0 saved

0 saved

19.8K views

19.8K views

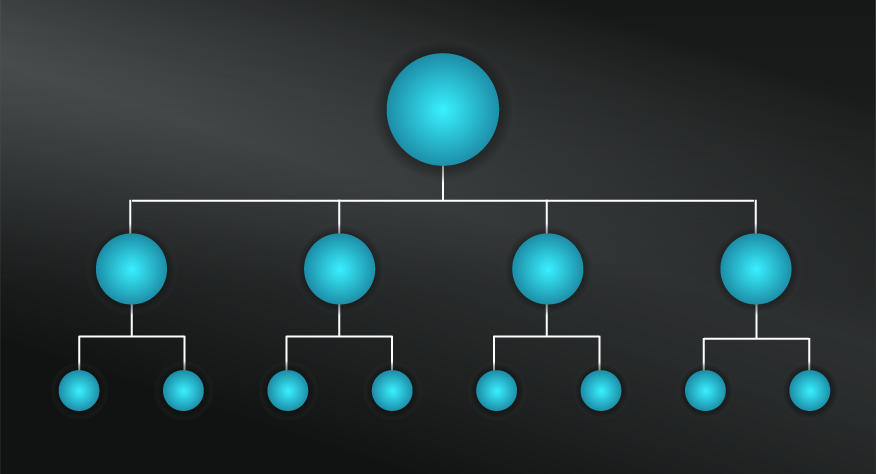

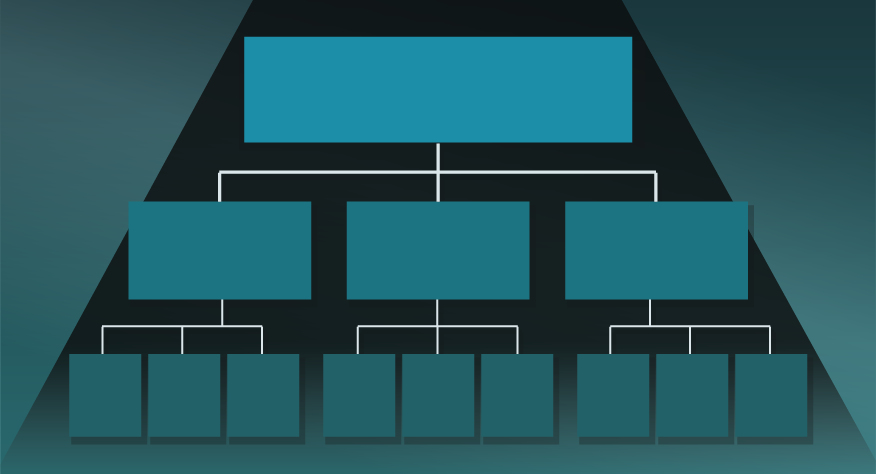

Typically employed by large, de-centralised companies, this model provides a framework to analyse and prioritise investment opportunities.

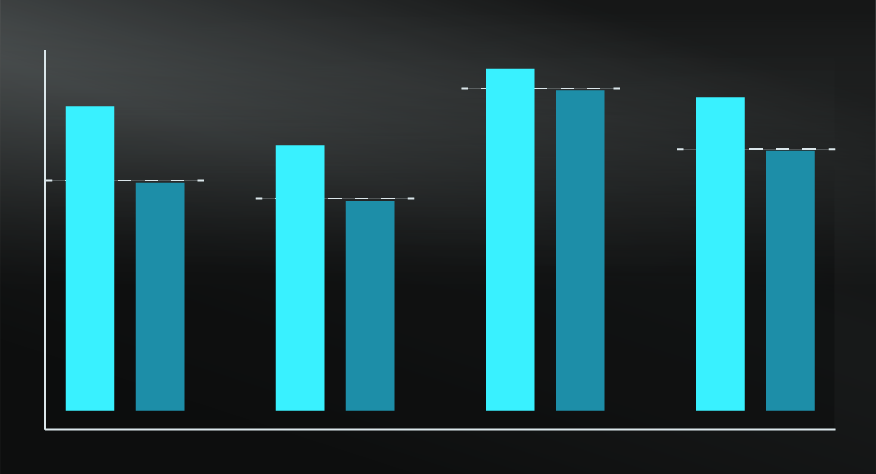

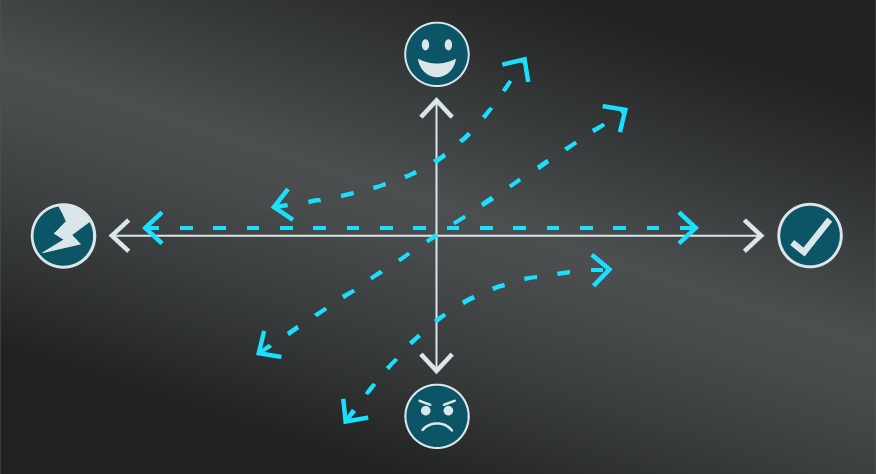

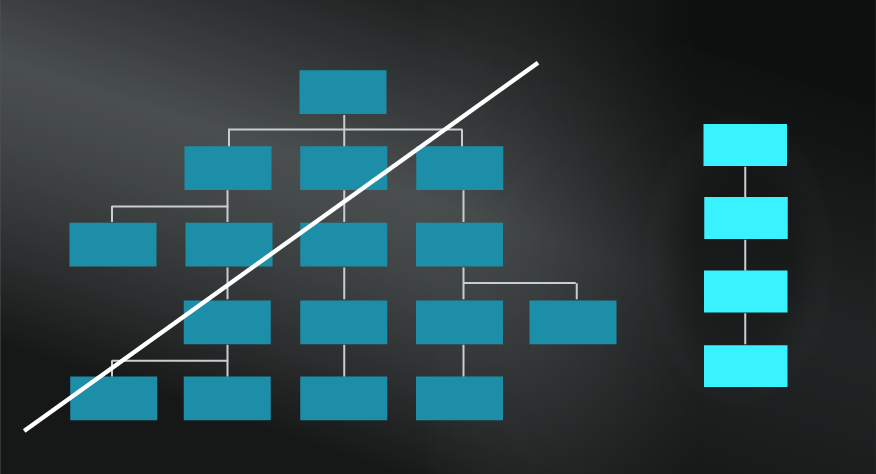

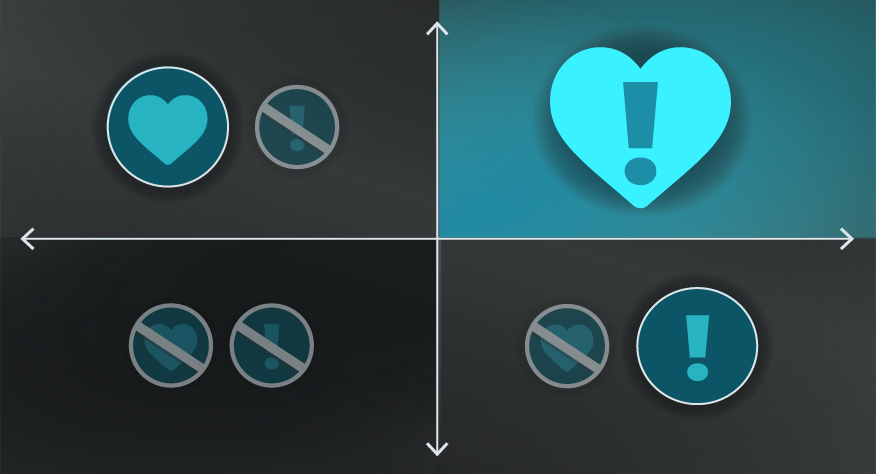

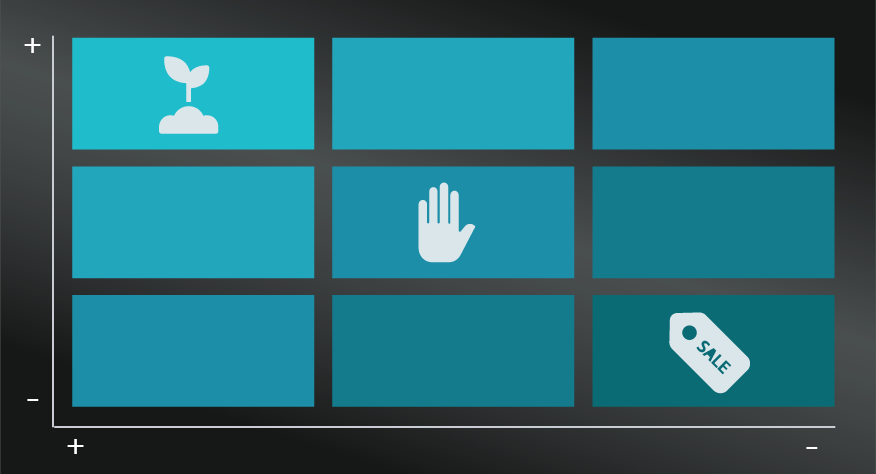

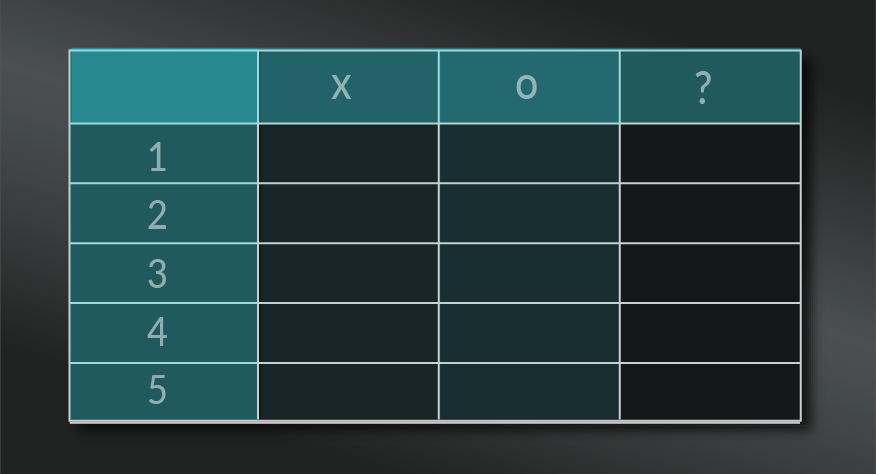

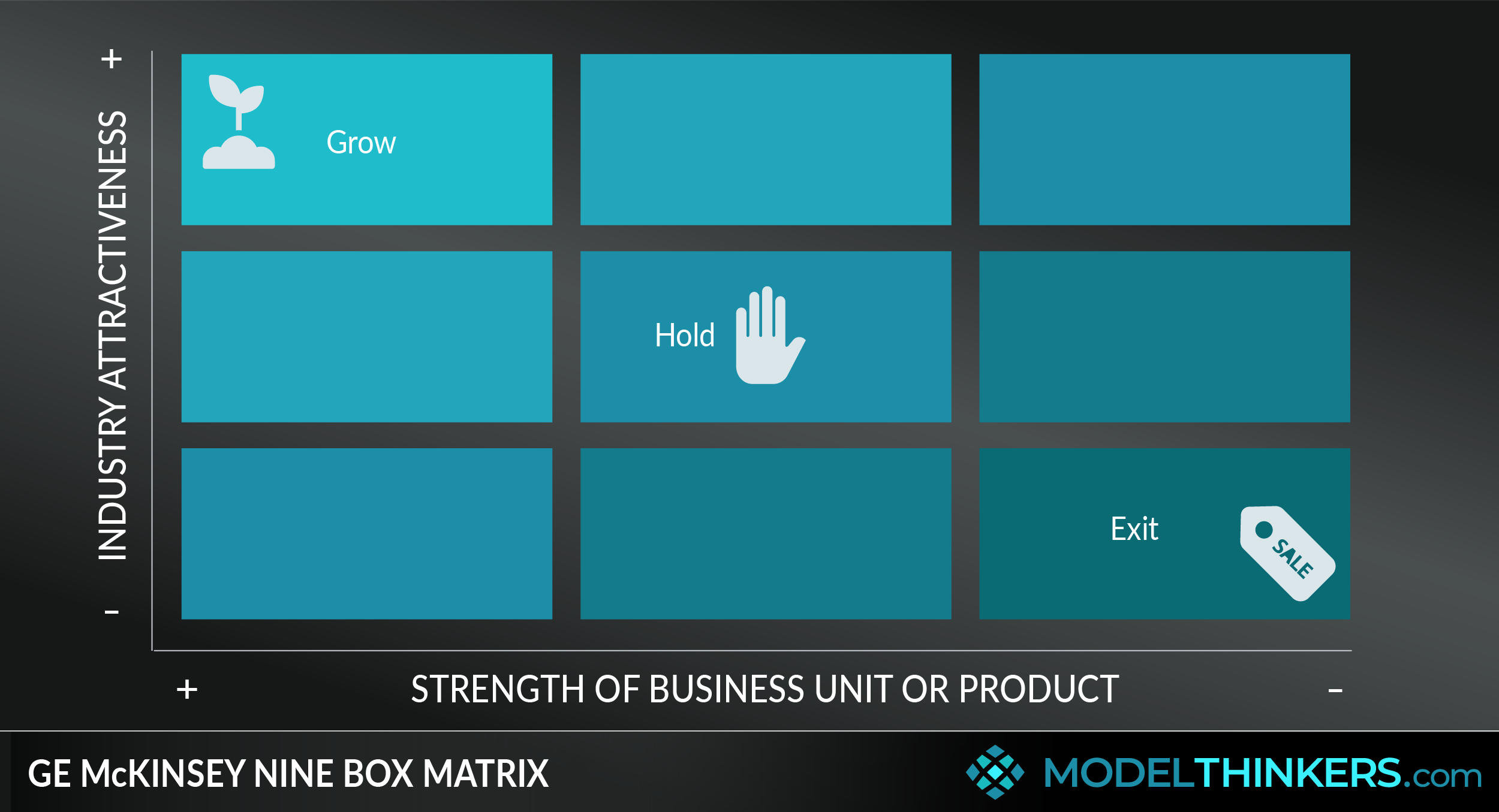

The GE McKinsey Nine Box Matrix helps multi-business corporations to make investment decisions about their business units by evaluating them on two axes: industry attractiveness and business unit strength.

THE BOXES.

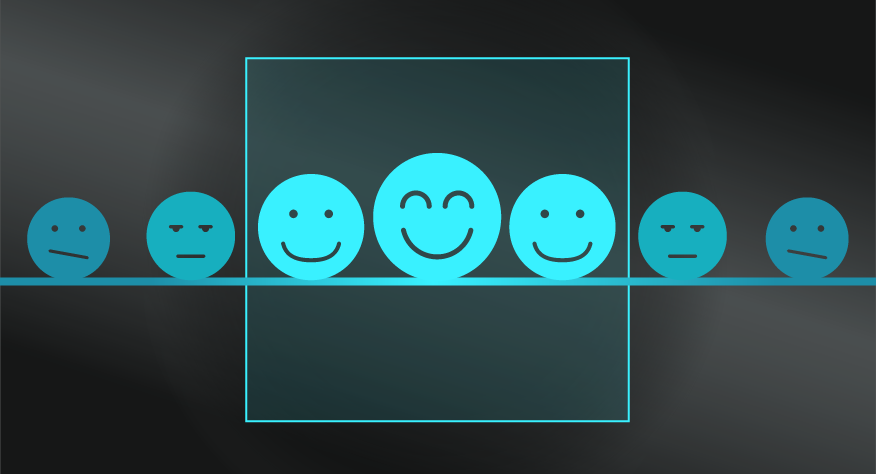

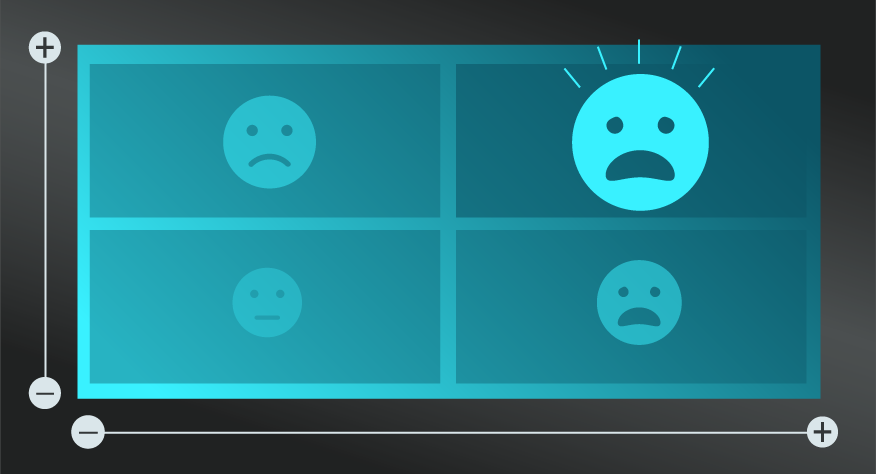

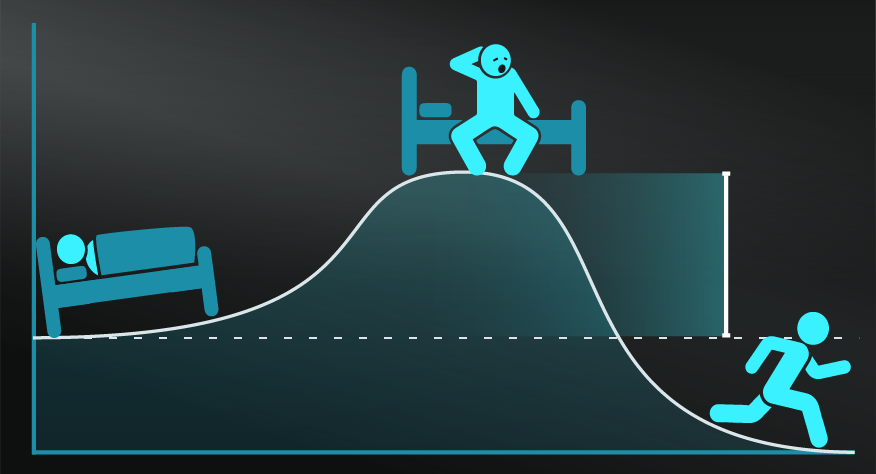

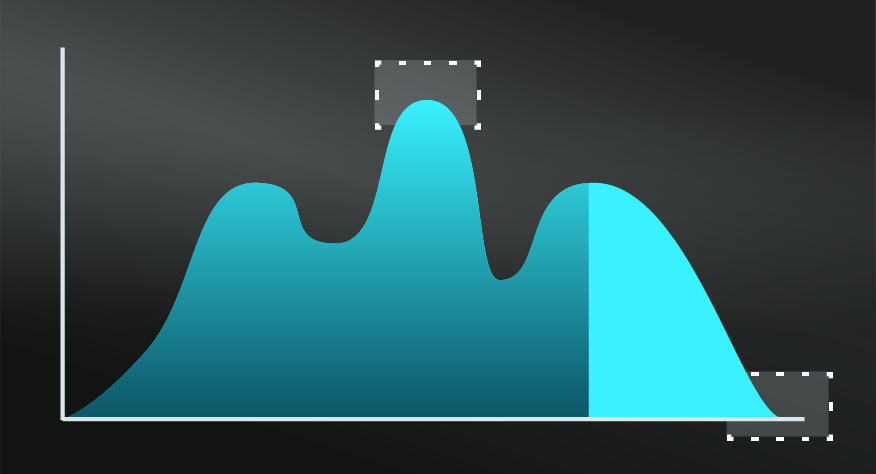

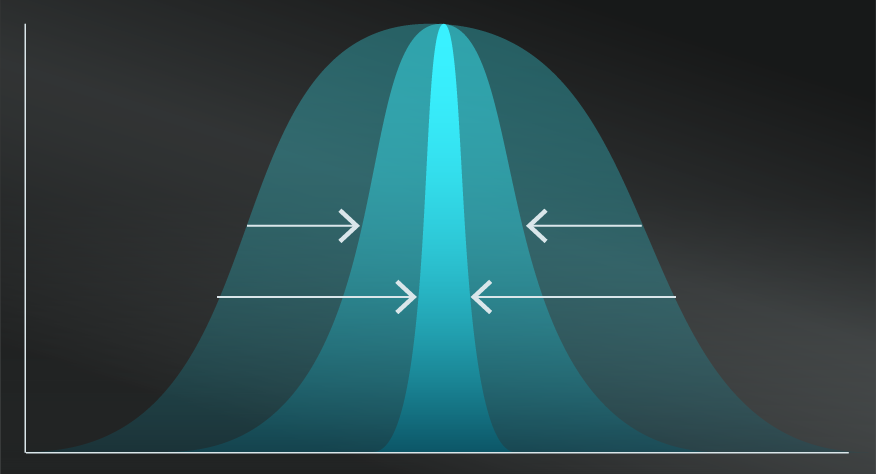

Each variable is assigned three levels: high, medium, and low. Nine boxes result from correlating the two factors, and each business unit is to be placed in one of the boxes. Cells indicate whether a company should invest in a product, leave it as it is, or drop it.

IN YOUR LATTICEWORK.

This model was developed because of perceived limitations in the BCG Growth-Share Matrix for the needs of McKinsey and GE.

- Determine industry attractiveness

Industry attractiveness is determined by factors such as industry size, industry growth rate, industry profitability, rivalry, demand variability, and global opportunities.

- Measure business unit strength

Factors that influence business unit strength include market share and its growth, profit margins in relation with competitors, customer loyalty, brand equity, level of product differentiation, production capacity, and production flexibility.

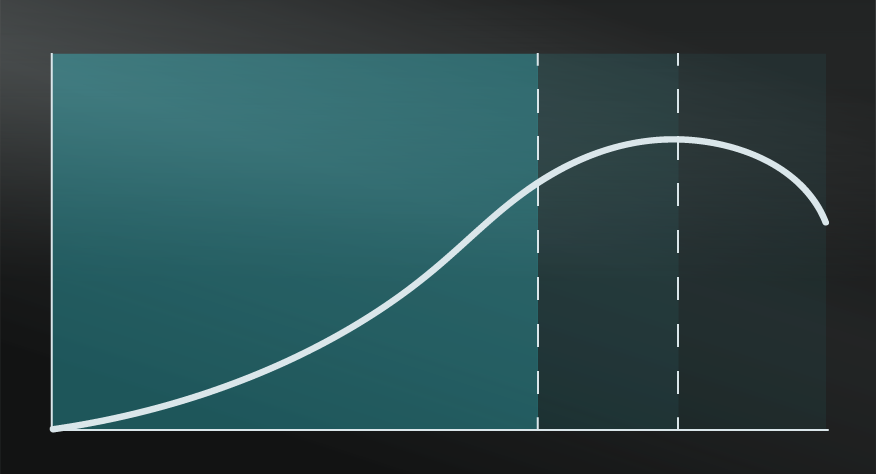

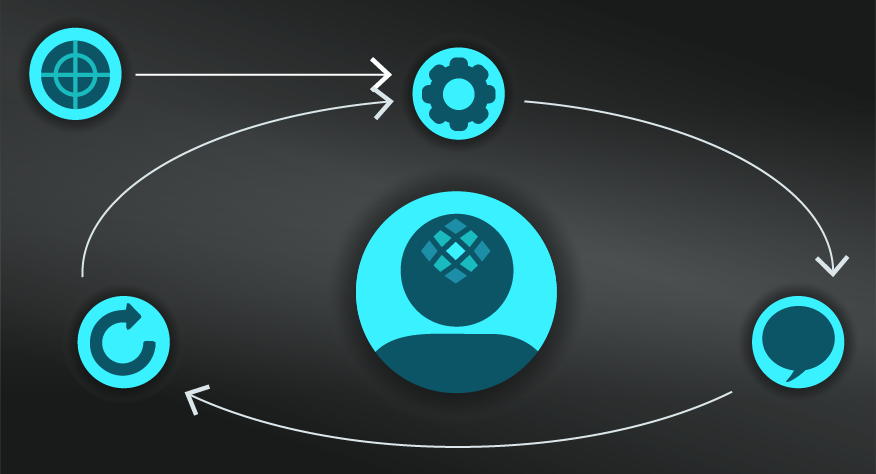

- Determine what business unit is likely to grow

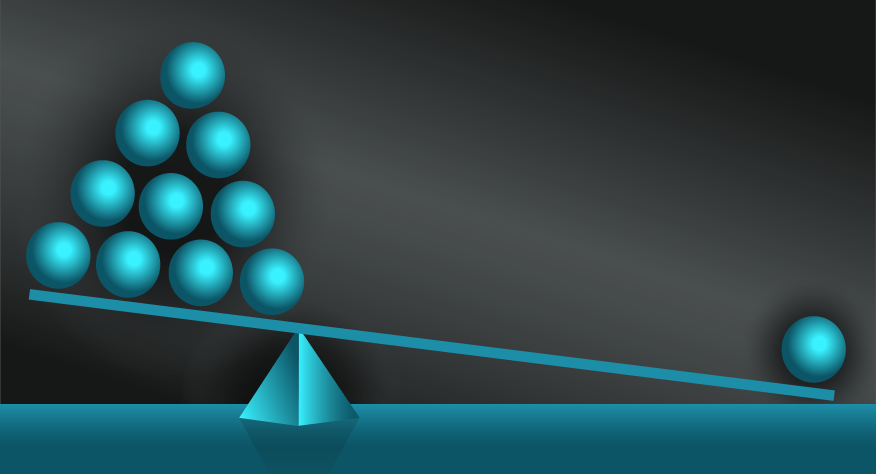

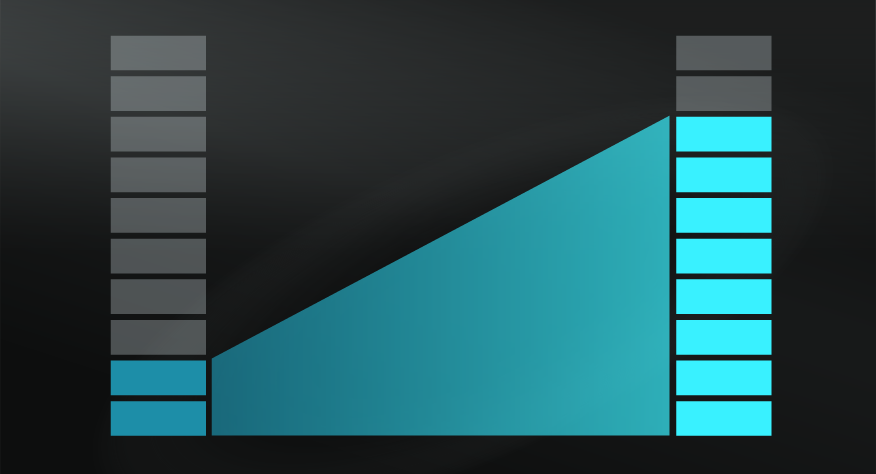

The ideal business unit is a strong one in an attractive industry, while the least desirable situation is a weak business in an unattractive industry. However, there are situations in between, like strong businesses in weak industries or weak businesses in attractive industries.

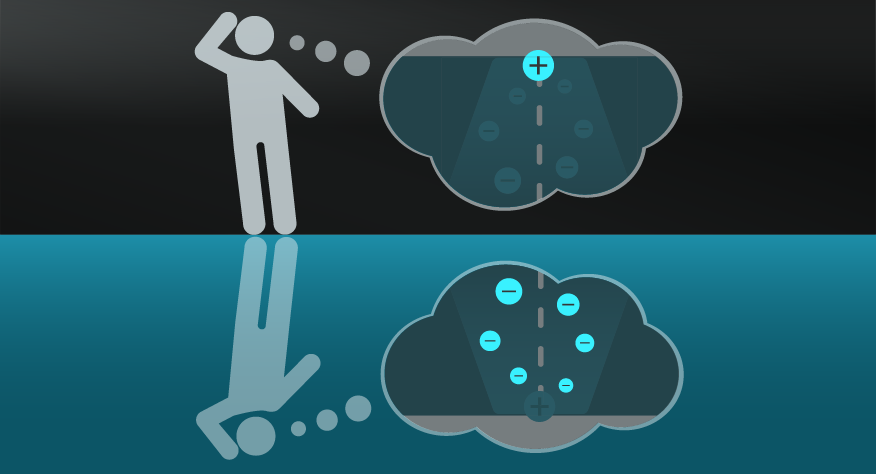

Although it significantly facilitates investment decisions, it could be argued that the McKinsey Nine-Box Matrix requires considerable expertise, time and effort to apply effectively. And, as with any such tool, it is ultimately dependent on the accuracy of the data and information to categorise different business units which are likely to be a politically charged analysis to begin with.

GE in the 1970s.

The GE McKinsey Nine Box Matrix was developed in the 1970s for General Electric, which was managing an immense portfolio of products but did not have a reliable method to allocate resources. The McKinsey Company designed the nine-box framework for GE, an instrument still used by many large companies today.

The GE McKinsey Nine Box Matrix is a business strategy tool that has particularly been adopted by marketing experts in assessing product opportunities.

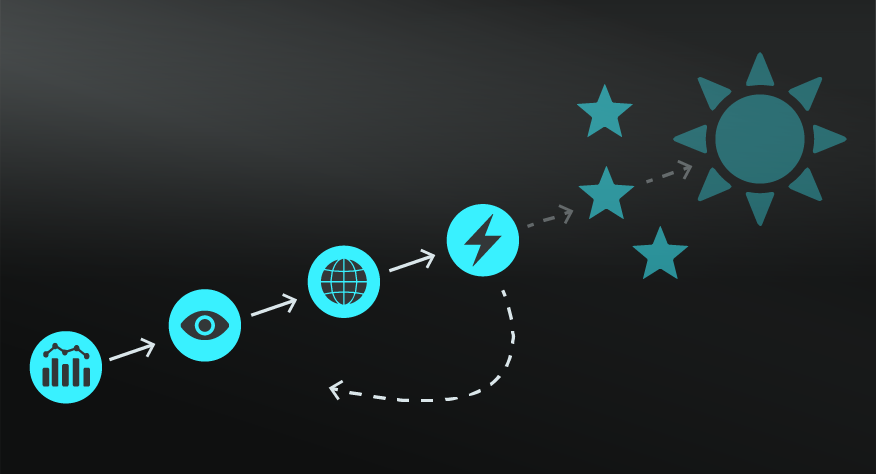

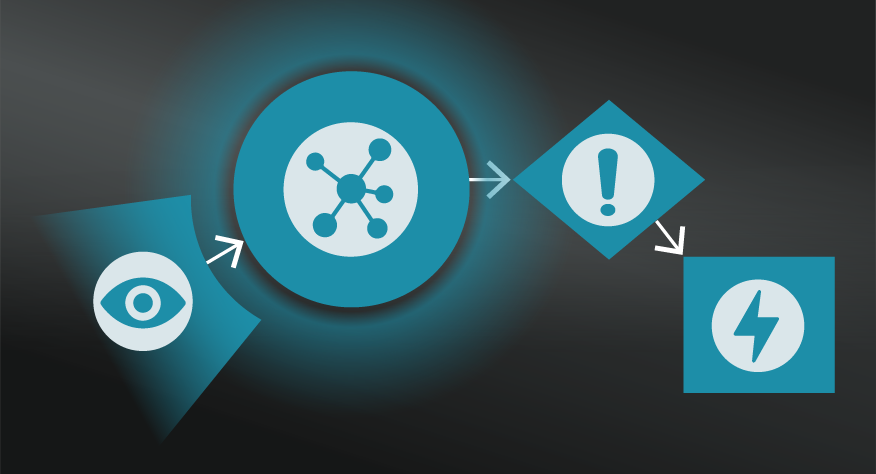

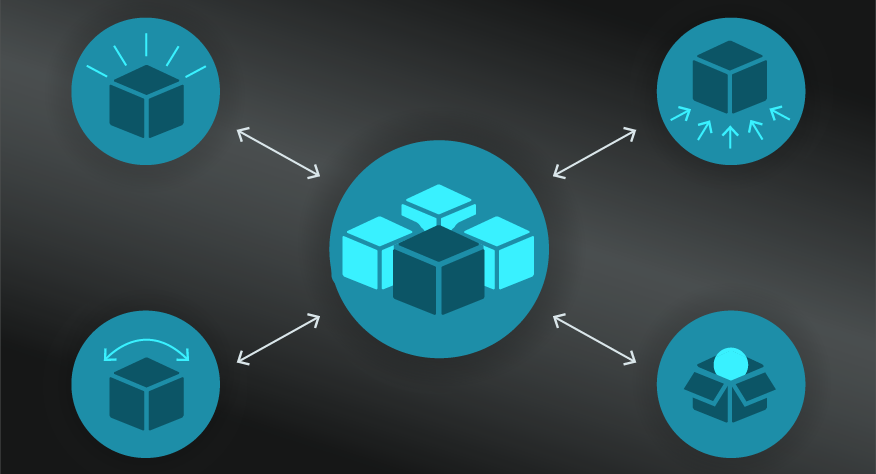

Use the following examples of connected and complementary models to weave GE McKinsey Nine Box Matrix into your broader latticework of mental models. Alternatively, discover your own connections by exploring the category list above.

Connected models:

- BCG growth-share matrix: presents an alternative, perhaps lighter approach to assess business units.

Complementary models:

- Porter's five forces: takes an external focused view in assessing competition.

- Pareto principle: in assessing which business units are delivering key value.

- Diversification and redundancy/ margins of safety: to take a broader view of the potential role a business unit provides.

- First principle thinking: to cut through assumptions about existing business units.

As stated earlier, the GE McKinsey Nine Box Matrix was developed in the 1970s for General Electric. GE determined that existing options, including the BCG Growth-Share Matrix were not comprehensive enough to examine their complexity.

McKinsey provides a comprehensive video and walkthrough of this model here.

My Notes

My Notes

Oops, That’s Members’ Only!

Fortunately, it only costs US$5/month to Join ModelThinkers and access everything so that you can rapidly discover, learn, and apply the world’s most powerful ideas.

ModelThinkers membership at a glance:

“Yeah, we hate pop ups too. But we wanted to let you know that, with ModelThinkers, we’re making it easier for you to adapt, innovate and create value. We hope you’ll join us and the growing community of ModelThinkers today.”