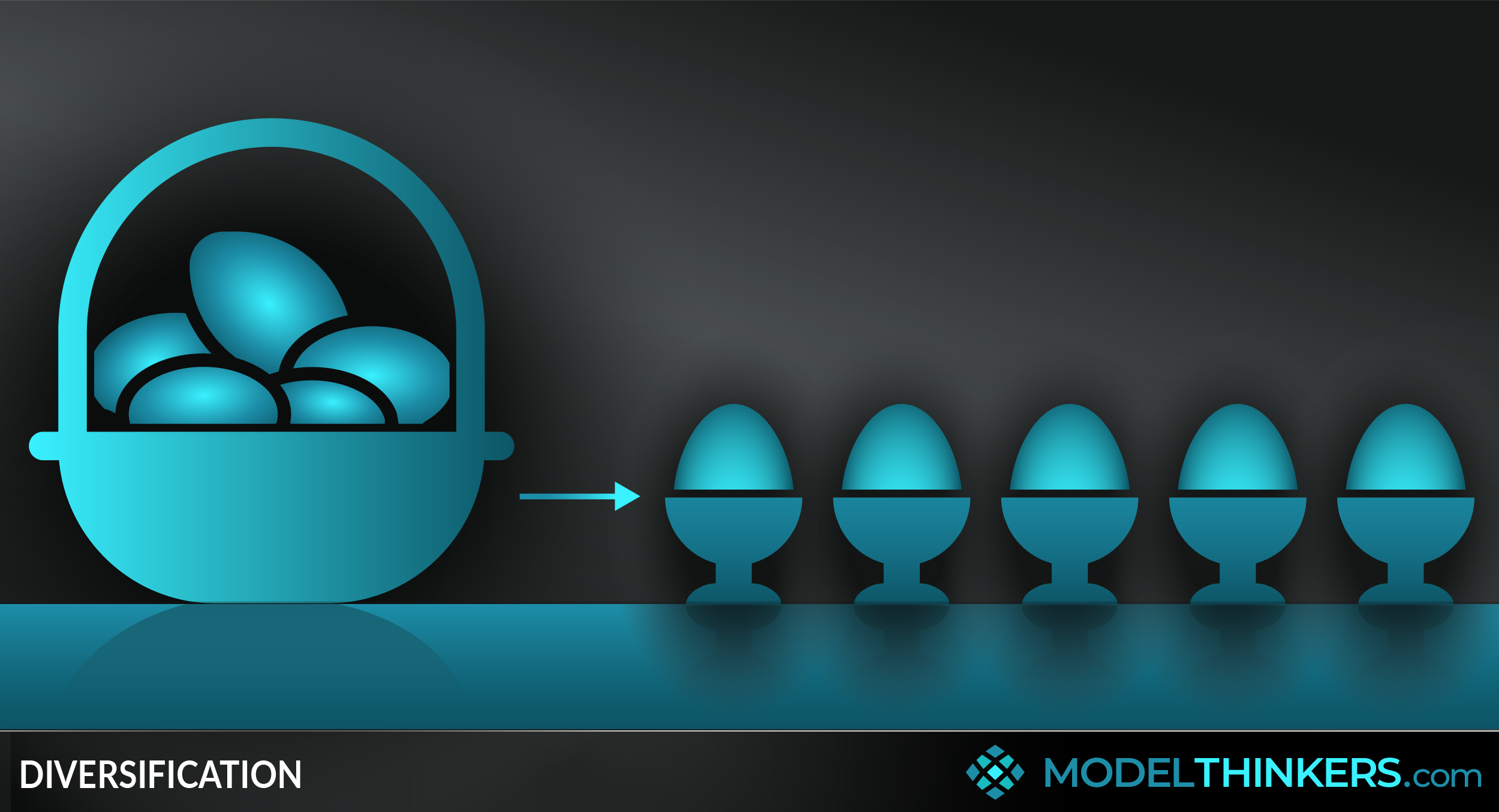

Diversification is a reminder not to put all your eggs in one basket.

INVESTMENTS.

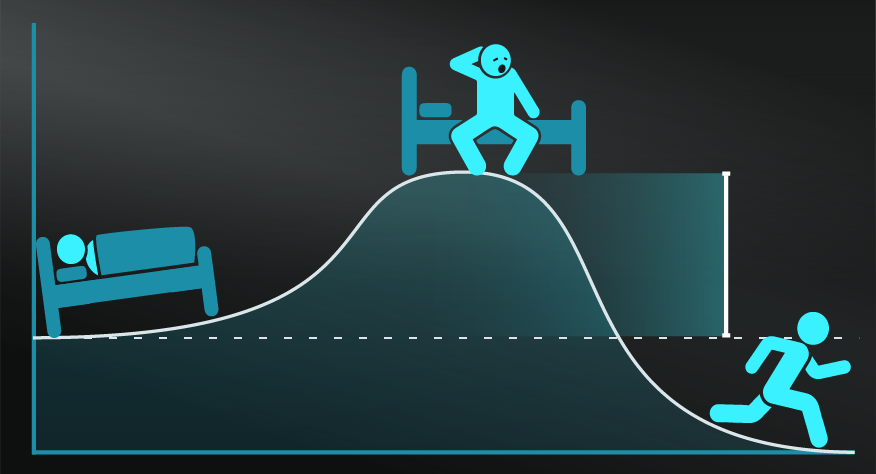

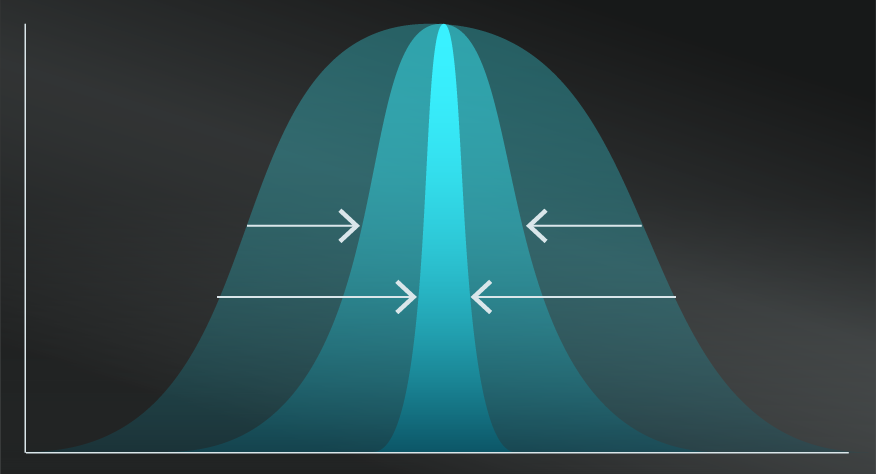

In a financial context, Diversification consists of investing in a variety of assets to reduce risk, exposure or volatility rather than allocating capital to a single asset. In contrast, an undiversified portfolio might experience strong growth in some circumstances, it will be more vulnerable to market fluctuations and unexpected events.

BEYOND FINANCES.

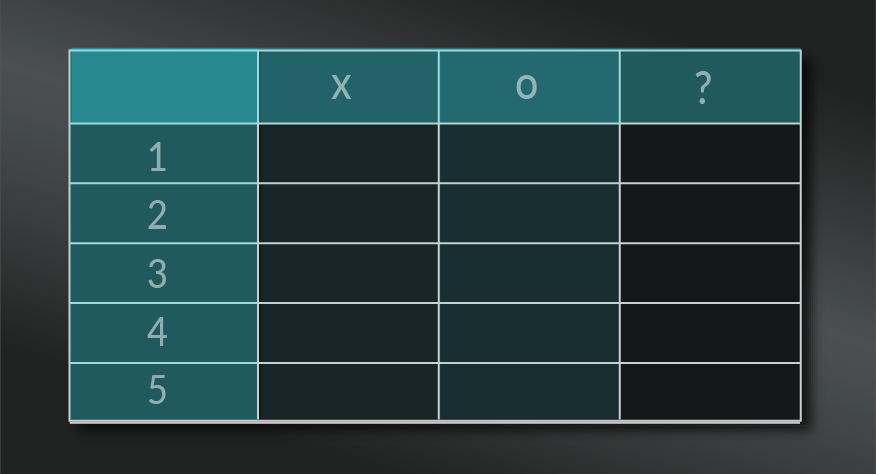

Diversification can also be used in a range of other areas, including:

- Product strategy: reducing risk and expanding markets by diversifying a product range.

- Marketing: using a combination of traditional, social, digital and other channels.

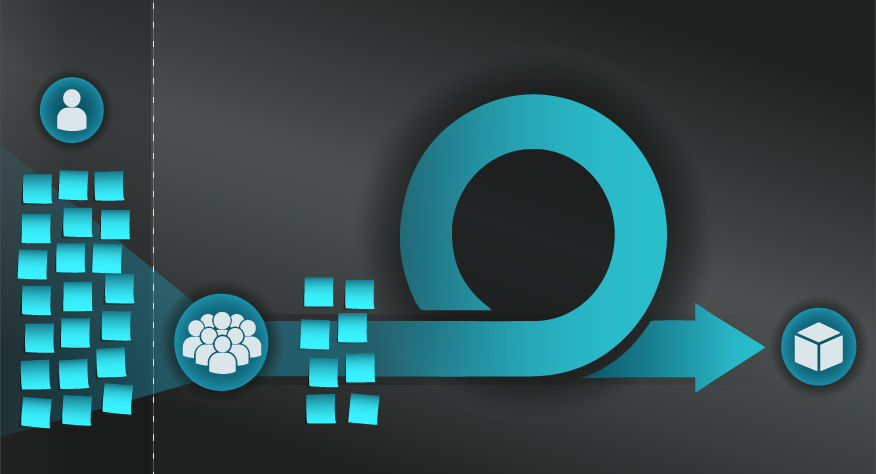

- Team formation: with evidence that diverse teams deliver greater innovation and results.

- Agriculture: diversifying land usage and crop choices, including vertical integration by introducing shops and restaurants on farmland.

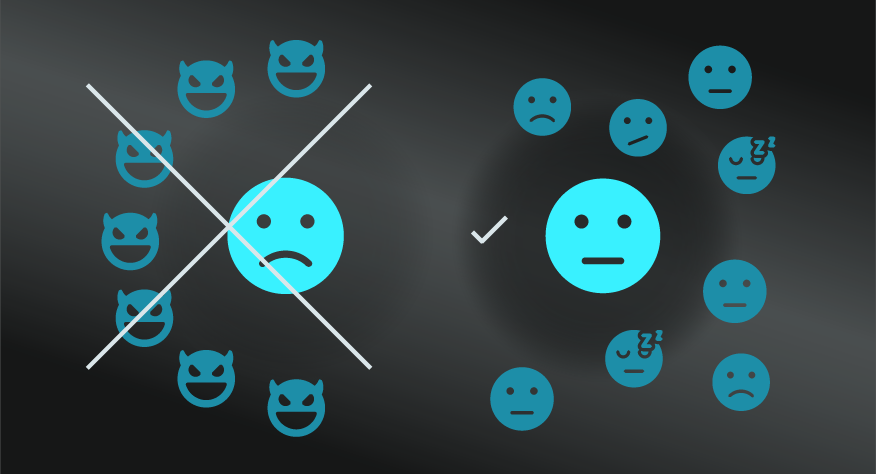

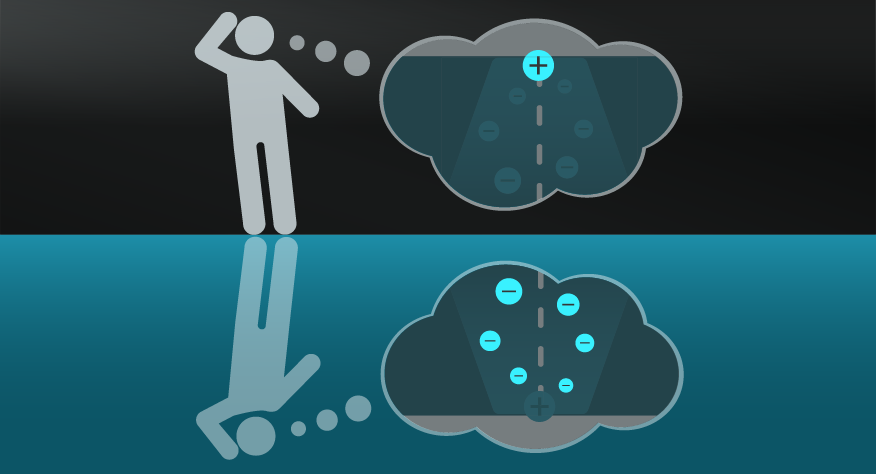

- Media input: avoiding an ‘echo chamber’ and siloed news experience by following diverse and conflicting media sources.

- Thinking: ModelThinkers has essentially applied diversification to thinking and development in our approach to developing a diverse Latticework of Mental Models.

THE TRANSFERABLE PRINCIPLE.

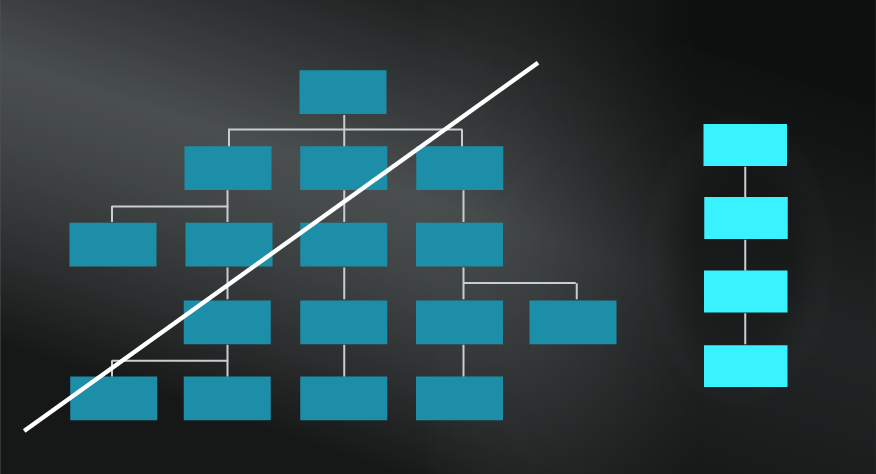

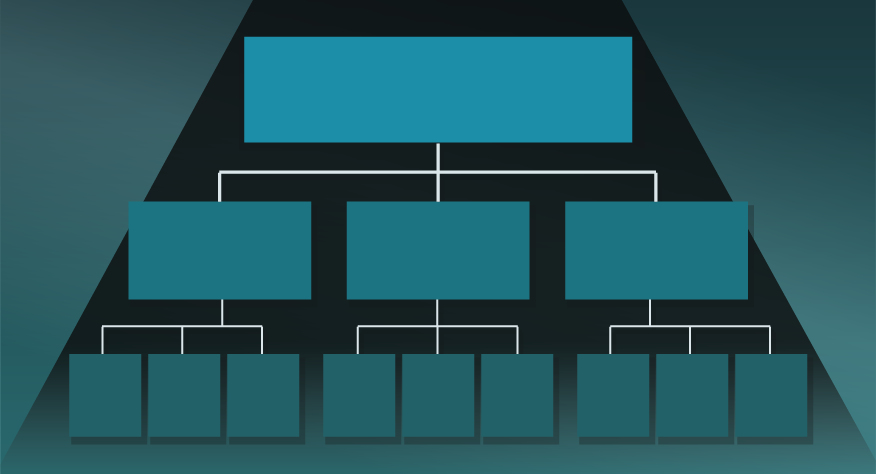

The main principle of diversification across any of these examples involves avoiding a single point of failure by embracing a diverse range of possible options that can be brought into play as required.

This approach some challenges is countered by models such as the Circle of Competence, which encourages you to focus on your strengths — see more under Limitations below.

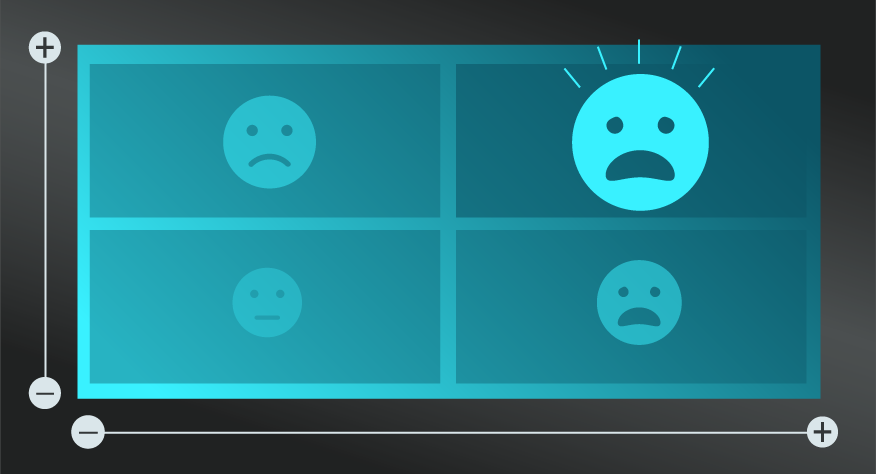

- Identify single point sensitivity and diversify around it

What single element have you bet everything on? Is it a product focus, a market segment, a purchasing event or service vendor? Consider how you might diversify to protect yourself and minimise exposure in that area.

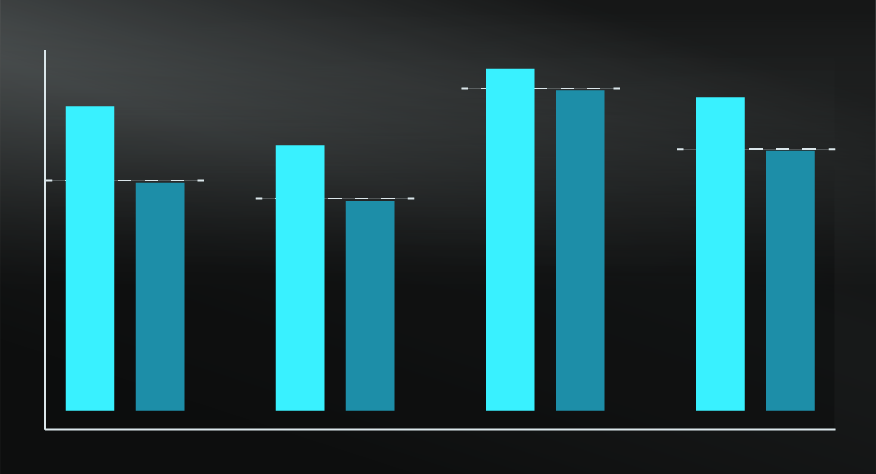

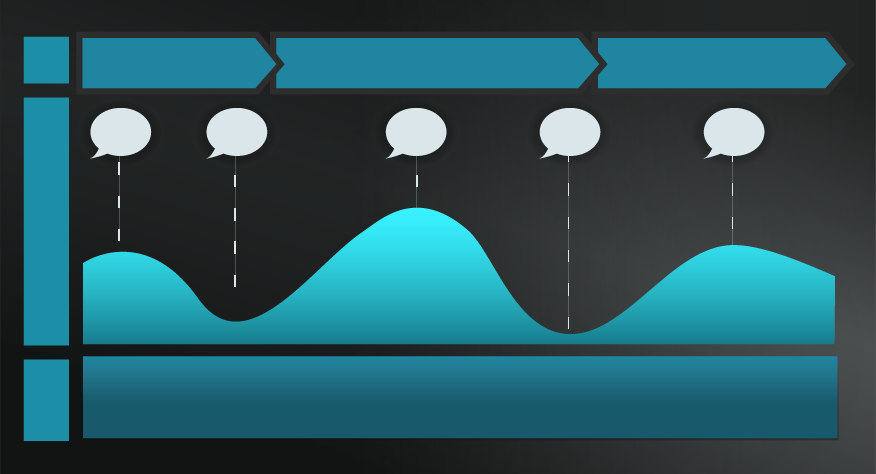

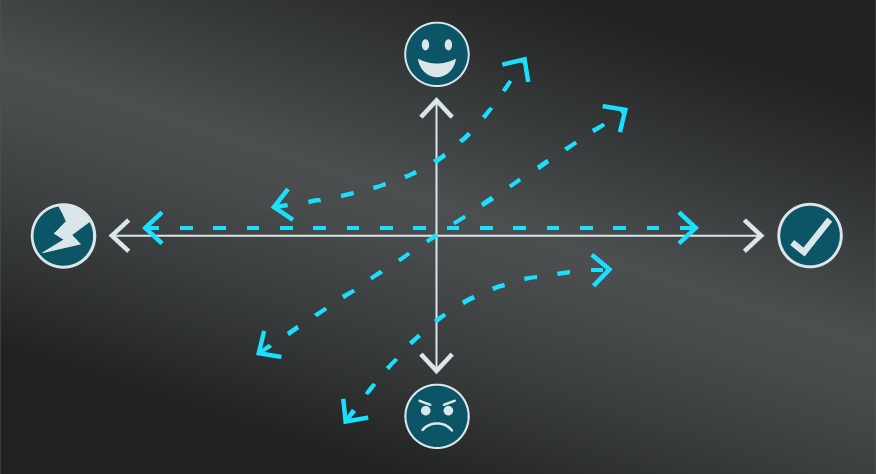

- Choose complimentary ‘baskets’

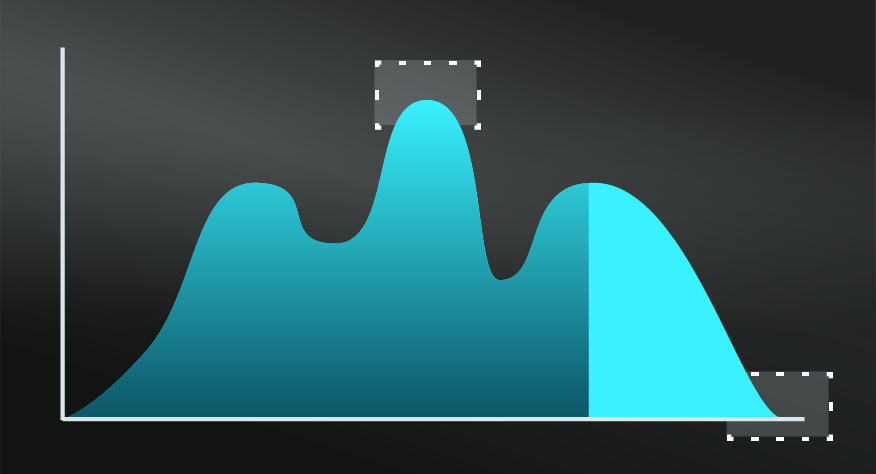

Given one of the main aims of diversification is to reduce risk, it makes sense to include complementary options within a diversification strategy. Suppose you invested in airline stocks, the best is to diversify your portfolio by investing in a complementary industry, such as railway stocks. If pilots go on strike, shares of airline stocks drop, but at the same time passengers will turn to trains for transportation and this can make railway stock prices climb.

- Geographical diversification

Look for opportunities beyond your geographical location; volatility in your region may not affect stocks and bonds in another part of the world.

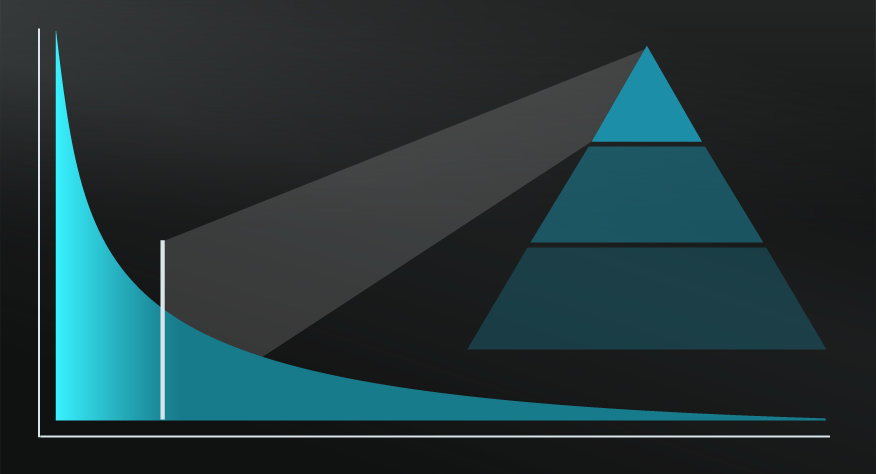

Warren Buffett once said: "Diversification is a protection against ignorance. [It] makes very little sense for those who know what they're doing."

This connects with his and Munger's approach of using the Circle of Competence to focus on strengths.

Managing a diverse portfolio can become cumbersome and having a lot of “baskets” may increase costs, limit economies of scale and be limited by your understanding or circle of competence.

Those who choose diversification strategies to mitigate risk might also lose to those who have gone ‘all in’ on a bet that actually pays off.

Same product, different markets.

A cleaning product that targets home use for families in the kitchen might be repackaged and marketed to the industrial sector to diversify a product offer.

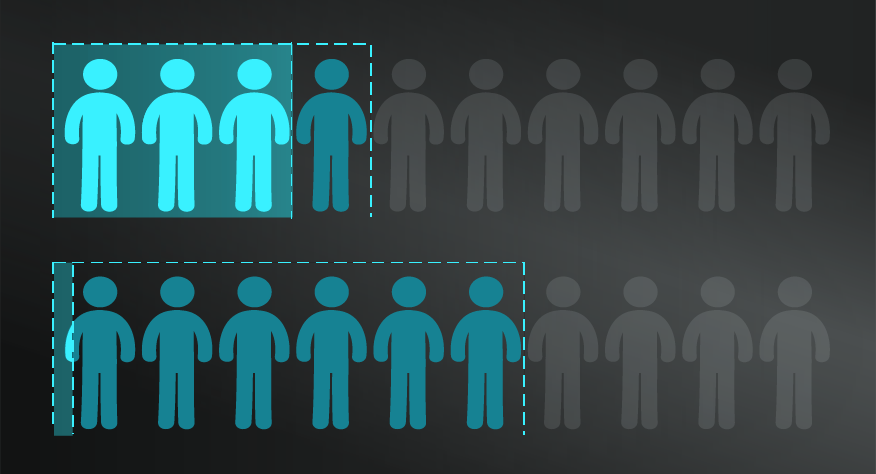

Diverse teams.

This Forbes article outlines some of the evidence that diverse and inclusive teams lead to greater innovation and improved business outcomes. In summary, the article explains: “The results, data, and studies are in, and they show that organizations that prioritize diversity and inclusion as a strategic priority do better than less diverse peers.”

Diversification helps to reduce risk and provides a more flexible approach to an unpredictable future.

Use the following examples of connected and complementary models to weave diversification into your broader latticework of mental models. Alternatively, discover your own connections by exploring the category list above.

Connected models:

- Ansoff matrix: diversification is identified as one of four business growth strategies.

- Black swan events: making the assumption that things will be unpredictably disrupted leads to a diversification strategy.

- Munger’s latticework: this mental model calls for diversification of mental models.

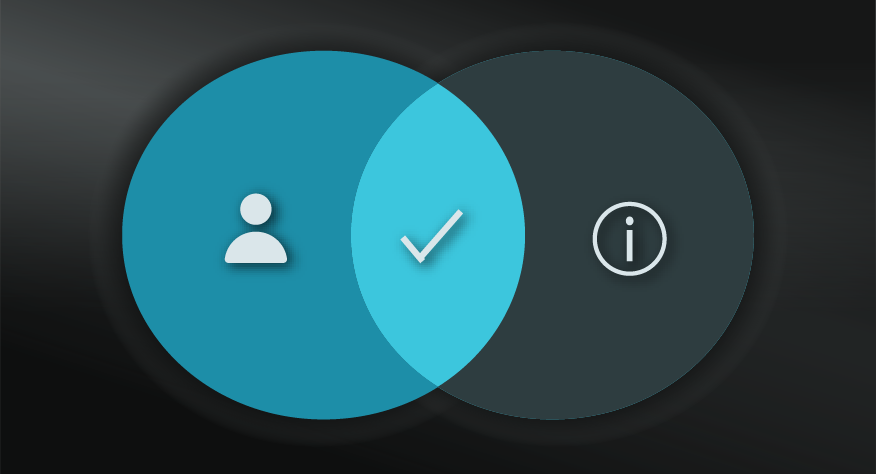

- T-shaped capabilities: considering the intersection between broad, diverse skills and deep specialists skills.

- Redundancy/ margin of safety as well as hedging: in designing strategies for volatility and unpredictability.

Complementary models:

- The golden circle: focusing on diversification of approaches that stem from a value driven why is a powerful combination.

- Features and benefits: when considering how you target audiences and pain points.

- Circle of competence: consider this before spreading resources over multiple domains or areas, particularly unfamiliar ones.

- Deep work: another counter, given the cost of splitting focus.

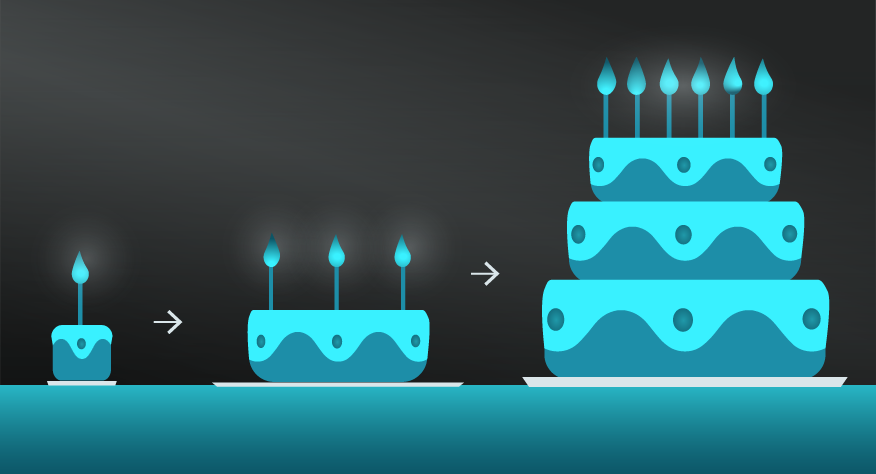

The modern view on diversification dates back to the 1950s, when American economist Harry Markowitz studied the effects of multiple strategies on probable investment portfolio returns.

The broader idea of diversifying your investments is very old and has been mentioned in the Bible in the book of Ecclesiastes 11:2 (“But divide your investments among many places, for you do not know what risks might lie ahead.”) and in the Talmud, which advises people to split one’s assets in three parts: one third in business, one third in liquid money, and one third in land.

My Notes

My Notes

Oops, That’s Members’ Only!

Fortunately, it only costs US$5/month to Join ModelThinkers and access everything so that you can rapidly discover, learn, and apply the world’s most powerful ideas.

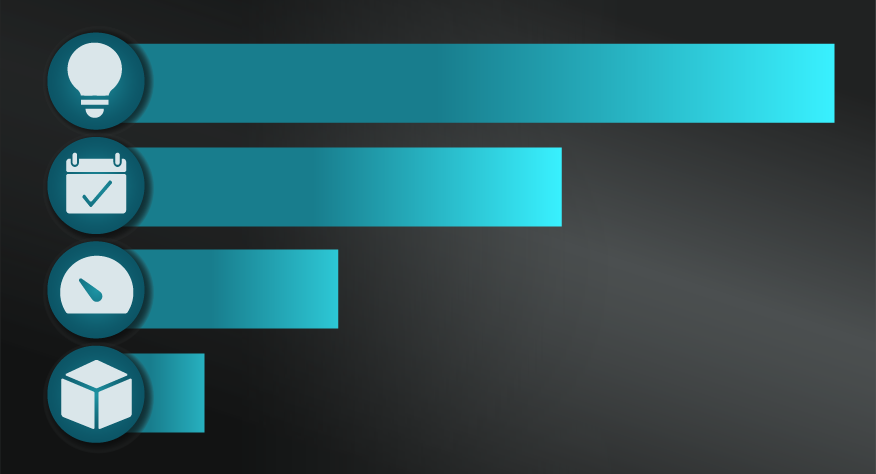

ModelThinkers membership at a glance:

“Yeah, we hate pop ups too. But we wanted to let you know that, with ModelThinkers, we’re making it easier for you to adapt, innovate and create value. We hope you’ll join us and the growing community of ModelThinkers today.”